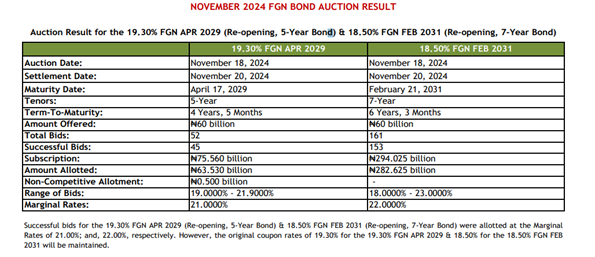

As the November FGN Bonds auction takes place today, with an offer of ₦60 billion each for April 2029 and February 2031, it seems to be a strategic development in the Nigerian debt market. Given the original range of offer of ₦80 – ₦100 each and the previous auction results, where the April 2029 bond closed at a stop rate of 20.75% and the February 2031 bond at 21.74%, there are several factors to consider regarding where these bonds might close in the current auction.

Considering the prevailing economic conditions, including inflation rates and investor sentiment, it is likely that the stop rates for both bonds could remain elevated. The recent trends in yields suggest that investors are demanding higher returns due to inflationary pressures and uncertainties in the economic environment. Therefore, it is plausible to expect that the April 2029 bond may close around 20.5% to 21.0%, while the February 2031 bond could close between 21.5% and 22.0%. This projection aligns with the need for competitive yields to attract both local and foreign investors.