You must be a Market Signals member to access this content.

Can emotional intelligence be more important than IQ in building a happy and successful life?

Read more on our website, link in bio 👆

@sancathaku

Can emotional intelligence be more important than IQ in building a happy and successful life?

Read more on our website, link in bio 👆

@sancathaku

...

4 signs to note before scaling your business.

@nosa.tundeoni

4 signs to note before scaling your business.

@nosa.tundeoni

...

The past week was a geopolitical stress test for crypto. Coordinated U.S.–Israeli strikes on Iran triggered an initial sell-off, but Bitcoin rebounded over 5% 𝐢𝐧𝐭𝐫𝐚𝐝𝐚𝐲, retesting the $71,000 𝐥𝐞𝐯𝐞𝐥, a psychological milestone rather than just a technical one.

Key insights:

• 𝐒𝐚𝐟𝐞-𝐇𝐚𝐯𝐞𝐧 𝐒𝐡𝐢𝐟𝐭: BTC’s dominance surged to 56.7% as global equities fell and oil hit $85/barrel. On-chain data from Iran showed massive capital flight to self-custody wallets, reinforcing Bitcoin’s utility as financial insurance.

• 𝐈𝐧𝐬𝐭𝐢𝐭𝐮𝐭𝐢𝐨𝐧𝐚𝐥 𝐌𝐨𝐦𝐞𝐧𝐭𝐮𝐦: The UK’s FCA approved a stablecoin sandbox led by Revolut. CME expanded crypto futures to cover 75% of the market cap, while Turkey proposed a formal 10% crypto gains tax. Binance deepened compliance, and Jamie Dimon pushed for stablecoin regulation like banks.

• 𝐏𝐫𝐢𝐜𝐞 & 𝐓𝐞𝐜𝐡𝐧𝐢𝐜𝐚𝐥𝐬: BTC bounced from $63,000, now testing $71,000–$72,000, with potential toward $77,000. ETH consolidates near $2,100, with supply at near decade-lows, a sign of long-term accumulation.

• 𝐒𝐞𝐧𝐭𝐢𝐦𝐞𝐧𝐭: “Extreme Fear” conditions (Fear & Greed Index 19) combined with breakout strength historically create asymmetric opportunities for investors.

💡 Takeaway: Amid geopolitical and macro volatility, Bitcoin is increasingly viewed not just as a speculative asset but as 𝐝𝐢𝐠𝐢𝐭𝐚𝐥 𝐜𝐨𝐥𝐥𝐚𝐭𝐞𝐫𝐚𝐥. The market is sending a signal: crisis moments highlight crypto’s emerging role in global finance.

#Bitcoin #Ethereum #CryptoMarket #GeopoliticalRisk

The past week was a geopolitical stress test for crypto. Coordinated U.S.–Israeli strikes on Iran triggered an initial sell-off, but Bitcoin rebounded over 5% 𝐢𝐧𝐭𝐫𝐚𝐝𝐚𝐲, retesting the $71,000 𝐥𝐞𝐯𝐞𝐥, a psychological milestone rather than just a technical one.

Key insights:

• 𝐒𝐚𝐟𝐞-𝐇𝐚𝐯𝐞𝐧 𝐒𝐡𝐢𝐟𝐭: BTC’s dominance surged to 56.7% as global equities fell and oil hit $85/barrel. On-chain data from Iran showed massive capital flight to self-custody wallets, reinforcing Bitcoin’s utility as financial insurance.

• 𝐈𝐧𝐬𝐭𝐢𝐭𝐮𝐭𝐢𝐨𝐧𝐚𝐥 𝐌𝐨𝐦𝐞𝐧𝐭𝐮𝐦: The UK’s FCA approved a stablecoin sandbox led by Revolut. CME expanded crypto futures to cover 75% of the market cap, while Turkey proposed a formal 10% crypto gains tax. Binance deepened compliance, and Jamie Dimon pushed for stablecoin regulation like banks.

• 𝐏𝐫𝐢𝐜𝐞 & 𝐓𝐞𝐜𝐡𝐧𝐢𝐜𝐚𝐥𝐬: BTC bounced from $63,000, now testing $71,000–$72,000, with potential toward $77,000. ETH consolidates near $2,100, with supply at near decade-lows, a sign of long-term accumulation.

• 𝐒𝐞𝐧𝐭𝐢𝐦𝐞𝐧𝐭: “Extreme Fear” conditions (Fear & Greed Index 19) combined with breakout strength historically create asymmetric opportunities for investors.

💡 Takeaway: Amid geopolitical and macro volatility, Bitcoin is increasingly viewed not just as a speculative asset but as 𝐝𝐢𝐠𝐢𝐭𝐚𝐥 𝐜𝐨𝐥𝐥𝐚𝐭𝐞𝐫𝐚𝐥. The market is sending a signal: crisis moments highlight crypto’s emerging role in global finance.

#Bitcoin #Ethereum #CryptoMarket #GeopoliticalRisk

...

You need to think big to grow, you don’t grow by thinking small - Dangote.

#economicgrowth #businessmindset #marinatimes

You need to think big to grow, you don’t grow by thinking small - Dangote.

#economicgrowth #businessmindset #marinatimes

...

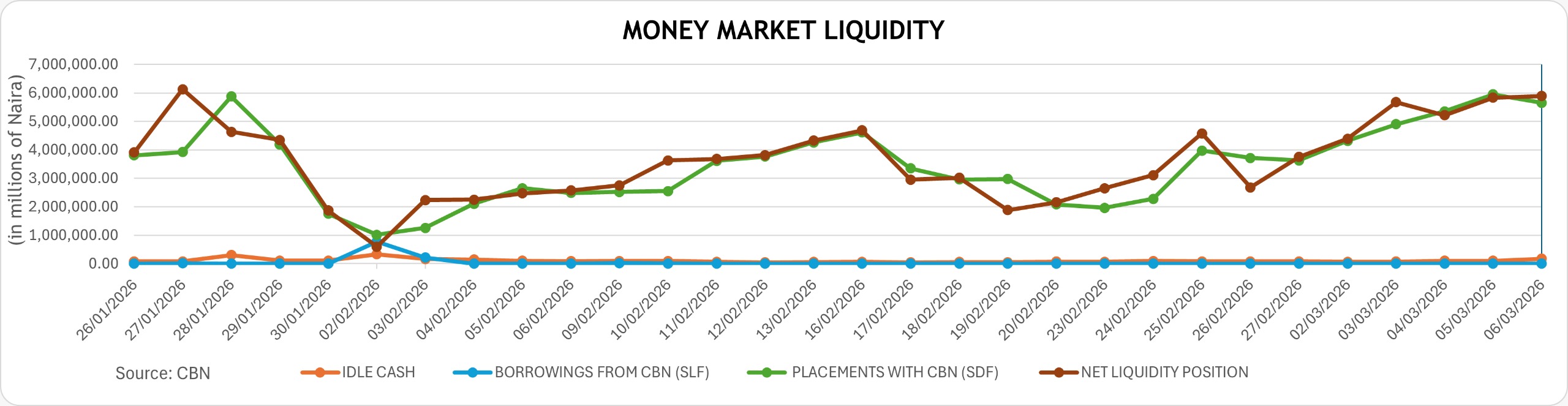

🔎 𝘓𝘪𝘲𝘶𝘪𝘥𝘪𝘵𝘺 𝘞𝘢𝘷𝘦 𝘈𝘩𝘦𝘢𝘥: ₦8.91 𝘛𝘳𝘪𝘭𝘭𝘪𝘰𝘯 𝘌𝘹𝘱𝘦𝘤𝘵𝘦𝘥 𝘵𝘰 𝘏𝘪𝘵 𝘵𝘩𝘦 𝘚𝘺𝘴𝘵𝘦𝘮

𝘕𝘪𝘨𝘦𝘳𝘪𝘢’𝘴 𝘧𝘪𝘹𝘦𝘥-𝘪𝘯𝘤𝘰𝘮𝘦 𝘮𝘢𝘳𝘬𝘦𝘵 𝘪𝘴 𝘴𝘦𝘵 𝘧𝘰𝘳 𝘢 𝘴𝘪𝘨𝘯𝘪𝘧𝘪𝘤𝘢𝘯𝘵 𝘭𝘪𝘲𝘶𝘪𝘥𝘪𝘵𝘺 𝘪𝘯𝘫𝘦𝘤𝘵𝘪𝘰𝘯 𝘵𝘩𝘪𝘴 𝘮𝘰𝘯𝘵𝘩, 𝘸𝘪𝘵𝘩 𝘢 𝘵𝘰𝘵𝘢𝘭 𝘢𝘯𝘵𝘪𝘤𝘪𝘱𝘢𝘵𝘦𝘥 𝘪𝘯𝘧𝘭𝘰𝘸 𝘰𝘧 ₦8.91 𝘵𝘳𝘪𝘭𝘭𝘪𝘰𝘯 𝘧𝘳𝘰𝘮 1-𝘺𝘦𝘢𝘳 𝘮𝘢𝘵𝘶𝘳𝘪𝘵𝘪𝘦𝘴, 𝘤𝘰𝘶𝘱𝘰𝘯 𝘱𝘢𝘺𝘮𝘦𝘯𝘵𝘴, 𝘢𝘯𝘥 𝘣𝘰𝘯𝘥 𝘳𝘦𝘥𝘦𝘮𝘱𝘵𝘪𝘰𝘯.

𝘉𝘳𝘦𝘢𝘬𝘥𝘰𝘸𝘯 𝘰𝘧 𝘦𝘹𝘱𝘦𝘤𝘵𝘦𝘥 𝘪𝘯𝘧𝘭𝘰𝘸𝘴:

• 𝘖𝘔𝘖 𝘮𝘢𝘵𝘶𝘳𝘪𝘵𝘪𝘦𝘴: ₦5.48 𝘵𝘳𝘪𝘭𝘭𝘪𝘰𝘯

• 𝘕𝘛𝘉 𝘮𝘢𝘵𝘶𝘳𝘪𝘵𝘪𝘦𝘴: ₦2.87 𝘵𝘳𝘪𝘭𝘭𝘪𝘰𝘯

• 𝘉𝘰𝘯𝘥 𝘤𝘰𝘶𝘱𝘰𝘯 𝘱𝘢𝘺𝘮𝘦𝘯𝘵𝘴: ₦562.93 𝘣𝘪𝘭𝘭𝘪𝘰𝘯

• 𝘍𝘎𝘕 21.00% 𝘔𝘢𝘳. 2026 𝘣𝘰𝘯𝘥 𝘳𝘦𝘥𝘦𝘮𝘱𝘵𝘪𝘰𝘯: ₦700 𝘣𝘪𝘭𝘭𝘪𝘰𝘯

𝘛𝘩𝘪𝘴 𝘴𝘶𝘣𝘴𝘵𝘢𝘯𝘵𝘪𝘢𝘭 𝘭𝘪𝘲𝘶𝘪𝘥𝘪𝘵𝘺 𝘦𝘷𝘦𝘯𝘵 𝘤𝘰𝘶𝘭𝘥 𝘴𝘩𝘢𝘱𝘦 𝘯𝘦𝘢𝘳-𝘵𝘦𝘳𝘮 𝘮𝘢𝘳𝘬𝘦𝘵 𝘥𝘺𝘯𝘢𝘮𝘪𝘤𝘴 𝘢𝘤𝘳𝘰𝘴𝘴 𝘵𝘩𝘦 𝘺𝘪𝘦𝘭𝘥 𝘤𝘶𝘳𝘷𝘦. 𝘏𝘪𝘴𝘵𝘰𝘳𝘪𝘤𝘢𝘭𝘭𝘺, 𝘪𝘯𝘧𝘭𝘰𝘸𝘴 𝘰𝘧 𝘵𝘩𝘪𝘴 𝘴𝘤𝘢𝘭𝘦 𝘵𝘦𝘯𝘥 𝘵𝘰:

✔ 𝘚𝘶𝘱𝘱𝘰𝘳𝘵 𝘥𝘦𝘮𝘢𝘯𝘥 𝘢𝘵 𝘱𝘳𝘪𝘮𝘢𝘳𝘺 𝘢𝘶𝘤𝘵𝘪𝘰𝘯𝘴

✔ 𝘊𝘰𝘮𝘱𝘳𝘦𝘴𝘴 𝘺𝘪𝘦𝘭𝘥𝘴 𝘪𝘯 𝘵𝘩𝘦 𝘴𝘦𝘤𝘰𝘯𝘥𝘢𝘳𝘺 𝘮𝘢𝘳𝘬𝘦𝘵

✔ 𝘚𝘵𝘳𝘦𝘯𝘨𝘵𝘩𝘦𝘯 𝘴𝘺𝘴𝘵𝘦𝘮 𝘭𝘪𝘲𝘶𝘪𝘥𝘪𝘵𝘺 𝘢𝘯𝘥 𝘮𝘰𝘥𝘦𝘳𝘢𝘵𝘦 𝘮𝘰𝘯𝘦𝘺 𝘮𝘢𝘳𝘬𝘦𝘵 𝘳𝘢𝘵𝘦𝘴

✔ 𝘐𝘯𝘧𝘭𝘶𝘦𝘯𝘤𝘦 𝘍𝘟 𝘱𝘰𝘴𝘪𝘵𝘪𝘰𝘯𝘪𝘯𝘨 𝘥𝘦𝘱𝘦𝘯𝘥𝘪𝘯𝘨 𝘰𝘯 𝘳𝘦𝘪𝘯𝘷𝘦𝘴𝘵𝘮𝘦𝘯𝘵 𝘣𝘦𝘩𝘢𝘷𝘪𝘰𝘶𝘳

𝘛𝘩𝘦 𝘬𝘦𝘺 𝘲𝘶𝘦𝘴𝘵𝘪𝘰𝘯 𝘯𝘰𝘸 𝘪𝘴 𝘳𝘦𝘪𝘯𝘷𝘦𝘴𝘵𝘮𝘦𝘯𝘵 𝘢𝘱𝘱𝘦𝘵𝘪𝘵𝘦:

𝘞𝘪𝘭𝘭 𝘪𝘯𝘷𝘦𝘴𝘵𝘰𝘳𝘴 𝘦𝘹𝘵𝘦𝘯𝘥 𝘥𝘶𝘳𝘢𝘵𝘪𝘰𝘯 𝘪𝘯𝘵𝘰 𝘍𝘎𝘕 𝘣𝘰𝘯𝘥𝘴, 𝘳𝘰𝘵𝘢𝘵𝘦 𝘪𝘯𝘵𝘰 𝘕𝘛𝘉𝘴/𝘖𝘔𝘖 𝘣𝘪𝘭𝘭𝘴, 𝘰𝘳 𝘥𝘪𝘷𝘦𝘳𝘴𝘪𝘧𝘺 𝘪𝘯𝘵𝘰 𝘢𝘭𝘵𝘦𝘳𝘯𝘢𝘵𝘪𝘷𝘦 𝘢𝘴𝘴𝘦𝘵𝘴?

𝘞𝘪𝘵𝘩 𝘮𝘰𝘯𝘦𝘵𝘢𝘳𝘺 𝘱𝘰𝘭𝘪𝘤𝘺 𝘦𝘹𝘱𝘦𝘤𝘵𝘢𝘵𝘪𝘰𝘯𝘴 𝘢𝘯𝘥 𝘭𝘪𝘲𝘶𝘪𝘥𝘪𝘵𝘺 𝘤𝘰𝘯𝘥𝘪𝘵𝘪𝘰𝘯𝘴 𝘦𝘷𝘰𝘭𝘷𝘪𝘯𝘨, 𝘱𝘰𝘴𝘪𝘵𝘪𝘰𝘯𝘪𝘯𝘨 𝘸𝘪𝘭𝘭 𝘣𝘦 𝘤𝘳𝘪𝘵𝘪𝘤𝘢𝘭.

#𝘕𝘪𝘨𝘦𝘳𝘪𝘢𝘔𝘢𝘳𝘬𝘦𝘵𝘴 #𝘍𝘪𝘹𝘦𝘥𝘐𝘯𝘤𝘰𝘮𝘦 #𝘓𝘪𝘲𝘶𝘪𝘥𝘪𝘵𝘺 #𝘍𝘎𝘕𝘉𝘰𝘯𝘥𝘴 #𝘕𝘛𝘉 𝘖𝘔𝘖 𝘊𝘢𝘱𝘪𝘵𝘢𝘭𝘔𝘢𝘳𝘬𝘦𝘵𝘴 𝘐𝘯𝘷𝘦𝘴𝘵𝘮𝘦𝘯𝘵𝘚𝘵𝘳𝘢𝘵𝘦𝘨𝘺

🔎 𝘓𝘪𝘲𝘶𝘪𝘥𝘪𝘵𝘺 𝘞𝘢𝘷𝘦 𝘈𝘩𝘦𝘢𝘥: ₦8.91 𝘛𝘳𝘪𝘭𝘭𝘪𝘰𝘯 𝘌𝘹𝘱𝘦𝘤𝘵𝘦𝘥 𝘵𝘰 𝘏𝘪𝘵 𝘵𝘩𝘦 𝘚𝘺𝘴𝘵𝘦𝘮

𝘕𝘪𝘨𝘦𝘳𝘪𝘢’𝘴 𝘧𝘪𝘹𝘦𝘥-𝘪𝘯𝘤𝘰𝘮𝘦 𝘮𝘢𝘳𝘬𝘦𝘵 𝘪𝘴 𝘴𝘦𝘵 𝘧𝘰𝘳 𝘢 𝘴𝘪𝘨𝘯𝘪𝘧𝘪𝘤𝘢𝘯𝘵 𝘭𝘪𝘲𝘶𝘪𝘥𝘪𝘵𝘺 𝘪𝘯𝘫𝘦𝘤𝘵𝘪𝘰𝘯 𝘵𝘩𝘪𝘴 𝘮𝘰𝘯𝘵𝘩, 𝘸𝘪𝘵𝘩 𝘢 𝘵𝘰𝘵𝘢𝘭 𝘢𝘯𝘵𝘪𝘤𝘪𝘱𝘢𝘵𝘦𝘥 𝘪𝘯𝘧𝘭𝘰𝘸 𝘰𝘧 ₦8.91 𝘵𝘳𝘪𝘭𝘭𝘪𝘰𝘯 𝘧𝘳𝘰𝘮 1-𝘺𝘦𝘢𝘳 𝘮𝘢𝘵𝘶𝘳𝘪𝘵𝘪𝘦𝘴, 𝘤𝘰𝘶𝘱𝘰𝘯 𝘱𝘢𝘺𝘮𝘦𝘯𝘵𝘴, 𝘢𝘯𝘥 𝘣𝘰𝘯𝘥 𝘳𝘦𝘥𝘦𝘮𝘱𝘵𝘪𝘰𝘯.

𝘉𝘳𝘦𝘢𝘬𝘥𝘰𝘸𝘯 𝘰𝘧 𝘦𝘹𝘱𝘦𝘤𝘵𝘦𝘥 𝘪𝘯𝘧𝘭𝘰𝘸𝘴:

• 𝘖𝘔𝘖 𝘮𝘢𝘵𝘶𝘳𝘪𝘵𝘪𝘦𝘴: ₦5.48 𝘵𝘳𝘪𝘭𝘭𝘪𝘰𝘯

• 𝘕𝘛𝘉 𝘮𝘢𝘵𝘶𝘳𝘪𝘵𝘪𝘦𝘴: ₦2.87 𝘵𝘳𝘪𝘭𝘭𝘪𝘰𝘯

• 𝘉𝘰𝘯𝘥 𝘤𝘰𝘶𝘱𝘰𝘯 𝘱𝘢𝘺𝘮𝘦𝘯𝘵𝘴: ₦562.93 𝘣𝘪𝘭𝘭𝘪𝘰𝘯

• 𝘍𝘎𝘕 21.00% 𝘔𝘢𝘳. 2026 𝘣𝘰𝘯𝘥 𝘳𝘦𝘥𝘦𝘮𝘱𝘵𝘪𝘰𝘯: ₦700 𝘣𝘪𝘭𝘭𝘪𝘰𝘯

𝘛𝘩𝘪𝘴 𝘴𝘶𝘣𝘴𝘵𝘢𝘯𝘵𝘪𝘢𝘭 𝘭𝘪𝘲𝘶𝘪𝘥𝘪𝘵𝘺 𝘦𝘷𝘦𝘯𝘵 𝘤𝘰𝘶𝘭𝘥 𝘴𝘩𝘢𝘱𝘦 𝘯𝘦𝘢𝘳-𝘵𝘦𝘳𝘮 𝘮𝘢𝘳𝘬𝘦𝘵 𝘥𝘺𝘯𝘢𝘮𝘪𝘤𝘴 𝘢𝘤𝘳𝘰𝘴𝘴 𝘵𝘩𝘦 𝘺𝘪𝘦𝘭𝘥 𝘤𝘶𝘳𝘷𝘦. 𝘏𝘪𝘴𝘵𝘰𝘳𝘪𝘤𝘢𝘭𝘭𝘺, 𝘪𝘯𝘧𝘭𝘰𝘸𝘴 𝘰𝘧 𝘵𝘩𝘪𝘴 𝘴𝘤𝘢𝘭𝘦 𝘵𝘦𝘯𝘥 𝘵𝘰:

✔ 𝘚𝘶𝘱𝘱𝘰𝘳𝘵 𝘥𝘦𝘮𝘢𝘯𝘥 𝘢𝘵 𝘱𝘳𝘪𝘮𝘢𝘳𝘺 𝘢𝘶𝘤𝘵𝘪𝘰𝘯𝘴

✔ 𝘊𝘰𝘮𝘱𝘳𝘦𝘴𝘴 𝘺𝘪𝘦𝘭𝘥𝘴 𝘪𝘯 𝘵𝘩𝘦 𝘴𝘦𝘤𝘰𝘯𝘥𝘢𝘳𝘺 𝘮𝘢𝘳𝘬𝘦𝘵

✔ 𝘚𝘵𝘳𝘦𝘯𝘨𝘵𝘩𝘦𝘯 𝘴𝘺𝘴𝘵𝘦𝘮 𝘭𝘪𝘲𝘶𝘪𝘥𝘪𝘵𝘺 𝘢𝘯𝘥 𝘮𝘰𝘥𝘦𝘳𝘢𝘵𝘦 𝘮𝘰𝘯𝘦𝘺 𝘮𝘢𝘳𝘬𝘦𝘵 𝘳𝘢𝘵𝘦𝘴

✔ 𝘐𝘯𝘧𝘭𝘶𝘦𝘯𝘤𝘦 𝘍𝘟 𝘱𝘰𝘴𝘪𝘵𝘪𝘰𝘯𝘪𝘯𝘨 𝘥𝘦𝘱𝘦𝘯𝘥𝘪𝘯𝘨 𝘰𝘯 𝘳𝘦𝘪𝘯𝘷𝘦𝘴𝘵𝘮𝘦𝘯𝘵 𝘣𝘦𝘩𝘢𝘷𝘪𝘰𝘶𝘳

𝘛𝘩𝘦 𝘬𝘦𝘺 𝘲𝘶𝘦𝘴𝘵𝘪𝘰𝘯 𝘯𝘰𝘸 𝘪𝘴 𝘳𝘦𝘪𝘯𝘷𝘦𝘴𝘵𝘮𝘦𝘯𝘵 𝘢𝘱𝘱𝘦𝘵𝘪𝘵𝘦:

𝘞𝘪𝘭𝘭 𝘪𝘯𝘷𝘦𝘴𝘵𝘰𝘳𝘴 𝘦𝘹𝘵𝘦𝘯𝘥 𝘥𝘶𝘳𝘢𝘵𝘪𝘰𝘯 𝘪𝘯𝘵𝘰 𝘍𝘎𝘕 𝘣𝘰𝘯𝘥𝘴, 𝘳𝘰𝘵𝘢𝘵𝘦 𝘪𝘯𝘵𝘰 𝘕𝘛𝘉𝘴/𝘖𝘔𝘖 𝘣𝘪𝘭𝘭𝘴, 𝘰𝘳 𝘥𝘪𝘷𝘦𝘳𝘴𝘪𝘧𝘺 𝘪𝘯𝘵𝘰 𝘢𝘭𝘵𝘦𝘳𝘯𝘢𝘵𝘪𝘷𝘦 𝘢𝘴𝘴𝘦𝘵𝘴?

𝘞𝘪𝘵𝘩 𝘮𝘰𝘯𝘦𝘵𝘢𝘳𝘺 𝘱𝘰𝘭𝘪𝘤𝘺 𝘦𝘹𝘱𝘦𝘤𝘵𝘢𝘵𝘪𝘰𝘯𝘴 𝘢𝘯𝘥 𝘭𝘪𝘲𝘶𝘪𝘥𝘪𝘵𝘺 𝘤𝘰𝘯𝘥𝘪𝘵𝘪𝘰𝘯𝘴 𝘦𝘷𝘰𝘭𝘷𝘪𝘯𝘨, 𝘱𝘰𝘴𝘪𝘵𝘪𝘰𝘯𝘪𝘯𝘨 𝘸𝘪𝘭𝘭 𝘣𝘦 𝘤𝘳𝘪𝘵𝘪𝘤𝘢𝘭.

#𝘕𝘪𝘨𝘦𝘳𝘪𝘢𝘔𝘢𝘳𝘬𝘦𝘵𝘴 #𝘍𝘪𝘹𝘦𝘥𝘐𝘯𝘤𝘰𝘮𝘦 #𝘓𝘪𝘲𝘶𝘪𝘥𝘪𝘵𝘺 #𝘍𝘎𝘕𝘉𝘰𝘯𝘥𝘴 #𝘕𝘛𝘉 𝘖𝘔𝘖 𝘊𝘢𝘱𝘪𝘵𝘢𝘭𝘔𝘢𝘳𝘬𝘦𝘵𝘴 𝘐𝘯𝘷𝘦𝘴𝘵𝘮𝘦𝘯𝘵𝘚𝘵𝘳𝘢𝘵𝘦𝘨𝘺

...

The week ahead features key macroeconomic trend determinants for the Nigerian Financial Market, from the scheduled NTB auction on March 4, 2026, with a total offer of ₦1.15bn across three tenors whose outcome will strengthen the near-term DMO pattern in yield compression, alongside the expected inflows of ₦1.75trn from maturing OMO and NTB bills.

The auction sale would only mop up a portion of the inflow if the total offer is maintained, resultantly increasing liquidity in an already surplus system, leading to renewed reinvestment pull, and potentially triggering fresh OMO auctions or heightened buying interest in other instruments.

#nigeriainterestrate #fgnbond #mpcmeetings

The week ahead features key macroeconomic trend determinants for the Nigerian Financial Market, from the scheduled NTB auction on March 4, 2026, with a total offer of ₦1.15bn across three tenors whose outcome will strengthen the near-term DMO pattern in yield compression, alongside the expected inflows of ₦1.75trn from maturing OMO and NTB bills.

The auction sale would only mop up a portion of the inflow if the total offer is maintained, resultantly increasing liquidity in an already surplus system, leading to renewed reinvestment pull, and potentially triggering fresh OMO auctions or heightened buying interest in other instruments.

#nigeriainterestrate #fgnbond #mpcmeetings

...

Expected March 2026 Fixed-income inflows rolling in!

OMO, NTB, and FGN Bond Coupon Payments hitting the books. Stable returns for smart investors.

#fixedincome

Expected March 2026 Fixed-income inflows rolling in!

OMO, NTB, and FGN Bond Coupon Payments hitting the books. Stable returns for smart investors.

#fixedincome

...

Do we become resilient because of success, or because of the struggles we overcome?

#resilience

@sancathaku

Do we become resilient because of success, or because of the struggles we overcome?

#resilience

@sancathaku

...

BTC entered the period, trading within a broader corrective structure that had dominated much of the month. After earlier declines in the month, it hovered in the mid-$60,000 range, attempting to stabilize above critical horizontal support.

BTC entered the period, trading within a broader corrective structure that had dominated much of the month. After earlier declines in the month, it hovered in the mid-$60,000 range, attempting to stabilize above critical horizontal support. ...