Nigeria’s financial market has entered a transition phase as policy direction, liquidity positioning, and inflation signals begin to align toward a more defined yield outlook. The adjustment in liquidity management strategy reflected in recent prospective issuance volumes and curve concentration (especially the full allotment of recent OMO auction bids totalling ₦2.13 trillion against ₦600bn offer), indicates a proactive stance in securing duration financing ahead of potential shifts in monetary guidance. This transition phase is drawing increased attention from portfolio managers seeking early positioning advantages in a market that is gradually shifting from short- tactical trades to medium-tenor collection.

In macro terms, disinflation momentum is beginning to stabilize market expectations, although consumer-level pressure points remain visible. Investor sentiment is therefore adjusting on two fronts easing inflation risk is triggering yield reassessment on the sovereign curve. At the same time persistent cost-push components in key CPI categories justify a cautious pace of duration extension. The interaction between FX liquidity management, external reserve flows, and offshore bid dynamics will remain key determinants of market direction over the coming trading cycles. Externally, the commodities markets ended the week in a mixed position; gold posted a new all-time high gain of 2.53% to close at $4,202.34/oz, crude oil extended its losses with West Texas Intermediate (WTI) down by 4.19% at $57.31, and Brent shed 4.18% to $60.95 per barrel. While the NGX ASI increased by 0.85% to close at 148,978.00 points.

Interbank liquidity opened with a surplus of over ₦1.80 trillion on Friday, marking a week-to-date decline of 11.31% after opening at ₦2.03 trillion on Monday. Money market rates mildly changed, with the Open Repo Rate (OPR) closing at 25.07%, up by 0.68%, while the Overnight (O/N) settled at 24.54% (+0.16%). In the FX market, the local currency traded between $/₦1,448.00 and $/₦1,482.00 during the week and closed at $/₦1,475.28 on Friday.

Nigeria’s Debt Management Office (DMO) released the Q4 2025 bond issuance calendar, increasing the auction volume size to ₦100 – ₦150 billion monthly, compared to the ₦80 – ₦120 billion range in Q3, and featured re-openings of the FGN 2030 and FGN 2032 bonds. This upward volume adjustment reflects a more assertive funding strategy, likely aimed at capitalizing on robust system liquidity, while also signalling the government’s intention to deepen the mid-tenor segment of the yield curve and secure funding ahead of potential shifts in monetary conditions.

The latest OMO Auction conducted by the CBN on October 17 OMO, experienced a shift towards the long tenors away from the mid tenors where it last auctioned. The apex bank offered a mix of 193-day and 249-day bills, attracting strong investor demand with bid coverage of 2.39x and 4.68x, respectively. Stop rates closed slightly lower at 19.40% (-4bps) for 193-day compared to the previous close (151-day) and 19.89% for the 249-day, signaling a measured upward repricing of yields despite heavy subscription. For the first time in a long while (since May 2025), the CBN fully allotted all bids above its offerings, maintaining its strong liquidity sterilization stance while subtly managing rates to retain market engagement and ease FX pressure. Effective yields rose to 21.62% and 23.01% respectively for 193- and 249-day compared to 21.14% last closed (151-day), further highlighting a clear market evolving risk-reward dynamics in favour of long-dated maturities.

OMO Auction – October 17, 2025

TENOR | AUCTION DATE | OFFER (₦‘B) | BIDS (₦‘B) | RANGE OF BIDS (%) | STOP RATES (%) | PREVIOUS STOP RATES (%) | TOTAL SALE (₦‘B) |

193-DAY | 17-10-2025 | 300.00 | 719.00 | 18.4000-19.4000 | 19.4000 | 19.4400 | 719.00 |

249-DAY | 17-10-2025 | 300.00 | 1,403.00 | 18.3400-19.8900 | 19.8900 | 0.0000 | 1,403.00 |

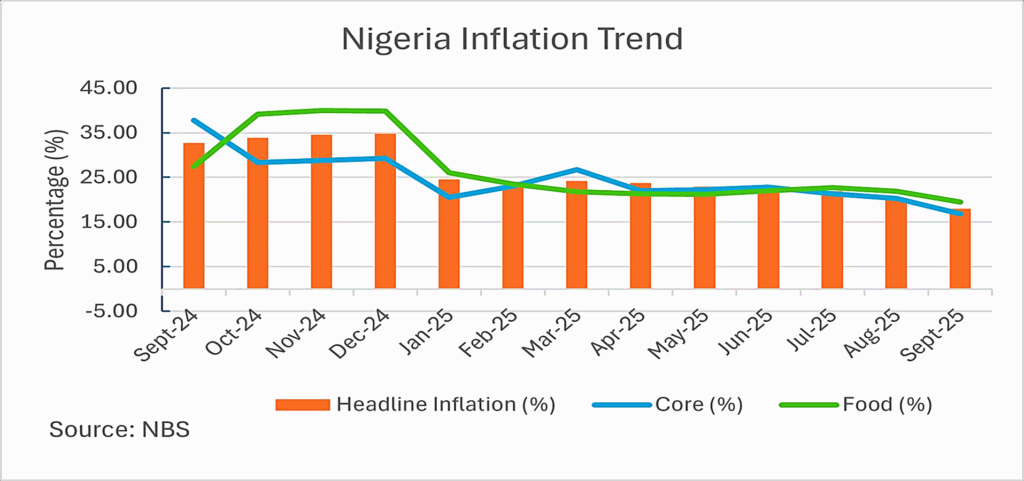

Nigeria’s post-rebasing inflation trajectory shows a clear easing inflection beginning in March 2025, when headline inflation peaked at 24.23% before entering a sustained disinflationary path to 18.02% by September. This represents a 6.21% moderation in six months, reflecting the impact of improved FX liquidity, tighter monetary policy, and early signs of supply stabilization. Core inflation, which remained elevated at 26.74% in March, has since declined sharply to 16.87%, indicating easing cost pressures in non-volatile categories. Food inflation, however, has been more resistant, only easing from 21.79% to 19.53%, indicating that while policy measures are reducing systemic pricing pressures, household-level inflation remains sticky.

The disinflation trend, while positive for yield-sensitive assets and market confidence, has not translated into meaningful household relief, as inflation remains heavily driven by the Food & Non-Alcoholic Beverages, Restaurants & Accommodation Services, Transport, Housing & Utilities, Education, and Health Services. These categories reflect inelastic consumption patterns, meaning households continue to absorb high costs despite macro stabilization. This deviation suggests that while markets may begin to price in lower risk premiums and a potential yield compression, the real economy still requires targeted structural interventions to address cost drivers in food logistics, energy pricing, and essential services.

The Naira weakened marginally against the US dollar over the review period, slipping from $/₦1,457.51 on October 13 to $/₦1,475.35 on October 17, reflecting a modest decline of ₦17.84 (-1.22%), despite sustained FX demand pressures and cautious liquidity conditions in the official market.

Nigeria’s external reserves improved month-to-date, rising from $42.35 billion on September 30 to $42.67 billion on October 15, driven by an increase in liquid reserves. Notably, blocked funds declined from $676.65 million to $652.72 million, reducing the blocked reserve ratio from 1.60% to 1.53%, indicating improved FX liquidity and reserve management efficiency.

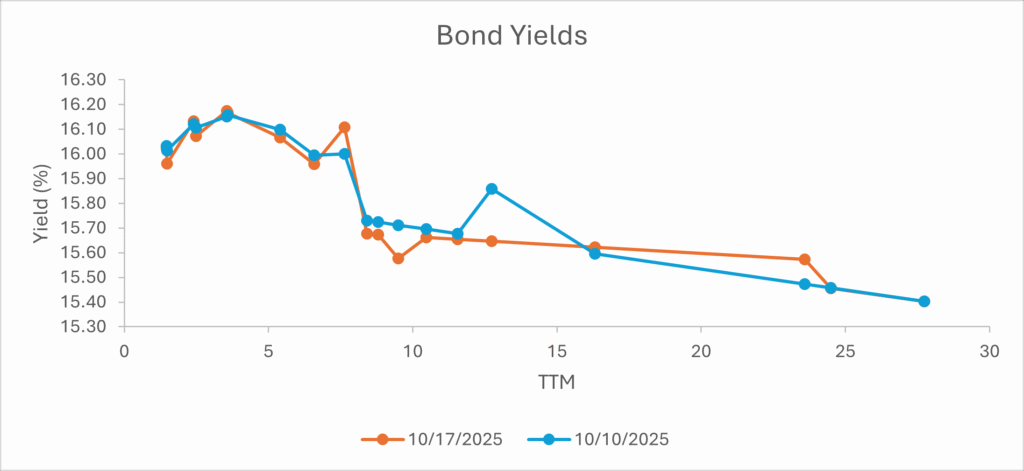

The secondary market for bonds traded bullish, with yields compressing from the low-16.00% range to the mid-15.00% levels as strong buy interest dominated short- to mid-tenor bonds, particularly the 2029–2035 maturities. Demand was active, while supply remained thin on longer papers such as Sukuk 2032–2033, 2049, and 2053, creating a tighter bid-ask environment. In the money market, investors also showed a strong preference for long-dated OMO bills (10-Mar, 3-Feb, 6-Jan, 13-Jan) and NTBs (9-Apr, 22-Jan, 26-Mar, 7-May, 3-Sept, and 8-Oct), further reflecting a shift toward duration positioning amid controlled liquidity conditions.

The International Monetary Fund’s (IMF) upward revision of Nigeria’s GDP growth outlook to 3.9% in 2025 and 4.2% in 2026, backed by expectations of higher oil production, improved investor sentiment, and a more supportive fiscal stance, signals a structural shift toward macro confidence that could trigger gradual yield compression and lower sovereign risk premiums in the fixed-income market, particularly if FX stability continues to reinforce external buffers and restore foreign investor participation. However, while Nigeria’s limited exposure to new U.S. tariff regimes and the African Growth and Opportunity Act (AGOA) expiry window positions it more favourably against peer African economies in attracting foreign capital, the timing and depth of yield repricing will hinge critically on inflation moderation and policy consistency to sustain investor conviction.

As such, portfolio strategy should tilt toward early accumulation of medium-duration sovereign bonds and OMO instruments, capitalizing on current elevated yields before the market transitions from high-yield speculative trades to more strategic duration securing by institutional and offshore investors, depending on reform alignment with IMF confidence signals and clarity from the CBN’s monetary guidance.

Gold extended its record-breaking rally through the week, surging from $4,098/oz on Monday to trade around $4,202.34/oz by Friday, a week-to-date gain of approximately 2.53%, marking a strong upward momentum as investors aggressively rotated into safe-haven assets amid escalating US–China trade tensions, a prolonged US government shutdown, and growing expectations of successive Federal Reserve rate cuts. The metal hit fresh all-time highs almost daily, driven by geopolitical flashpoints including Beijing’s retaliation threats over rare earth restrictions, Washington’s tariff warnings, and uncertainty surrounding US fiscal stability as mass federal layoffs loomed. Market conviction for a 25bps Fed rate cut this month, followed by another in December, weakened the dollar and further supported bullion demand. With central banks, exchange-traded funds (ETFs) inflows, and risk-averse investors driving flows, gold is now on track for its strongest weekly performance since 2020, cementing its position as the market’s preferred hedge against macroeconomic uncertainty.

The Nigeria Exchange All-Share Index (ASI) opened the week at 147,717.00 on Monday and edged slightly lower to 147,711.00 on Tuesday and 147,676.00 by Wednesday, reflecting mild profit-taking and cautious positioning ahead of key macroeconomic data releases. Sentiment shifted on Thursday with a notable rebound to 148,355.00, suggesting renewed buying interest in large-cap stocks, powered by bargain-hunting and rotational flows into banking and industrial counters. The market closed positively on Friday at 148,978.00, an increase of 1,261 points and a week-to-date (WTD) gain of 0.85%.

Brent crude opened the week around $63.61 per barrel on Monday and closed near $60.95 per barrel on Friday, marking a week-to-date decline of approximately 4.18%. WTI crude started the week at $59.80 per barrel and traded around $57.31 per barrel by Friday, reflecting a weekly drop of about 4.19%. Both benchmarks hit five-month lows by midweek, highlighting mounting bearish pressure amidst rising supply expectations and softening demand prospects.

The decline was largely driven by a series of supply-side risks turning increasingly skewed toward surplus, with the International Energy Agency (IEA) warning of an oversupply of up to 4 million barrels per day (bpd) next year, compounded by steady Organisation of Petroleum Exporting Countries and allies’ (OPEC+) output increases and growing US inventories. Geopolitical signals, which initially lifted prices early in the week due to US–China tariff moderation and speculation around India reducing Russian crude intake, quickly faded as policy clarity remained lacking. Market sentiment turned risk-off as inventories in the US rose by over 7 million barrels, while speculation of talks between the US and Russia showed potential easing of supply limits, further reducing bullish positioning heading into the new week.

The week ahead is poised for a potential yield readjustment with respect to the issuance of long-dated bills, besides inflows from NTB maturities exceeding ₦390bn and a scheduled NTB auction. While the mild adjustment in rates at the recent auction suggest room for an optimistic anticipation in the near term; however, global risk sentiment is shifting as tensions heighten with US–China trade, the prolonged US government shutdown, and rising expectations of Fed rate cuts fuel a flight to safety, pushing gold to record highs, in addition to crude oil prices declining on weak demand. With the release of the FGN Bond Circular for the October 2025 auction, the DMO increased the offer size by ₦30bn each for the instruments on auction bringing the total volume to ₦260bn from ₦200bn from previous auction. This expansion likely signals a response to recent yield repricing, as the market has shifted in expectation of higher term premiums and liquidity absorption.

As major central banks tilt toward easing and developed market yields begin to flatten, high-yield markets like Nigeria could attract fresh offshore interest, provided that FX stability holds and the disinflation trend persists. Conversely, external shocks from commodity price swings and tariff-driven volatility will remain key factors influencing yield direction and foreign portfolio flows in the near term. We expect Nigerian yields to inch higher in the near term to keep the country attractive. In the digital assets market, Cryptocurrencies may recover from last week’s shock crash, but there is a strong expectation that we will retest recent lows soon. In the view of some analysts, Bitcoin, the industry’s flagship, may trade sub $100,000 before a sustainable rally commences!!! The equities markets in Nigeria will possibly continue to improve as the macroeconomic environment stays positive, barring global shocks emanating from the US (which is likely imminent at this point).

By: Sandra A. Aghaizu

The market drifts into a new tide…

₦390 billion flows back to shore,

New bills set sail,

And yields adjust to shifting winds.

Beyond our shores, gold glitters as fear rises,

Oil weakens on fading demand,

And central banks ease their grip.

Nigeria, still a beacon of yield,

May draw new eyes…

If calm holds in the Naira’s seas

And inflation’s fire stays low.

Yet the waves of trade and oil

Can change the course overnight.