Changpeng Zhao (CZ), the former CEO of Binance, made headlines with a notable statement: “If you sold the dip, you need to unfollow the weak minds and follow the right people.” CZ remains a strong advocate for long-term crypto investment. While his perspective is valid, it is important to recognize that economic circumstances vary globally, prompting some individuals to sell their holdings after modest gains to meet personal or regional needs. Others remain cautious, fearing substantial losses if market prices drop significantly.

In regulatory developments, the U.S. Securities and Exchange Commission (SEC) Crypto Task Force convened with the New York Stock Exchange to deliberate on approaches for crypto regulation. The meeting addressed key topics, including tokenized equity trading, standardizing listing criteria for spot crypto exchange-traded products (ETPs), and fostering a level playing field for market participants.

Simultaneously, the U.S. Senate Banking Committee released guiding principles for its digital asset market structure. The document, endorsed by GOP Senators Tim Scott, Cynthia Lummis, Bill Hagerty, and Thom Tillis, outlines the framework for an upcoming discussion draft of a comprehensive cryptocurrency bill.

Coinbase announced its involvement in aiding the U.S. Secret Service in seizing $225 million worth of stolen cryptocurrency linked to pig butchering scams. The exchange played a critical role in tracing frozen funds and identifying victims, contributing to a landmark enforcement operation.

BlackRock’s spot Ethereum ETF made a significant acquisition on June 24, purchasing 40,660 ETH valued at approximately $98 million, demonstrating institutional confidence amid broader market volatility.

In Norway, Green Minerals, a deep-sea mining company, unveiled a Bitcoin Treasury strategy with plans to raise $1.2 billion to acquire Bitcoin.

Arizona’s House Bill 2324, which authorizes the establishment of a digital asset reserve using seized digital assets from criminal forfeitures, has passed the House vote and is awaiting Governor Hobbs’ signature.

In Asia, eight leading South Korean banks have joined forces with the Open Blockchain and Decentralized ID (DID) Association and the Financial Settlement Institute to launch a won-backed stablecoin through a new joint venture, highlighting growing public-private interest in blockchain infrastructure.

Meanwhile, the U.S. Federal Reserve Chairman Jerome Powell confirmed that banks are permitted to offer services to the cryptocurrency sector and are also allowed to engage in crypto-related activities.

In the sports and entertainment arena, Tether announced it has acquired a 10.7% equity stake in Juventus Football Club for €128 million, expanding its global brand presence and making it the second-largest shareholder.

In the United Kingdom, Barclays Bank announced a ban effective June 27, preventing customers from using credit cards for any cryptocurrency-related transactions. The development has drawn criticism from the crypto community.

GameStop raised an additional $450 million through zero-interest notes, bringing its total liquidity to $2.7 billion. The company had disclosed its plans to allocate a portion of these funds to Bitcoin as part of its reserve asset.

Across Europe, the European Commission is preparing guidance that will permit the interchangeability of stablecoins between EU and non-EU issuers under the MiCA (Markets in Crypto-Assets) regulatory framework, according to Reuters. This development is expected to significantly boost mainstream adoption.

JPMorgan has filed a trademark for “JPMD,” covering cryptocurrency trading, digital currency issuance, and blockchain custody services, marking a clear divergence from Barclays’ restrictive approach.

In Asia-Pacific, Hong Kong launched its “Policy 2.0” alongside the LEAP initiative, aimed at advancing tokenization and stablecoin use, positioning itself as a global leader in digital assets.

Per Coindesk, the illiquid supply of Bitcoin has surpassed 14 million BTC, reflecting a trend of holders transferring their assets off exchanges into long-term storage.

BlackRock’s spot Bitcoin ETF recorded significant activity across key dates:

—

Bitcoin Treasury Capital in Sweden purchased 66 BTC (~$7 million) at $105,000 each and plans further acquisitions.

Coinbase CEO Brian Armstrong reiterated the exchange’s bullish outlook, declared: “We’re buying more Bitcoin every week. Long #Bitcoin.” However, the U.S. Supreme Court rejected an appeal to prevent the IRS from accessing Coinbase user data. This decision allows the IRS to obtain information on more than 14,000 users. The breach of confidentiality could diminish trust in centralized exchanges such as Coinbase and disrupt a foundational pillar of cybersecurity: confidentiality.

El Salvador continued its daily Bitcoin purchases, adding 7 BTC this week, bringing its total holdings to 6,222 BTC.

The Blockchain Group acquired an additional 60 BTC for €5.5 million, increasing its total holdings to 1,788 BTC.

Fidelity made a strategic purchase of 10,283 ETH valued at $25.7 million.

Pompliano’s investment firm, ProCap, added 1,208 BTC at $105,977 per coin, increasing its total to 4,932 BTC as it approaches a $1 billion treasury in preparation for a public listing. This aggressive acquisition mirrors the strategy of Michael Saylor’s company, MicroStrategy.

Saylor’s firm purchased 4,980 BTC worth $531.9 million at $106,801 per coin, bringing its total to 597,325 BTC valued at approximately $42.4 billion.

In the judicial arena, U.S. Judge Analisa Torres denied motions from both Ripple and the SEC to amend the final judgment, thereby halting a fast-tracked $50 million settlement. As a result, institutional XRP sales remain under legal constraint. Meanwhile, Ripple has integrated Wormhole to connect its XRP Ledger and EVM sidechain to over 35 blockchains.

In the Middle East, former U.S. President Donald Trump’s company, World Liberty Financial, secured a $100 million investment from a UAE-based fund, underscoring the Emirati enthusiasm for cryptocurrency ventures.

The Australian authorities launched a public awareness campaign following the report of a 77-year-old widow who lost $282,000 in a cryptocurrency romance scam. The incident has triggered a nationwide crackdown on fraud linked to Bitcoin ATMs.

Bitcoin ETFs now hold more than $27 billion in assets, increasingly being viewed as a complementary tool to traditional bond investments within institutional portfolios.

Senator Tim Scott, Chair of the U.S Senate Banking Committee, has set a target date of September 30 to pass the proposed crypto market structure bill.

On June 27, a user lost $199,025 in USDT due to an address poisoning scam. The attacker created a deceptive wallet address nearly identical to one previously used by the victim, leading to an accidental transfer of funds. This highlights the critical need for strong cybersecurity awareness among cryptocurrency users.

In an intriguing development, Bhutan has discreetly mined 12,000 BTC since 2020, reportedly valued at approximately $1.3 billion. This amount now constitutes nearly 40% of the nation’s GDP, making Bhutan the third-largest sovereign holder of Bitcoin globally.

Bitcoin has now surpassed Google to become the world’s sixth-largest asset by market capitalization, a testament to its growing prominence in the global financial landscape.

In Bolivia, the usage of Bitcoin and Tether is surging amid worsening inflation. Small businesses are increasingly turning to cryptocurrencies for stability, raising concerns about global economic instability and accelerating inflation trends.

Finally, the Russian authorities on June 29 uncovered a KamAZ truck outfitted with 95 illegal crypto mining rigs, stealing electricity from the grid, marking the sixth such case reported in Buryatia this year.

Recent survey data indicates that 27% of South Koreans aged 20 to 50 currently hold cryptocurrency, with 70% intending to buy more. Digital assets now represent 14% of their total holdings, driven largely by retirement planning and economic uncertainty.

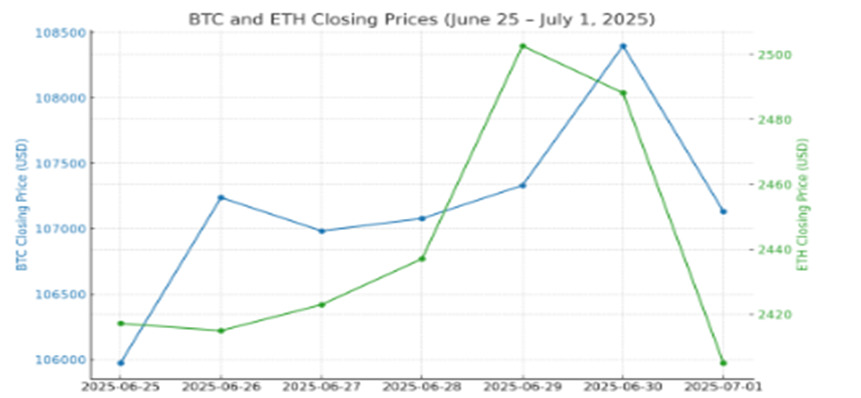

Date | BTC Closing Price (USD) | ETH Closing Price (USD) |

June 25, 2025 | $105,976.10 | $2,417.23 |

June 26, 2025 | $107,238.50 | $2,415.03 |

June 27, 2025 | $106,984.00 | $2,423.03 |

June 28, 2025 | $107,078.90 | $2,437.13 |

June 29, 2025 | $107,331.60 | $2,502.67 |

June 30, 2025 | $108,396.60 | $2,488.19 |

July 1, 2025 | $107,132.80 | $2,405.10 |

Barclays’ Move...

In a volatile market, Barclays remains cautious about coins not forged from ore. They cling to what they know, dipping toes in the waters with hesitation. While they permit transactions, if the customer insists and bears the cost. They're reluctant to stake borrowed funds on a market so unstable, where value can vanish overnight.

Crypto lacks the safety net of insurance or the protection of financial ombudsman schemes. Ghost faces linger behind the transactions, transparency fades, fraud, scams, and money laundering surge.

Borrowing to chase digital coins only doubles the risk. With real estate, there's at least tangible ground for growth. But crypto? One misstep, and the floor disappears.

Barclays, in their restraint, may simply be trying to shield customers from the swaying tower that is crypto.

Do we applaud their prudence or question their fear?

- By: Sandra A. Aghaizu