Dearest Readers,

The past week in cryptocurrency has been yet another whirlwind of events, and we are always here for it! Here are notable updates:

—

Corporate Treasury Moves

Companies are increasingly allocating funds to digital assets:

—

ETF Investments

Spot cryptocurrency ETFs are gaining remarkable traction:

—

Banking and Financial Services

Traditional institutions are embracing crypto, including:

—

U.S. Regulatory Scene

—

Global Regulatory Moves

—

Stablecoin Launches

—

Infrastructure Developments

—

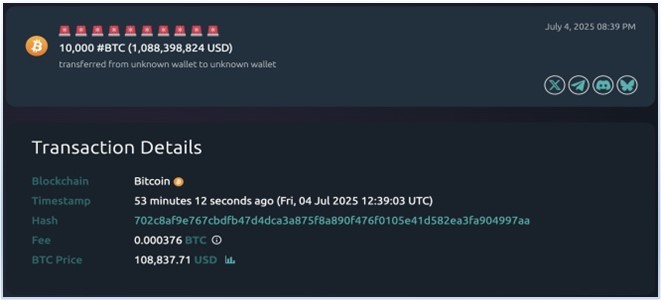

Large-Scale Transactions

—

Market Predictions

—

Memecoins and Speculative Assets

—

Security and Legal Issues, Scams and Breaches

—

Crypto Crime Initiatives – The U.S. Secret Service expanded its global network to combat crypto crime, focusing on cross-border blockchain tracing.

—

FTX Compensation Controversy – FTX may exclude users in 49 countries from compensation due to local crypto bans, raising ethical concerns.

—

Bitcoin Mining – A solo Bitcoin miner earned 3.173 Bitcoin ($350,000) by successfully mining a block.

New Ventures – Peter Thiel, Palmer Luckey, and Joe Lonsdale plan to launch Erebor, a bank serving startups and crypto businesses, aiming to rival Silicon Valley Bank.

—

Exchange Updates

—

Blockchain Milestones: Telegram’s blockchain startup TOP became TON’s first unicorn, reaching a $1 billion valuation after raising $28.5 million.

—

Last but certainly not least, billionaire Elon Musk has said that “Fiat is hopeless”. We tend to believe him because inflation is at its worst in the history of world economies!

In a world where currency no longer clinks but clicks, digital coins serve many purposes, good or evil.

—

Fortunately, the crime can’t go unnoticed, as strong, tight nets are built to catch the wrong and guard the good users.

—

Laws are in place not only to deter theft and fraud, but to safeguard, guarantee trust, and value.

—

Despite hackers hiding behind the screens, cyber investigators are trained to trace every digital footprint, examining each case with precision. These digital guardians work tirelessly, helping nations recognize red flags and empower users to stay secure.

—

Yes, the world of Crypto seems so fast, free, and full of promise.. It’s good to know that there is a vigilant eye carefully watching over the system.

By: Sandra A. Aghaizu