The week was packed with developments such as the Senate’s approval to raise an additional ₦1.15 trillion in domestic debt, the Central Bank’s strategic mid-tenor OMO interventions and the anticipated slowdown in October inflation, all highlighting the intricate interplay between government financing, liquidity management, and market expectations. In the secondary market’s cautious rotation, the NGX’s volatile swings, and key commodity movements in oil and gold emphasise both opportunities and risks in the local and global investment landscapes. In addition, the stabilizing FX reserves, shifts in international yields, and uneven economic growth across the US, UK, and Eurozone, contributed to ensuring that the current environment demands incisive analysis for portfolio strategy, risk management, and a keen eye on policy signals. This editorial delves into these interconnected trends, providing a holistic view of Nigeria’s evolving investment climate and the forces influencing capital flows, asset prices, and market sentiment.

Interbank liquidity opened with a surplus of over ₦1.07 trillion on Friday, marking a week-to-date decline of 72.1% after opening at 3.83 trillion on Monday and rising as high as ₦5.9 trillion approximately. Money market rates mildly changed, with the Open Repo Rate (OPR) and Overnight (O/N) peaking at 24.57% and 24.92%, before closing at 24.50% and 24.92% respectively. In the currency market, the Naira traded between $/₦1,435.00 and $/₦1,445.50 during the week and settled at $/₦1,442.43 on Friday.

The senate’s approval to raise an additional ₦1.15 trillion in domestic debt signaled tighter funding conditions, with the government likely issuing securities at relatively improved yields to attract investors, supporting strong demand for fixed income but increasing the risk of crowding out private-sector borrowing. While the move offers clarity on the 2025 fiscal financing plan and may stabilize investor sentiment, it also adds liquidity that the CBN may need to actively manage through OMO auctions to prevent excess pressure on interest rates. Overall, the decision reinforces the dominance of government paper in the investment landscape while raising medium-term concerns around debt sustainability.

With the rotation of mid-tenor day bills, the CBN’s November 13 OMO auction featured the 152- and 173-day bills, marking the first issuance of such bills in November 2025 which resulted in an oversubscription against their offer of 2.15x and 8.15x, respectively. Allotment to demand took another pattern of 2.13x and 6.35x respectively, both in the same range of 19% and 22% bid levels and a cleared stop rate above mid 20% levels for both tenors, with a difference of 10bps apart. Effective yield stood at 22.52%(+138bps) and 22.94%(+132bps) respectively, for the 152- and 173-day bills. In contrast to the previous 151- and 193-day notes, which had marginal rates below mid 19% levels at 19.44% and 19.40% with effective yields at 21.14% and 21.62%. A clear depiction of the CBN’s efforts to aggressively control the yield curve from deviating from its desired threshold due to demand pull and maintain investors’ appetite. Conversely, the effective yield for the recent mid-tenor OMO bills was lower than the prior auctioned short-tenor OMO bills. This invariably showed that effective yield was continuously tilting to match investors’ expectations.

OMO Auction – November 13, 2025

TENOR | AUCTION DATE | OFFER (₦‘B) | BIDS (₦‘B) | RANGE OF BIDS (%) | STOP RATES (%) | PREVIOUS TENOR STOP RATES (%) | TOTAL SALE (₦‘B) |

152-DAY | 13-11-2025 | 300.00 | 645.15 | 19.0500-22.1400 | 20.5900 | – | 640.15 |

173-DAY | 13-11-2025 | 300.00 | 2,445.40 | 19.1000-22.4900 | 20.6900 | – | 1,907.40 |

Nigeria’s October 2025 inflation print is expected to show a further slowdown, reinforcing signs that price pressures are gradually easing as food supply improves and FX conditions stabilise. Ahead of the monetary policy committee (MPC) meeting, a softer reading strengthens the case for easing and potentially signals a shift towards a more neutral stance, especially with rising growth concerns. However, where the decline is marginal or core inflation remains sticky, the Committee could maintain its cautious tone, keeping rates steady to anchor expectations. Overall, the report will be a key determinant of whether the MPC leans toward a hold-and-watch approach or keeps the door open to tightening where upside risks resurface.

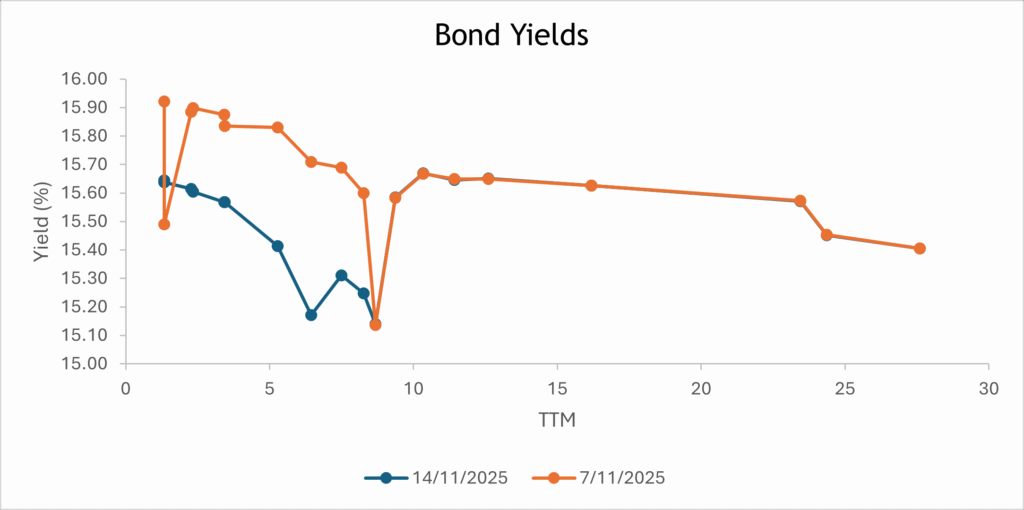

The secondary market sustained a mixed bear-bull tone across bonds and money market instruments, with yields holding within the low-15% range for bonds and low-20% band for bills, as renewed supply in short- to mid-tenor papers, particularly the 2027–2035 notes, was met with selective and resilient demand, while interest in the 2053s maturity showed minimal traction. In the money market, positioning stayed constructive, with investors rotating across the curve but showing a stronger appetite for the mid- and long-dated OMO bills (7-Apr, 21-Apr, 21-Feb, 23-Dec, 5-May, 23-Jun, 20-Jan) and NTBs (5-Feb, 22-Jan, 10-Jul, 8-Oct, 22-Oct, 5-Nov), reflecting cautious duration extension amidst surplus liquidity dynamics. Overall, trading skewed towards a bear market, with quotes pushing prices lower as investors favoured safer, short-term plays.

The Naira traded largely stable at the Nigerian Foreign Exchange Market (NFEM), declining slightly from $/₦1,437.29 to $/₦1,442.43, with a week-to-date decline of about ₦5.14 (0.36%). The narrow trading range was indicative of improved FX liquidity and steady reserve growth, supported by the CBN’s proactive interventions to forestall FX pressures.

Nigeria’s external reserves continued their upward momentum, rising from $43.19 billion on October 31 to $43.54 billion on November 13, marking a gain of approximately $338 million month-to-date (+0.78%), an increase of 0.86% in liquid reserves. At the same time, blocked funds declined from $615.47 million to $585.11 million, reducing the blocked reserve ratio from 1.42% to 1.34%, indicating enhanced FX liquidity, reserve management efficiency, and progress in clearing outstanding obligations.

Beyond the Nigerian Market

The rise in the UK unemployment rate to 5.0% alongside a marginal 0.1% GDP expansion in Q3 2025 signals a cooling labour market and a stalling economy, reinforcing expectations that the Bank of England will maintain a cautious policy path. In contrast, the elevated US Treasury yields, anchored around the 4% range, continued to tighten global financial conditions, drawing capital toward dollar assets and increasing funding costs for other economies. However, the Eurozone’s modest 0.2% Q3 2025 growth kept the European Central Bank (ECB) in a delicate position, balancing sticky inflation against a fragile recovery. Together, these dynamics create a landscape where investors closely track interest-rate differentials and central-bank signals, with risk sentiment heavily influenced by shifts in global yield curves and diverging economic trajectories.

The Nigerian Exchange (NGX) All-Share Index opened the week at 149,569.00 but fell sharply through Tuesday, posting a steep one-day loss of 5,868 points, the largest in years. The index rebounded on Wednesday and maintained momentum into Friday, closing positive, following announcements by the Minister of Finance and Coordinating Minister of the Economy, Mr Wale Edun, of a potential Capital Gains Tax revision. For the week ended November 14, 2025, the ASI recorded a week-to-date decline of 1.15% and 1,716 points, closing at 147,116.00. The bearish trend was largely driven by profit-taking across the banking, industrial, telecommunications, energy, and insurance sectors.

Oil prices were volatile during the week, as the market balanced supply concerns against global oversupply risks. WTI crude futures started at $59.64 per barrel on Monday and rose to $60.77 on Tuesday, before dipping $59.19 on Wednesday amid OPEC’s Q3 2025 supply surplus revisions of 500,000 bpd, before slipping further to a three-week low of $58.80 on Thursday and rebounding to $59.95 on Friday. Brent crude rose from $63.49 on Monday to $64.74 on Tuesday, retreated to $63.38 on Wednesday, fell to $63.07 on Thursday, and recovered to $64.26 on Friday. Early-week gains were supported by hopes of an end to the US government shutdown and robust fuel demand, while mid-week declines reflected higher US production, OPEC+ output, and IEA warnings of a growing global glut with supply projected to exceed demand by 2.4 million barrels per day this year and 4 million next year. Geopolitical tensions, including US sanctions on Russian firms and recent drone and airstrike activity impacting Russian exports, helped support prices toward the end of the week, highlighting persistent supply-side pressures despite a backdrop of elevated inventories and longer-term demand growth projections through 2050.

Gold extended its upward trajectory during the week, climbing from $4,080 per ounce on Monday to a three-week high of $4,207 on Thursday before easing slightly to $4,080 on Friday, marking a week-to-date decline of 0.09%. The rally was driven by heightened expectations of a Federal Reserve rate cut in December amid weak US labour data, with private reports showing job losses averaging 11,250 per week in October and consumer sentiment falling sharply. The end of the 40-day US government shutdown, following the Senate’s approval of a temporary funding measure and President Trump’s signing of the bill, provided some clarity but also fuelled uncertainty. Traders priced in a 50–70% probability of a 25-bps rate cut, supporting bullion as a safe-haven asset, while ongoing central bank purchases and investor demand for protection against fiscal risks further supported prices. Gold’s daily levels ranged from a low of $4,000.98 to a high of $4,381.58 over the period.

With October inflation expected to show further moderation, the CBN may lean toward a hold-and-watch stance at its upcoming MPC meeting. It is anticipated that the ₦700 billion scheduled NTB auction, coupled with the Senate-approved domestic borrowing and anticipated inflows of ₦1.7 trillion from OMO, NTB, and coupon maturities, will keep government paper in strong demand. In the same vein, yields are expected to remain attractive, although investors are advised to be mindful of potential crowding out of private-sector borrowing and short-term pressure on rates, making this a critical period for fixed-income markets and liquidity management.

By: Sandra A. Aghaizu

The UK’s rising unemployment and faint 0.1% growth are like dimming lights, signalling an economy catching its breath. The Bank of England moves carefully, stepping softly across uncertain ground.

Across the Atlantic, elevated US Treasury yields glow like a powerful beacon, pulling money toward the dollar and making borrowing elsewhere feel like climbing a steeper hill.

The Eurozone’s gentle 0.2% growth leaves the ECB balancing on a thin wire, weighing stubborn inflation against a fragile recovery.

Across markets, investors read these signals like shifting skies…global yields, drifting economies, and diverging paths shaping whether they lean into risk or retreat to safety.