The week under review witnessed three auctions (two OMOs and one NTB), with a view to mop up the excess liquidity that trickled into the system from maturities and other inflows during the week, in addition to the steady decline in headline inflation and FX resilience suggested underlying stability. However, global uncertainties perceived from the non-expected US data report for October and November, with ongoing geopolitical tensions affecting oil and commodity markets, kept investors cautious. Against this backdrop, the market was choppy, shaping expectations for the rest of the year.

Interbank liquidity opened with a surplus of over ₦1.30 trillion on Friday, marking a week-to-date decline of 66.6% after opening at 3.90 trillion on Monday and peaking at ₦5.47 trillion during the week. Money market rates marginally changed, with the Open Repo Rate (OPR) and Overnight (O/N) peaking at 24.60% and 25.10%, before closing at 24.50% and 24.83% respectively. In the currency market, the Naira traded between $/₦1,440.00 and $/₦1,462.00 during the week and closed at $/₦1,456.73 on Friday.

The latest OMO auctions conducted by CBN on November 18 and 19, 2025 showed strong demand across mid-tenor bills, with total bids far exceeding the ₦300bn offer per tenor, most notably the 182-day bill, which attracted a massive ₦3.04tn in bids. Compared to previous auctions, stop rates were largely stable, edging marginally lower by 15bps, 9bps, and 1bps for the 175-, 174-. and 188-day respectively, reflecting robust investor appetite for high yields. The CBN surpassed its total offer on both auctions, overselling the 175 and 182 day by over 2X and 10X, respectively, on the 18th and by over 2X for the 188 day on the 19th, absorbing sizable liquidity while keeping rates anchored around the 20.45%–20.55% band. Overall, the auctions witnessed strong demand for high-yield OMO instruments amid persistent liquidity surpluses.

AUCTION DATE | TENOR | OFFER (₦‘B) | BIDS (₦‘B) | STOP RATES (%) | PREVIOUS TENOR STOP RATES (%) | TOTAL SALE (₦‘B) |

18-11-2025 | 175-DAY | 300.00 | 729.70 | 20.5400 | 20.6900 | 729.70 |

182-DAY | 300.00 | 3,042.43 | 20.5500 | – | 2,246.53 | |

19-11-2025 | 174-DAY | 300.00 | 277.00 | 20.4500 | 20.5400 | 277.00 |

188-DAY | 300.00 | 703.35 | 20.5400 | 20.5500 | 626.35 |

The November 19, 2025 NTB auction result reflected soft demand in the short and mid tenors, with subscriptions falling well below the offer, while the 364-day paper continued to dominate investor interest, recording a strong ₦1.23tn subscription against its offer. Stop rates remained unchanged across all tenors, signalling market stability and comfort with current yield levels. The heavy bid concentration in the one-year paper emphasized investors’ preference for high turnover despite elevated liquidity and cautious positioning ahead of year-end. Ultimately, the auction outcome point to a strong yield control environment, with demand skewed firmly toward the long end of the curve.

AUCTION DATE | 19-11-2025 | 19-11-2025 | 19-11-2025 |

ALLOTMENT DATE | 20-11-2025 | 20-11-2025 | 20-11-2025 |

MATURITY DATE | 19-02-2026 | 21-05-2026 | 19-11-2026 |

TENOR | 91-DAY | 182-DAY | 364-DAY |

OFFER (₦) | 100,000,000,000 | 150,000,000,000 | 450,000,000,000 |

SUBSCRIPTION (₦) | 34,546,520,000 | 26,714,048,000 | 1,230,749,438,000 |

ALLOTMENT (₦) | 33,808,519,000 | 26,414,048,000 | 1,029,799,326,000 |

RANGE OF BIDS (%) | 14.2500 – 18.0000 | 14.8500 – 16.0000 | 15.0000 – 18.0300 |

STOP RATES (%) | 15.3000 | 15.5000 | 16.0400 |

PREVIOUS STOP RATES (%) | 15.3000 | 15.5000 | 16.0400 |

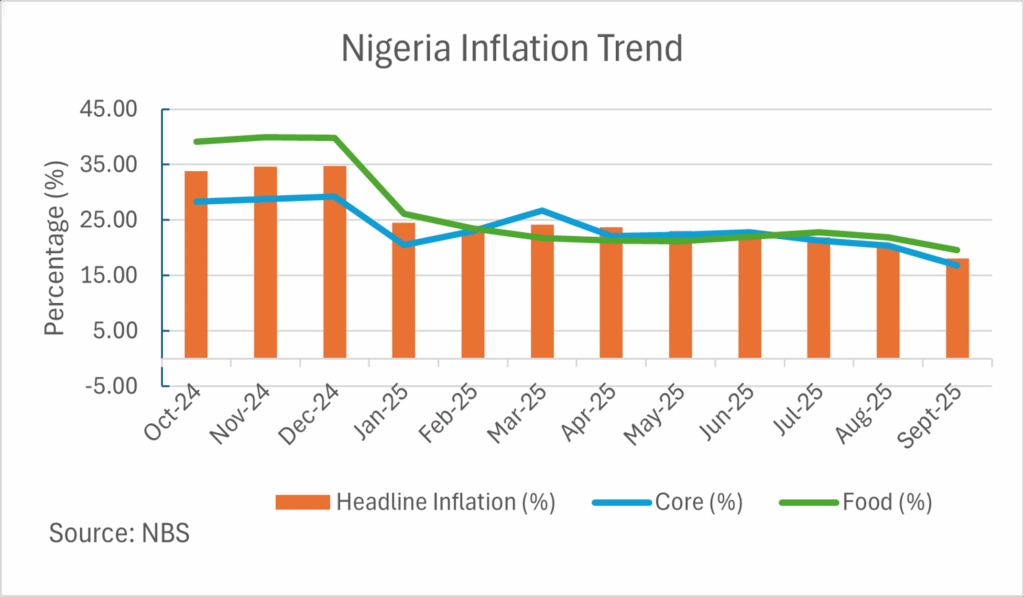

Per the Nigerian Bureau of Statistics (NBS), Nigeria’s October 2025 headline inflation rate eased to 16.05% year-on-year, marking the seventh consecutive monthly decline and the lowest level since March 2025. Food inflation, which is a major contributor to the basket, fell significantly by 641bps MoM, while core inflation (excluding volatile agricultural products and energy) ticked up by 182 bps. The moderation reflects improving supply conditions and some stability in the exchange rate, but persistent underlying inflationary pressures in non-food items remain a risk.

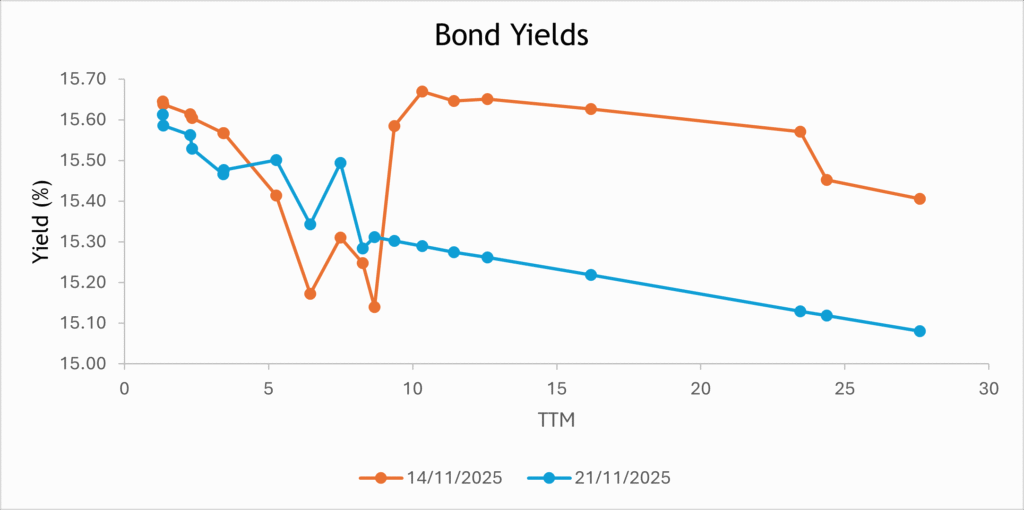

Ahead of the November 2025 FGN Bond Auction, the DMO released a revised Q4 issuance calendar showing a noteworthy step-up in offer volumes, with a planned range of ₦200–₦250 billion, a 67% increment from the offered volume in October. The auction will feature reopenings of the 19.945% FGN AUG 2030 and 17.95% FGN JUN 2032 bonds, signaling the DMO’s intention to deepen liquidity in benchmark maturities while meeting elevated government funding needs. This upward revision in supply points to a more assertive issuance posture, likely shaping yield expectations and investor positioning ahead of the sale. Given current market dynamics, we expect yields to remain broadly in line with levels seen at the previous issuance.

The Nigerian Exchange Foreign Investment Report showed Equity market activity moderated sharply in October 2025, with total transactions down 36.31% to ₦1.03tn, reflecting the absence of the large block trades that had boosted September flows. Domestic investors continued to dominate market participation at 82%, though their activity declined by 31.43%, driven mainly by a steep 46% contraction in institutional trades, even as retail participation rose by 19%. Foreign transactions also weakened significantly, falling 51.85% month-on-month, emphasizing lingering risk-off sentiment despite a firmer Naira. Overall, while turnover remained more than double the level recorded in September 2025, the pullback in institutional activity highlights a more cautious posture ahead of year-end positioning.

The secondary market sustained a mixed bear-bull tone across bonds and money market instruments, with yields holding within the low-15% range for bonds and low-20% band for bills, as renewed supply in short- to mid-tenor papers, particularly the 2027–2035 notes, was met with selective and resilient demand, while interest in the 2053 maturity showed minimal traction. In the money market, positioning stayed constructive, with investors rotating across the curve but showing a stronger appetite for the mid- and long-dated OMO and NTB bills, reflecting cautious duration extension amidst a system awash with cash dynamics. In a nutshell, trading skewed towards a bear market, with quotes pushing prices lower as investors favoured safer, short-term plays.

The Naira traded on modest volatility at the Nigerian Foreign Exchange Market (NFEM), declining from $/₦1,448.03 to $/₦1,456.73, with a week-to-date decline of about ₦8.70. The intra-week movements showed a resilient market despite FX pressures, indicative of improved FX liquidity and steady reserve growth, supported by the CBN’s proactive interventions to forestall FX pressures.

Nigeria’s external reserves continued their upward momentum, rising from $43.19 billion on October 31 to $44.19 billion on November 20, marking a gain of approximately $992 million month-to-date (+2.30%), an increase of 2.44% in liquid reserves. Concurrently, blocked funds declined from $615.47 million to $569.51 million, reducing the blocked reserve ratio from 1.42% to 1.29%, indicating enhanced FX liquidity, reserve management efficiency, and progress in clearing outstanding obligations.

The Nigerian Exchange (NGX) All-Share Index opened the week at 145,160.00 but declined throughout the week, closing at 143,790.90 points on Friday. For the week ended November 21, 2025, the ASI recorded a week-to-date decline of 0.94% and 1,369.00 points. The bearish trend was mostly driven by profit-taking and broader risk view across the banking, consumer goods, telecommunications, energy, and insurance sectors.

Global markets remain cautious as major central banks maintain steady policies. In the U.S., the Federal Reserve continues its restrictive stance, signaling caution on rapid rate cuts due to persistent inflation risks, while the absence of the October 2025 labour report, cancelled due to the federal shutdown, creates uncertainty about the labour market, complicating the US Federal Reserve decision-making and likely reinforcing a cautious or neutral policy outlook. In the U.K., the Bank of England held rates amidst sticky inflation and slowing growth, indicating a careful and gradual approach despite some internal pressure to ease in 2026. The European Central Bank also remained guarded, noting persistent core inflation in spite of softer Eurozone data. Collectively, these dynamics have reinforced a defensive investor mood, with heightened risk-off sentiment and flows into emerging markets, including Nigeria, remaining selective.

Oil prices were volatile during the week as markets balanced supply concerns with geopolitical developments. WTI crude fell from $60.04 on Monday to $57.51 on Friday, while Brent retreated from $64.29 to $62.01. Both benchmarks experienced a steady decline, reflecting bearish reaction driven by expected global supply gluts, potential increases in Russian exports, and mixed US inventory data, despite ongoing sanctions and geopolitical risks. Early-week gains were supported by the resumption of operations at Russia’s Novorossiysk port following a Ukrainian drone strike and looming US sanctions on Rosneft and Lukoil. Later in the week, optimism over US-drafted peace talks between Russia and Ukraine, along with fluctuating US fuel and crude stocks, kept markets under pressure.

Gold price was volatile during the week as markets reacted to Federal Reserve policy signals and US economic data. After it opened at $4,072 per ounce on Monday, it slipped to $4,054 on Tuesday amidst fading expectations of a December rate cut. Gold recovered slightly to $4,093 on Wednesday as investors sought safe-haven assets ahead of the US Federal Reserve’s meeting minutes and the delayed jobs report. On Thursday, bullion hovered around $4,077 following the release of the stronger-than-expected jobs data, which showed 119,000 new positions and a 4.4% unemployment rate, strengthening expectations that the Fed would hold rates. By Friday, gold eased to $4,063, closing the week lower as the labour data tempered hopes for policy easing. Notwithstanding the weekly decline, gold remains up by 55% year-to-date, supported by central bank buying, geopolitical risks, and investor demand for protection against economic uncertainty. Gold’s daily levels ranged from a low of $4,050.00 to a high of $4,093.28 over the period.

The upcoming MPC meeting is likely to adopt a firm stance, reflecting caution in a global risk-off environment, despite easing inflation, foreign exchange pressures, and domestic factors. The increased government funding demand is expected to influence the yield direction at the November 2025 FGN bond auction. The Debt Management Office (DMO) may maintain a highly guarded rate to balance investor demand, fiscal needs, and management cost. Additionally, anticipated inflows of approximately ₦1.16 trillion from OMO maturities and coupon payments would support liquidity in the system, potentially moderating pressures on yields and market rates. MTN Nigeria Communications Plc and Aradel Holdings Plc are set to pay an interim dividend to their shareholders on the 28th of November, 2025.

By: Sandra A. Aghaizu

The MPC moves like a careful captain in choppy global waters, even as local inflation and FX winds begin to ease.

Government borrowing rises, shaping the November bond auction, while the DMO balances cost and demand like a tightrope walker.

A tide of ₦1.16 trillion in inflows approaches, promising to soften yield pressures.

And as the month ends, MTN and Aradel offer dividends…small beacons in a shifting market.