Nigeria’s fixed-income market navigated a week shaped by easing inflation and an active NTB auction. Headline inflation printed at 20.12% in August (the fifth consecutive monthly decline), reinforcing the disinflationary trend and improving real yield dynamics. At the September 17 NTB auction conducted by the DMO, with an offer of ₦290 billion across the curve, the stop rates cleared at 15.00%, 15.30% and 16.78% for the 91-, 182-, and 364-day bills, respectively. As usual, the 364-day bill drew outsized demand, confirming investors’ preference for long-dated bills. Together, these developments set the stage for a market recalibration where liquidity conditions, real yields, and investor positioning continue to interact.

The country’s macro-financial landscape is at an inflection point, driven by ample domestic liquidity, fiscal interventions, the FAAC’s August disbursement of ₦2.22 trillion, and shifting global policy dynamics. Strong reserve accretion, robust primary market demand, and suppressed CBN sterilization have driven yield compression and FX stability, despite macro-economic pressures. The Federal Government’s planned ₦758 billion bond issuance to clear pension arrears signals fiscal resolve with broad implications for domestic debt markets, while the widening policy split between the US Federal Reserve’s dovish tilt and the Bank of England’s inflation-focused stance highlights rising cross-asset volatility. Against this backdrop, commodities remain in flux, with gold testing record highs and oil trading mixed on supply shocks and demand uncertainty, leaving investors to balance liquidity-driven opportunities at home with policy and commodity risks abroad.

The interbank system liquidity position opened with a surplus of over ₦1.6 trillion on Friday, marking a 21.09% decline within the week, after peaking as high as ₦2.8 trillion midweek. Money market rates held steady throughout, with the Open Repo Rate (OPR) at 26.50% and Overnight (O/N) anchored around 26.96% declining 0.15%, before closing the week at 26.50% and 26.95% respectively. In the FX market, the Naira traded between $/₦1,479.50 and $/₦1,510.00 during the week, closing at $/₦1,488.00 on Friday.

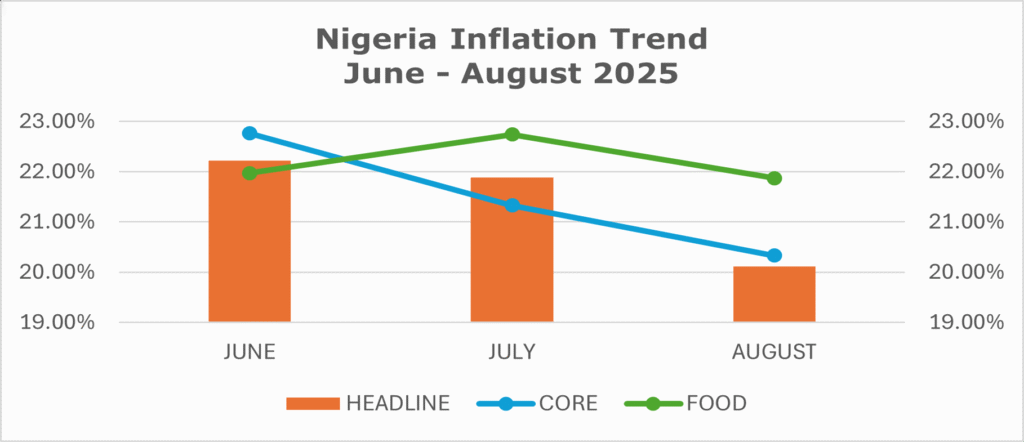

According to the National Bureau of Statistics (NBS), Nigeria’s headline inflation eased for the fifth consecutive month, printing at 20.12% in August 2025, down from 21.88% in July, marking a 1.76% MoM decline and a sharp 12.03% YoY drop from 32.15% in August 2024. The change was largely driven by food & non-alcoholic beverages, restaurants & accommodation, transport, housing/utilities, and education, which remain the top contributors. Notably, insurance and financial services had nil contribution on a month-on-month basis. Food inflation slowed to 21.87%, reflecting a 15.65% YoY decline from 37.52% in August 2024, while MoM food inflation fell to 1.65% (vs. 3.12% in July), supported by easing staple prices and improved supply. Core inflation moderated YoY to 20.33%, though MoM pressures quickened to 1.43% (vs. 0.97% in July), emphasizing residual cost pressures in services, housing, and education despite the broader disinflationary trend.

The sustained decline in headline inflation strengthens Nigeria’s disinflationary outlook, enhancing real yields on Naira assets and offering a more constructive backdrop for fixed-income markets. Medium-duration sovereign securities appear increasingly attractive as FX reforms and stable harvest inflows anchor expectations. Consumer-exposed equities are poised to benefit from softer food prices, though service-linked sectors such as education, housing, and utilities may continue to face cost-push pressure, reflecting the uneven distribution of disinflation across the economy. In the near term, the disinflation path remains vulnerable to administered price adjustments, FX volatility, and global commodity shocks, keeping the authorities cautiously dovish, leaning toward liquidity support while avoiding premature policy easing.

The result of the NTB auction conducted by the DMO on 17 September 2025 reinforced the depth of system liquidity and investor conviction, with total subscriptions of ₦1.59tn against an offer of ₦290bn, delivering an overall Bid-to-Cover Ratio (BCR) of 5.5x. Market appetite was concentrated on the 364-day paper (₦1.48tn vs. ₦200bn; BCR 7.4x), while the 91-day saw healthy oversubscription (₦61.35bn vs. ₦30bn; BCR 2.0x) and the 182-day underwhelmed (₦50.07bn vs. ₦60bn; BCR 0.8x). Stop rates compressed across tenors: 91-day by 0.32bps, 182-day by 0.20bps, and 364-day by a hefty 0.91bps, reflecting a decisive shift in yield dynamics.

Beyond mega demand, the outcome reflects a strategic repositioning by investors. The outsized subscription for the one-year bill is not merely liquidity chasing yield but a forward-looking vote of confidence in Nigeria’s disinflationary trajectory, with markets betting real yields will widen further as headline inflation continues to ease. The steep drop in the 364-day stop rate illustrates the DMO’s willingness to accept market-driven repricing, a tactical liquidity play that anchors expectations of a softer rate environment without overt policy signals, while allowing market demand to naturally drive down yields.

AUCTION DATE | 17-09-2025 | 17-09-2025 | 17-09-2025 |

ALLOTMENT DATE | 18-09-2025 | 18-09-2025 | 18-09-2025 |

MATURITY DATE | 18-12-2025 | 19-03-2026 | 17-09-2026 |

TENOR | 91-DAY | 182-DAY | 364-DAY |

OFFER (₦) | 30,000,000,000 | 60,000,000,000 | 200,000,000,000 |

SUBSCRIPTION (₦) | 61,352,332,000 | 50,069,499,000 | 1,479,634,896,000 |

ALLOTMENT (₦) | 30,321,711,000 | 42,276,621,000 | 272,499,771,000 |

RANGE OF BIDS (%) | 14.5000 – 17.5000 | 15.1900 – 18.0000 | 15.9890 – 20.0300 |

STOP RATES (%) | 15.0000 | 15.3000 | 16.7800 |

PREVIOUS STOP RATES (%) | 15.3200 | 15.5000 | 17.6900 |

External reserve accretion by 0.59% to $41.95bn, strong NTB demand, and absence of a much-anticipated liquidity mop-up have created a reinforcing cycle: ample Naira chasing government securities compresses yields, while excess liquidity channels into the FX market, fuelling Naira volatility. Still, this stability remains liquidity-driven rather than structural. Once the CBN resumes OMO issuance or external flows soften, both NTB yields and FX rates may reprice higher. For investors, the near-term environment supports tactical positioning in sovereign paper while monitoring FX market signals for an early read on policy recalibration.

Nigeria’s Federation Account Allocation Committee (FAAC) disbursed ₦2.22 trillion to the three tiers of government for August 2025, up from ₦2.00 trillion in July, driven by higher oil and gas royalties, value added tax (VAT), and common external tariff (CET) levies, though statutory revenue fell by ₦231.9 billion MoM on weaker petroleum profit tax, company income tax (CIT), excise duty, and electronic money transfer levy (EMTL) collections. From the total distributable revenue comprising ₦1.47 trillion statutory revenue, ₦672.9 billion VAT, ₦32.3 billion EMTL, and ₦41.3 billion exchange difference, while the FG, States, and LGAs received ₦810.05 billion, ₦709.83 billion, ₦522.23 billion respectively, and oil-producing states earned ₦183.01 billion as 13% derivation.

This larger disbursement improves near-term fiscal liquidity at federal and subnational levels, supporting government spending and debt servicing capacity. In the financial markets, this injection would likely sustain demand for sovereign securities, reinforcing the recent bid-driven compression in yields, particularly at the mid- to long-end. However, the revenue mix highlights Nigeria’s fiscal vulnerability to oil volatility and uneven non-oil tax receipts, suggesting that while liquidity may drive bullish sentiment in fixed income in the short term, duration management and selective positioning remain critical against lingering fiscal and global commodity risks.

The Federal Government’s plan to issue a ₦758 billion bond to offset pension arrears marks a significant fiscal intervention with broad market implications. The move, expected to be finalized by late September or early October, will provide long-awaited relief to over 250,000 retirees under the Contributory Pension Scheme. The issuance is set to boost fixed-income market activity, expand sovereign debt instruments available to investors, and improve secondary market liquidity. By clearing pension liabilities, the government not only strengthens household consumption capacity but also reinforces investor confidence in Nigeria’s debt management framework, with potential spillover benefits for financial stability and capital market depth.

As a consequence of buoyant system liquidity throughout the week, activity in the bond secondary market focused on mid-tenors, where bullish sentiment drove yields lower with a resistance level of 16%. Most mid-tenor bonds were traded within the 16.20% and 16.70% range. Although there was upward movement in yields midweek towards the upper range, activities peaked on Friday as more demand and matching offers were observed for select papers, notably the MAR-2027s, APR-2029s, FEB-2031s, MAY-2033s, FEB-2034s, MAR-2035s, APR-2049s, and JUN-2053s. There was also significant buying interest recorded in T-bill and OMO papers across all maturities at the long end of the curve. Particularly, demand was seen in T-bills (3-Sept., 17-Sept., 19-Mar., and 25-Dec.) as well as OMO maturities (7-Apr., 17-Feb., 8-Jan., 27-Jan., 3-Mar., and 17-Mar). The robust appetite for both sovereign bonds and money market instruments highlights investors’ positioning for attractive yields.

The Bank of England’s (BoE) decision to hold rates at 4% contrasts sharply with the US Federal Reserve’s recent 25bps cut to 4.25% from 4.50%, supporting divergent policy priorities. While the Fed has shifted toward supporting employment amid labour market weakness, the BoE remains firmly focused on combating inflation, which is still running at nearly double its 2% target. This policy split highlights the different stages of economic risk: the US leans toward growth concerns, whereas the UK remains constrained by inflation stickiness and the added drag of quantitative tightening through gilt sales.

For the market, this divergence could keep GBP/USD supported in the near term, as the Pound sterling benefits from the BoE’s relatively hawkish stance. US Treasuries may continue to outperform Gilts given the Fed’s easing bias, while UK yields stay firmer on sticky inflation. Equities tell a different story: US equities stand to benefit more from lower rates, while UK equities may lag under tighter conditions. Overall, the Fed-BoE divergence sets the stage for cross-asset volatility, with investors needing to navigate between US growth-supportive liquidity and the UK’s inflation-fighting rigidity.

Gold prices traded at record highs early in the week, breaching $3,680/oz on September 16th, supported by a weaker US dollar, falling Treasury yields, and safe-haven demand ahead of the Federal Reserve’s widely anticipated 25bps rate cut. However, momentum eased midweek as profit-taking set in, with prices slipping toward $3,630/oz by Thursday before closing at $3,656/oz on Friday. While the Fed’s cautious tone signalled gradual easing rather than an aggressive cycle, gold remains up nearly 39% year-to-date, reinforced by robust central bank demand, persistent geopolitical tensions, and strong investor inflows. Despite the late-week pullback, bullion continues to hold a firm upward bias, with markets betting on further policy accommodation and resilient safe-haven flows.

The Nigerian Exchange (NGX) ASI closed the week at 141,845 points, up a marginal 0.13% WTD from 141,659 points at the start of the week. The market saw mixed sessions: easing slightly by 0.08% on Tuesday, rebounding 0.0043% midweek with strong momentum to 142,263.00 on Thursday, before profit-taking trimmed gains into Friday’s close. The overall trend highlights resilient liquidity-driven demand and bargain-hunting, supported by tactical sell-offs. With moderating inflation and ample system liquidity, equities remain positioned as an attractive play relative to softening fixed-income yields.

Crude oil prices traded mixed through the week of September 15–19, WTI crude and Brent traded at $63 and $67 per barrel, respectively on Monday, before advancing to $64 and $68 on Tuesday. Both commodities initially rallied on heightened supply risks before retreating on demand concerns and policy signals. Following midweek intensified Ukrainian strikes on Russian key energy infrastructure, including the Kirishi refinery, sidelining its estimated 350,000 bpd of refining capacity, and heightened concerns of additional Western sanctions. These geopolitical tensions, alongside ongoing EU deliberations on new restrictions targeting Russian crude trade via Asian intermediaries, pushed bullish sentiment. Meanwhile, anticipation of the US Federal Reserve’s rate decision and expectations of a 25 bps cut provided a soft floor for prices by signaling potential support for economic activity and energy demand.

However, momentum faded later in the week as oversupply fears resurfaced, with macro headwinds tempering optimism. By Friday, WTI slipped to $62.72 per barrel and Brent eased to $66.63 per barrel, marking three straight sessions of losses. The market sentiment shifted after US President Donald Trump emphasized a preference for lower oil prices over additional sanctions on Russia, cooling fears of imminent supply disruptions. On the data front, EIA figures showed a sharp 9.3 million-barrel draw in U.S. crude inventories, the steepest in three months, although distillate stockpiles climbed to their highest since January, softening the bullish impact. Amidst robust OPEC+ production, a stronger dollar, and weakening global economic signals offsetting geopolitical risks, oil prices ended the week with minimal change, reflecting a cautious balance between supply risks and demand uncertainties.

The week ahead will be shaped by anticipated inflows of over ₦620bn from coupon payments, OMO and NTB maturities, a boost that would significantly lift system liquidity, coinciding with FAAC disbursements. This surge may prompt the CBN to deploy targeted OMO auctions to sterilize excess cash and stabilize yields. The fixed-income market awaits the outcome of the CBN 302 MPC Meeting on Sept. 23rd, where a steady policy stance or modest easing is expected, amid the key central banks’ pivots.

Meanwhile, the US dollar could weaken modestly, given narrowing rate differentials, which in turn provides a tailwind for commodities like gold, often viewed as a hedge against both inflation and dollar weakness. However, the Fed’s delicate balancing act means volatility will remain elevated: investors should expect short-term rallies but guard against medium-term risks if sticky inflation forces a policy reversal. With its impact being mirrored in the cryptocurrency market, a subtle depicts of expected trends in the global financial markets.

By: Sandra A. Aghaizu

Two ships set sail on the same global sea, yet chart different courses.

In Washington, the Federal Reserve lowers its sails, trimming rates to 4.25% to catch the faint winds of growth and keep employment afloat. Meanwhile, in London, the Bank of England keeps its rigging taut at 4%, bracing against the storm of inflation still pounding its shores.

The markets feel the currents. The Pound Sterling steadies like a vessel with a firm hand on the helm, while the Dollar drifts softer. Treasuries ride smoother waters under easing winds; gilts remain heavy in choppy seas. Equities split: Wall Street lifted by gentler breezes, London weighed by headwinds.

And above the waves, gold glitters like a lighthouse, rising to record highs at $3,680 before easing, its beam still strong, guiding investors seeking safe harbour.

Two captains, two strategies: one chasing growth’s horizon, the other anchoring against inflation’s tide. Their divergence writes the rhythm of the world’s financial voyage.