The Giant of Africa’s financial markets remained steady through the week of October 20–24, 2025, as investors balanced local policy signals with shifting global trends. The Central Bank of Nigeria (CBN) sustained its firm stance through active Open Market Operations (OMO), while the Debt Management Office managed yields at the Nigeria Treasury Bill (NTB) auction to maintain market stability. The naira stayed steady in the official window, aided by stronger FX inflows and improved external reserves. In the bond market, moderate demand across mid-tenor instruments reflected investor rotation with duration, anchoring yields in the high-15% and low-16% levels.

Nigeria’s announced plan to raise $2.3 billion in the Eurobond market in Q4 of 2025 is well timed, as the Country’s international bonds traded stable amid mild yield adjustments in major economies and improving risk appetite for emerging-market debt. Oil prices advanced, with West Texas Intermediate (WTI) up by 9.02% at $62.24, and Brent up 9.68% at $66.62 per barrel, hunched on renewed supply concerns. Meanwhile, gold eased from recent highs (-5.02%) to close at $4,103.30/oz as investors booked profits. The Nigerian Exchange (NGX) All-Share Index gained 3.80% to close at 155,645.00 points, buoyed by solid earnings expectations. Together, these dynamics reinforced a broadly stable outlook for Nigeria’s financial system as October drew to a close.

Interbank liquidity opened with a surplus of over ₦3.10 trillion on Friday, marking a week-to-date increase of 226.01% after opening at 956.70 billion on Monday. Money market rates changed relatively, with the Open Repo Rate (OPR) and Overnight (O/N) peaking at 24.80% and 25.35% respectively, before easily slightly to close at 24.50% and 24.83%. In the FX market, the Naira traded between $/₦1,452.00 and $/₦1,470.00 during the week and closed at $/₦1,457.95 on Friday.

The latest OMO auction conducted on October 21, 2025, reflected a continued tightening bias by the CBN, with a total sale of 1.38x against offer, signalling strong system liquidity and investor appetite for higher-yielding instruments. The 196-day bill saw relatively soft demand of 0.33x against offer, with a marginal upward adjustment in the cleared stop rate at 19.50% (+10bps) compared to the previous (193-day). Conversely, the 252-day bill attracted robust demand of 3.37x, far exceeding the offer size, though the stop rate slightly declined to 19.84% (-5bps) liken to 249-day, suggesting competitive bidding pressure among investors seeking longer-duration exposure. Effective yields were 21.78%(+16bps) and 22.98%(-3bps) respectively for 196- and 252-day.

The divergence in subscription levels indicates a clear investor preference for the longer tenor, suggesting expectations that yields at the short end may have peaked in the near term. The CBN’s allotment of 78% of bids on the 252-day bill highlights its ongoing strategy to absorb excess liquidity while subtly anchoring rates in line with market sentiment. Despite the strong bid coverage, the relatively stable stop rates point to a cautious yield control stance, maintaining attractiveness to investors while mitigating excessive yield escalation. Overall, the auction outcome reinforces a short-term outlook of steady-to-slightly higher yields, especially if liquidity inflows persist and fiscal financing pressures intensify toward year-end.

TENOR | AUCTION DATE | OFFER (₦‘B) | BIDS (₦‘B) | RANGE OF BIDS (%) | STOP RATES (%) | PREVIOUS STOP RATES (%) | TOTAL SALE (₦‘B) |

196-DAY | 21-10-2025 | 300.00 | 98.00 | 19.4000-20.0000 | 19.5000 | 19.4000 | 38.00 |

252-DAY | 21-10-2025 | 300.00 | 1,010.50 | 19.7500-20.7800 | 19.8400 | 19.8900 | 789.00 |

The Nigerian Treasury Bills (NTB) auction held on October 22, 2025, showed a moderate upward repricing of yields across tenors, consistent with the market’s evolving liquidity and inflation expectations. Total subscription came in at approximately 1.16x against the total offer, reflecting continued investor participation amid surplus liquidity. The 364-day bill remained the most attractive tenor, drawing 0.89x in bids (90% of total demand) but received an allotment of 81% across the board. The total allotment was less than the offer volume compared to the previous auction, which was exactly the offer volume. Stop rates adjusted slightly upward to 16.14% (+37bps) for the 1-year paper, 15.50% (+25bps) for the 182-day, and 15.30% (+30bps) for the 91-day tenor, as investors sought higher compensation amidst yield pressures and policy uncertainty.

The upward tilt in stop rates suggests a coordinated response by the DMO to maintain balance between funding needs and market confidence. Investors appear to be positioning tactically at the long end of the NTB curve, as disinflation persists and external financing confidence builds. Overall, the auction outcome emphasizes a cautious and constructive sentiment in the short-term debt market, where investors are actively managing duration risk while staying responsive to changing monetary signals.

AUCTION DATE | 22-10-2025 | 22-10-2025 | 22-10-2025 |

ALLOTMENT DATE | 23-10-2025 | 23-10-2025 | 23-10-2025 |

MATURITY DATE | 22-01-2026 | 23-04-2026 | 22-10-2026 |

TENOR | 91-DAY | 182-DAY | 364-DAY |

OFFER (₦) | 100,000,000,000 | 100,000,000,000 | 450,000,000,000 |

SUBSCRIPTION (₦) | 8,129,718,000 | 68,528,998,000 | 674,247,849,000 |

ALLOTMENT (₦) | 7,613,718,000 | 67,418,998,000 | 316,556,585,000 |

RANGE OF BIDS (%) | 14.9000 – 16.5000 | 14.5000 – 17.0300 | 14.5000 – 20.0000 |

STOP RATES (%) | 15.3000 | 15.5000 | 16.1400 |

PREVIOUS STOP RATES (%) | 15.0000 | 15.2500 | 15.7700 |

The local currency traded largely stable at the Nigerian Foreign Exchange Market (NFEM) during the week ended October 24, 2025, appreciating slightly from $/₦1,465.29 to $/₦1,457.95, with a week-to-date gain of about ₦7.34 (+0.50%). The narrow trading range indicates improved FX liquidity and steady reserve growth, supported by the CBN’s tight monetary stance and proactive interventions.

Nigeria’s external reserves continued their upward momentum, rising from $42.35 billion on September 30 to $42.87 billion on October 22, marking a cumulative gain of approximately $511 million month-to-date. The increase was driven by an increase in liquid reserves, while blocked funds declined from $676.65 million to $638.77 million, reducing the blocked reserve ratio from 1.60% to 1.49%, emphasizing improved FX liquidity, reserve management efficiency, and progress in clearing outstanding obligations.

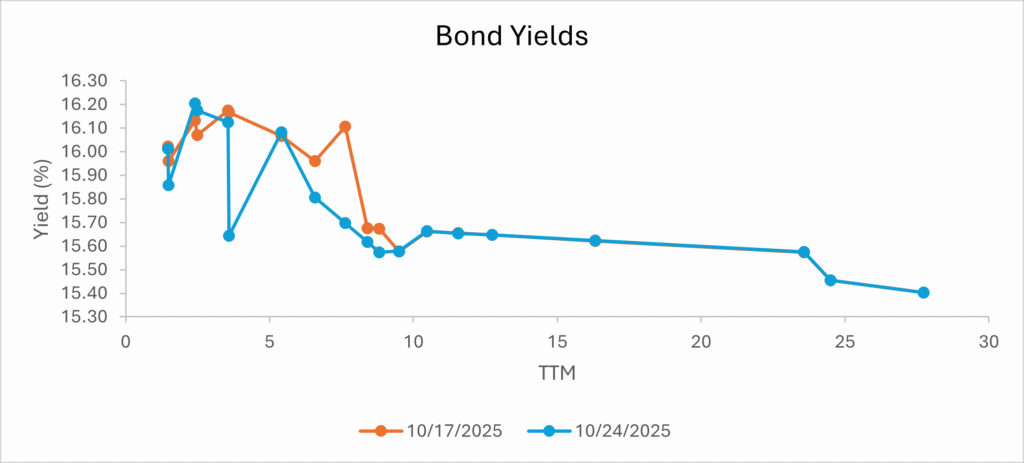

The secondary market for bonds sustained a bullish tone, with yields between the high-15.00% and low-16.00% levels as increased supply dominated short- to mid-tenor papers, particularly the 2029–2037 maturities, met moderate and selective demand, creating a competitive bid-ask environment. In the money market, buying interest skewed towards mid- to long-dated OMOs (10-Mar, 3-Feb, 23-Jun, 30-Jun) and NTBs bills (19-Feb, 10-Jul, 3-Sept, 8-Oct, and 22-Oct), further reflecting a shift toward duration positioning.

In the Eurobond market, Nigeria’s securities were resilient during the week, supported by stable global risk sentiment and consistent investor appetite for emerging-market debt. The IMF Global Markets Monitor noted mild yield increases across European sovereigns and UK gilts, indicating cautious optimism about growth, while US municipal bond yields flattened as investors positioned for steady policy rates and moderating inflation. This relative calm in global fixed-income markets helped anchor Nigeria’s external borrowing costs, highlighting investors’ view of the country’s sovereign risk as manageable. Overall, easing long-term yields in advanced economies and stable Eurobond pricing point to a favourable window for Nigeria to sustain foreign portfolio participation, provided it maintains macroeconomic discipline and policy transparency.

Nigeria has moved to modernize its tax framework by including digital assets and refining the scope of chargeable gains, marking a progressive step toward revenue diversification. However, the introduction of Capital Gains Tax (CGT) on securities and money instruments must be carefully structured to preserve market depth and investor confidence. A two-tier, time-based CGT model is recommended, applying a low, preferential rate (around 5% or less) on long-term holdings of 24–36 months and beyond, while maintaining the standard rate for short-term gains. Such an approach encourages steady capital, discourages speculative trading, and ensures that the market continues to attract stable, growth-oriented investments while the government still benefits from meaningful tax inflows.

Equally important is the need for simplicity and awareness in execution. The authorities should prioritize investor education and administrative ease, particularly in managing the complexities of digital asset taxation. A well-designed campaign clarifying cost basis calculations and streamlined reporting for small investors can reduce non-compliance and improve trust. By balancing fair taxation with efficient administration, Nigeria would expand its tax net, promote voluntary compliance, and maintain a competitive investment climate that supports long-term economic growth.

The Nigerian Exchange (NGX) All-Share Index extended its strong bullish momentum, rising from 149,941.00 to 155,645.00, a week-to-date gain of 3.80% and 5,704 points during the week ended October 24, 2025. The rally was driven by sustained buying interest in banking, industrial, and consumer goods stocks, as investors positioned for Q3 earnings releases and dividend declarations. Improved market sentiment, aided by moderating inflation and stable FX conditions, also contributed to the market’s positive performance. The uptrend reflects renewed confidence in equities as attractive yields in fixed-income instruments begin to stabilize, prompting selective portfolio rebalancing towards risky assets.

Crude oil prices rebounded strongly during the week, reversing early losses as geopolitical tensions and supply disruptions reignited bullish sentiment. Brent crude, which opened the week near $60.74 per barrel, closed at $66.62 on Friday, up 9.68% week-to-date (WTD), while WTI rose from about $57.09 to $62.24, gaining nearly 9.02% WTD. Early in the week, both benchmarks hovered near six-month lows, besides lingering oversupply concerns following the IEA’s projection of a 2026 market surplus and record tanker shipments signalling a global glut. However, sentiment began to improve midweek after reports of a potential US–India trade deal and a surprise US inventory draw, suggesting firmer near-term demand.

The uptick accelerated after Washington imposed sanctions on Russian oil majors Rosneft and Lukoil, triggering renewed supply fears and tightening expectations. The move prompted Chinese and Indian refiners to curb Russian oil imports, while the EU’s 19th sanctions package targeted Moscow’s energy infrastructure. Combined with continued Ukrainian strikes on Russian refineries, these developments shifted market focus from demand weakness to supply risk. By the end of the week, both Brent and WTI clinched their strongest weekly gains since early June, indicating a swift change in market tone from bearish oversupply to renewed geopolitical risk premium.

The Gold market experienced a volatile week as prices surged to an all-time high of $4,382 per ounce on Monday, October 21, 2025, before retreating sharply amid profit-taking and a stronger dollar. The rally was initially driven by expectations of further Federal Reserve rate cuts, ongoing safe-haven demand linked to the prolonged U.S. government shutdown, and the optimism surrounding the U.S.–China trade talks between U.S. Treasury Secretary Scott Bessent and Vice Premier He Lifeng while in Malaysia. However, gold tumbled over 6% on Tuesday, its steepest drop since 2013, falling to around $4,100, as improved risk sentiment and optimism over upcoming Trump–Xi negotiations triggered a broad sell-off. By Friday, October 24, gold closed at $4,103.30 per ounce, pressured by Exchange-Traded Funds (ETF) outflows and profit-taking that ended its nine-week winning streak. Despite the pullback, bullion remains up about 55% year-to-date, reinforced by anticipation of further Fed easing, lingering geopolitical tensions, and renewed sanctions on Russia that continue to support its long-term safe-haven appeal.

Looking ahead, markets will navigate a delicate balance between rising domestic liquidity and global policy cues as over ₦250 billion expected coupon inflows will boost system liquidity, potentially driving renewed interest in equities and the scheduled FGN Bond Auction on Monday with a total offer volume of ₦260 billion split evenly between the reopened 17.945% AUG 2030 and 17.95% JUN 2032 paper. The outcome will be a key guide to yield direction. Also, this liquidity surge may trigger OMO(s) auction by the Central Bank to absorb excess cash and maintain yield discipline across the curve.

Globally, attention will focus on the U.S. Federal Reserve meeting, where a steady policy stance or dovish tone could sustain risk appetite for emerging-market assets, reinforcing demand for Nigerian sovereign and corporate securities.

Notably, Nigeria’s recent removal from the Financial Action Task Force (FATF) grey list further brightens its investment narrative, amplifying improved financial governance, enhanced cross-border credibility, and potential capital from previously constrained institutional investors. Overall, the interplay of local inflows and global monetary moderation, in addition to restored investor confidence, positions Nigeria for a short-term rotation toward equities and longer-duration fixed-income instruments, tempered by the CBN’s liquidity management measures.

By: Sandra A. Aghaizu

The Nigerian stock market soared this week, rising like a plane breaking through clearing clouds. The All-Share Index climbed from 149,941 to 155,645 points, up 3.8%, powered by gains in banking, industrial, and consumer goods stocks.

With inflation clouds thinning and FX skies steady, investor confidence brightened. As the fixed-income horizon levelled, many turned their eyes to equities… chasing new sunlight above the clouds.