Nigeria’s fixed-income landscape closed the week ending December 19, 2025, with clear bullish signals from both the December FGN Bond and Nigeria Treasury Bill (NTB) auctions, offering a timely read on how investors are positioning in a market still flush with liquidity but increasingly selective on duration and pricing, while secondary markets saw bonds trade around 17% levels while bills traded upper-17% to lower-20% range, supported by active price discovery.

Demand patterns pointed to a deliberate extension into longer-dated securities to secure elevated yields, while short-term instruments continued to serve tactical liquidity needs. Framed by easing inflation, resilient FX buffers, and a globally divergent monetary backdrop, these auction outcomes underline a market adjusting not to falling rates, but to clarity, where compensation, conviction, and timing now matter more than abundance. Commodities diverged: oil struggled under supply pressures with West Texas Intermediate (WTI) at $56.5 and Brent at $60.1 per barrel; however, gold pulled through to $4,331/oz on dovish Federal Reserve signals, softer labour and inflation data.

Interbank liquidity opened with a surplus of over ₦3.28 trillion on Friday, its highest in the week, marking a week-to-date increase of 27.0% after opening at 2.58 trillion on Monday. Money market rates witnessed mild changes, with the Open Repo Rate (OPR) steady at 22.50% and Overnight (O/N) rate peaking at 22.83%, before closing at 22.50% and 22.83%, respectively. In the currency market, the Naira traded between $/₦1,450.00 and $/₦1,469.90 during the week, closing at$/₦1,464.49 on Friday.

The result of the final FGN Bond Auction for 2025, conducted on December 15, 2025 by the Debt Management Office (DMO), revealed a segmented demand profile, highlighting investors’ evolving duration and yield preferences amid a surplus system liquidity. The sale featured reopened paper of 17.945% August 2030 and 17.95% June 2032, with tenors of 5- and 7-year, respectively. The short tenor bond was undersubscribed at ~0.69x and allotted 0.44x against the offer, while the mid-tenor bond drew exceptionally strong demand, with an oversubscription of ~3.18x and 2.15x sale to offer, highlighting a clear investor tilt toward extended-dated securities to lock in elevated yields. With a bid-to-cover ratio of 1.48 and 1.56, stop rates closed higher despite a minimal difference of 10bps apart at 17.20% (+130bps) and 17.30% (+130bps) for the corresponding papers, reflecting a uniform rate increase, factored inflation risk, excess system liquidity, and investors’ demand for higher real returns.

BONDS TENOR | AUGUST 2030 | JUNE 2032 |

MATURITY DATE | 27-08-2030 | 25-06-2032 |

TENORS | 5-YEAR | 7-YEAR |

AMOUNT OFFERED (₦) | 230 BILLION | 230 BILLION |

SUBSCRIPTION (₦) | 159.211 BILLION | 731.399 BILLION |

BID RANGE (%) | 15.0000 – 18.5100 | 15.0000 – 18.5200 |

AMOUNT ALLOTTED (₦) | 101.987 BILLION | 494.478 BILLION |

STOP RATES (%) | 17.2000 | 17.3000 |

PREVIOUS STOP RATES (%) | 15.9000 | 16.0000 |

The outcome of the December 17, 2025, NTB auction highlighted a pronounced preference for short- and long-dated instruments amidst surplus liquidity and evolving rate expectations. Demand was heavily skewed toward the 364-day and reasonably on the 91-day bills, recording a strong oversubscription of 2.27x and ~1.01x the offer, demonstrating investors’ appetite to lock in attractive yields and manage reinvestment risk in a firm monetary policy environment. In contrast, the 182-day tenor saw relatively muted participation, with remarkable undersubscription of ~0.23x, pointing to cautious positioning at the mid end of the curve. Bid to cover was 1.01, 1.03, and 2.38 for the short, mid, and long-day, respectively. Bid ranges across all tenors reveal a declining tilt: the 364-day paper saw bids as high as 20% compared to the previous sale, which had 22%, highlighting softening rate expectations from some participants. Stop rates rose marginally for the 91-day and 182-day tenors to 15.50% (+20bps) and 15.95% (+45bps) respectively, while the 364-day stop rate declined to 17.51%(-44bps), signalling growing confidence in medium-term inflation moderation and a tentative softening in rate expectations. Overall, the result of the auction was suggestive of a gradual flattening and comfort at the short end positioning, with a strengthened demand for duration, supporting elevated yields, although hinting at early expectations of stabilising monetary conditions in 2026, while the authority accommodates higher management costs with the total auction allotment at 100.6%.

AUCTION DATE | 17-12-2025 | 17-12-2025 | 17-12-2025 |

MATURITY DATE | 19-03-2026 | 18-06-2026 | 17-12-2026 |

TENOR | 91-DAY | 182-DAY | 364-DAY |

OFFER (₦) | 100,000,000,000 | 100,000,000,000 | 500,000,000,000 |

SUBSCRIPTION (₦) | 100,626,463,000 | 22,657,586,000 | 1,385,758,691,000 |

ALLOTMENT (₦) | 100,013,963,000 | 22,067,586,000 | 581,994,928,000 |

STOP RATES (%) | 15.5000 | 15.9500 | 17.5100 |

PREVIOUS STOP RATES (%) | 15.3000 | 15.5000 | 17.9500 |

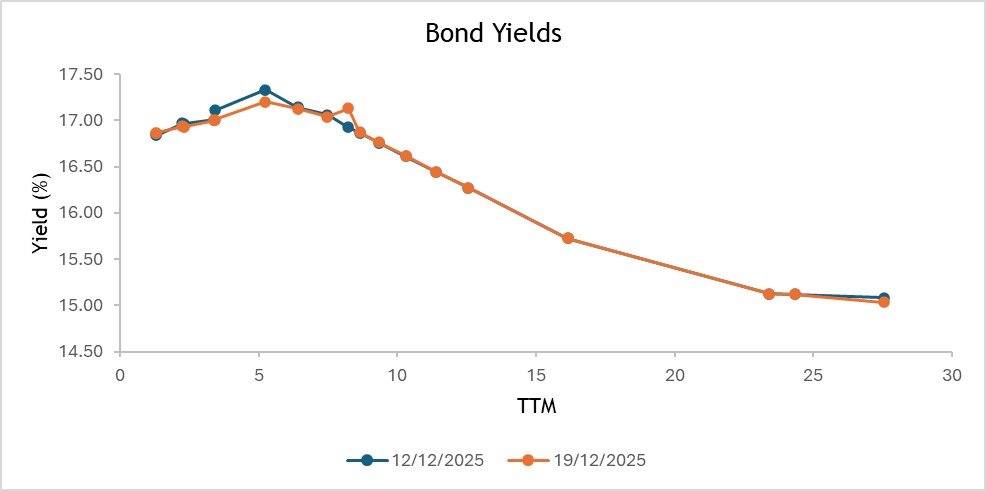

The secondary market turned bearish relative to the prior week, driven by the higher stop rate at the recent NTB auction. Bond yields remained supported around the 17% level, while bills were within the mid-17% to low-20% band, reinforcing a higher-for-longer rate backdrop. Renewed supply in short- to mid-tenor papers, particularly the 2030s–2034s, were met with selective and resilient demand, especially the 2031s, 2032s, and 2033s, while appetite for the 2053 maturity remained minimal. In the money market, positioning stayed constructive with new issuance demand as investors rotated deliberately across the curve, showing a firmer preference favouring mid- and long-dated OMO and NTB instruments, consistent with cautious duration extension in a system flush with liquidity. Generally, interest rates in the fixed income market showed a sharp uptrend, with yields edging higher as investors gravitated toward short-term instruments and matching quotes reflecting improved market price discovery.

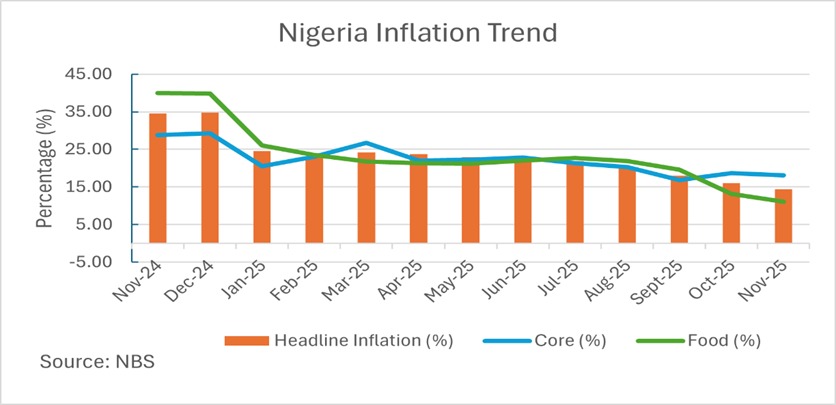

The November 2025 Consumer Price Index released by the National Bureau of Statistics on December 15 strengthens Nigeria’s disinflationary path, with headline inflation easing for the eighth consecutive month since March to 14.45%, marking a sharp 160bps month-on-month decline, even as the pace of price pressures remained marginally firmer than as stated in October. With top-5 contributors of inflationary pressures concentrated in food and consumer-facing services, namely Food & Non-Alcoholic Beverages, Restaurants and Accommodation, Transport, Housing and Utilities, and Education, illustrating persistent cost pass-through in essential sectors. Food inflation settled at 11.08% with a month-on-month change of 1.13%, driven by higher prices of key staples and protein items, signalling that supply-side vulnerabilities and seasonal factors continue to inject short-term volatility into household expenses. Encouragingly, core inflation moderated to 18.04% on a month-on-month basis of 1.28%, pointing to a gradual easing of underlying demand-driven pressures and suggesting that prior monetary adjustment is gaining traction. In the financial markets, the report is broadly supportive of fixed income as the sustained moderation in headline and core inflation improves real return prospects and supports demand for longer-dated government securities. Although lingering food and services inflation constrains the scope for near-term policy easing, keeping yields supported and liquidity selective.

The Naira traded with modest volatility at ₦1,451.81 to ₦1,464.49 in the Nigerian Foreign Exchange Market (NFEM), falling by ₦12.68 (-0.87%) intra-week, and a week-on-week decline of ₦10.09 (-0.69%), closing at ₦1,464.49 (down from ₦1,454.41 the previous week). Intra-week movements showed a resilient market despite FX pressures, supported by improved FX liquidity and steady reserve growth.

Nigeria’s external reserves continued their upward momentum despite a mild volatility intra-week, rising from $44.67 billion on November 28 to $45.21 billion on December 17, marking a gain of approximately $540.77 million month-to-date (+1.21%), an increase of 1.23% in liquid reserves. In addition, blocked funds declined from $557.08 million to $555.53 million, reducing the blocked reserve ratio from 1.25% to 1.23%, indicating enhanced FX liquidity, reserve management efficiency, and progress in clearing outstanding obligations.

The November 2025 Federation Account Allocation Committee (FAAC) allocation show mounting fiscal pressure, with distributable revenue declining 7.9% month-on-month to ₦1.93 trillion due to broad-based weakness in oil and non-oil inflows. The shortfall tightens government cash flows, raises borrowing needs, and sustains a higher-for-longer yield environment at the debt market, while highlighting structural fiscal fragility among FAAC-dependent states and supporting the need for revenue diversification and spending discipline.

President Bola Tinubu’s presentation of the ₦58.18 trillion 2026 Appropriation Bill to a joint session of the National Assembly signals a defining point in Nigeria’s fiscal narrative, anchored on firmer execution discipline and results-driven governance. Titled as the “Budget of Consolidation, Renewed Resilience and Shared Prosperity,” the proposal seeks to convert recent macroeconomic stabilisation into measurable socio-economic outcomes, tightening accountability, prioritising capital delivery, and strengthening revenue mobilisation. Beyond its scale, the Budget’s significance lies in its reform intent: restoring credibility to the budget process while addressing citizens’ core concerns on inflation, security, jobs, and infrastructure, with effective and timely implementation set to determine its ultimate impact.

The Nigerian Exchange (NGX) All-Share Index opened the week at 149,438.00 and traded bullish through the week, before closing at 152,057.00 points on Friday. In the week ended December 19, 2025, the ASI recorded a marginal week-to-date increase of 1.75% (+2619.00 points) and a week-on-week advance of 1.76% (2624.00 points) and a year-to-date return of 47%. The rally was driven by key sectors, including consumer goods, oil and gas, manufacturing, banking, insurance, and industrial.

This week, global financial markets were shaped by divergent central bank policies and mixed US macro data, highlighting a nuanced global outlook. In the US, November inflation cooled to about 2.7% year-on-year for headline CPI and 2.6% for core CPI, below expectations and supporting further market bets on Federal Reserve rate cuts in 2026, while the labour market showed slower momentum with a modest 64,000 jobs gain and unemployment at 4.6%, the highest since 2021. The Bank of England cut its policy rate by 25bps to 3.75% despite easing UK inflation and rising unemployment, but signalled caution on further cuts. The European Central Bank held rates steady at 2%, maintaining a neutral stance as euro-zone inflation remains close to target and growth outlooks were revised upward. Meanwhile, the Bank of Japan raised its benchmark rate to 0.75%, the highest in three decades, marking a shift from extreme-accommodation due to persistent inflation pressures, even as the yen weakened. Together, these developments nurtured a global background of policy divergence: easing bias in the US and UK, stability in the Eurozone, and tightening in Japan, which has influenced FX volatility, bond yields, and cross-market risk allocation ahead of year-end positioning.

Oil and gold markets moved in opposite directions over the week, reflecting contrasting supply-demand dynamics and macro drivers. Crude oil remained under pressure, with WTI opening the week near $57.4 and Brent around $61.1 per barrel on Monday, before sliding further on Tuesday to roughly $55.2 (WTI) and $58.1 (Brent) amid oversupply concerns, rising OPEC+ and non-OPEC output, weak demand signals from China and the US, and optimism around a potential Russia–Ukraine peace deal. Prices rebounded midweek, with WTI climbing above $55 and Brent recovering to about $60.6, supported by heightened geopolitical risks following US sanctions and a maritime blockade on Venezuelan oil shipments, prospective sanctions on Russia’s energy sector, and the Energy Information Administration (EIA) data showing a 1.27mb draw in US crude inventories. However, gains proved short-lived, as prices eased again by Friday, December 19, to around $56.5 and $60.1 for WTI and Brent, respectively, leaving oil down roughly 20% year-to-date and on track for its weakest annual performance in seven years. In contrast, gold posted a strong weekly performance, trading near record highs throughout the period as expectations of further US monetary easing, softer inflation and labour market data, persistent geopolitical tensions, strong central bank buying, exchange-traded fund (ETF) inflows, and a shift away from sovereign bonds and currencies underpinned demand, lifting bullion from around $4,320–$4,340/oz early in the week to a peak near $4,370/oz before settling close to $4,331/oz by week’s end, with year-to-date gains of roughly 60–65%, its strongest annual performance since 1979.

Should the current macroeconomic trend hold, Nigeria’s debt and FX markets could offer a rare combination of stability and attractive yields. The strong demand for FGN bonds and NTBs, easing inflation, in addition to robust reserves, points to sustained investor confidence and tighter spreads. With over ₦1.5 trillion in inflows from coupon payments, maturing NTBs, and OMOs, system liquidity is set to further increase, leading to liquidity-rich conditions that support selective duration extension, paving the way for potential aggressive OMO auctions. While strategic rotation across maturities can optimize returns. Coupled with improving fiscal inflows and supportive global policy, the outlook remains cautiously positive, rewarding disciplined investors who balance yield capture with risk vigilance.

By: Sandra A. Aghaizu

Liquidity drips like rain into once-dry markets,

Banks of capital swell, no longer afraid.

Bonds breathe easier as spreads slowly exhale,

Inflation loosens its grip and steps aside.

Reserves stand watch like quiet sentinels,

Yields rise with discipline, not haste.

Money rotates along the curve, seeking balance,

Time itself becomes an asset, carefully priced.

In this season of measured confidence and restraint,

Only steady hands harvest the return.