The final days of 2025 emphasized a decisive policy recalibration as Nigerian financial conditions firmed in response to fragile global liquidity. Domestically, the Central Bank of Nigeria (CBN) executed an aggressive liquidity mop-up, at the December 30 Open Market Operation (OMO) auction, which saw a massive ₦1.27 trillion allotment to sterilize excess cash and anchor the Naira. This disciplined stance was mirrored in the equities market, which closed the year as one of the world’s best performers with a 51.19% annual gain, bringing total market capitalization to ₦99.4 trillion. Against a backdrop of thin global markets, commodities responded to geopolitical risk, with West Texas Intermediate (WTI) and Brent closing on Friday at $56.7 and $60.1 per barrel, respectively. Gold sustained the $4,300/oz level during the period before closing at $4,320/oz, in addition to shifting monetary expectations. Nigeria concluded 2025 signaling clearer policy, firmer reserves at $45.50 billion, and improving macro visibility. As 2026 begins, the tone is set for consolidation, with projected GDP growth of 4.49% and a sharp anticipated drop in inflation to 12.94%, marking a transition from crisis management to structured economic control.

Interbank liquidity opened with a surplus of over ₦3.36 trillion on Friday, its lowest in the year-end week, marking a week-to-date decline of 16.6% after opening at ₦4.02 trillion on Monday. Money market rates witnessed mild changes, with the Open Repo Rate (OPR) steady at 22.50% and Overnight (O/N) rate peaking at 22.79%, before closing at 22.50% and 22.75%, correspondingly. In the currency market, the Naira traded between $/₦1,427.00 and $/₦1,450.00 during the week, closing at $/₦1,430.84 on Friday.

The December 30, 2025, OMO auction results revealed a strong liquidity sterilization strategy by the CBN, evidenced by a massive 404% oversubscription on offer and subsequent allotment of 398% on the 210-day bill. Conversely, the 168-day bill witnessed 40.3% undersubscription to offer and sale of 25%. Stop rate cleared at 19.41% (-1bps) and 19.38% (-3bps) for the 210- and 168-day bill, respectively. Also, the marginal compression of stop rates indicates the Bank’s success in utilizing high institutional demand to stabilize yields. Consequently, this mop-up is expected to support exchange rate stability by making the Naira scarcer and attractive to foreign portfolio investors, aligning with the 2026 outlook of a range-bound currency and moderated inflation.

AUCTION DATE | TENOR | OFFER (₦‘B) | BIDS (₦‘B) | STOP RATES (%) | PREVIOUS TENOR STOP RATES (%) | TOTAL SALE (₦‘B) |

30-12-2025 | 168-DAY | 300.00 | 121.00 | 19.3500 | 19.3800 | 75.00 |

210-DAY | 300.00 | 1,214.50 | 19.4100 | 19.4200 | 1,193.50 |

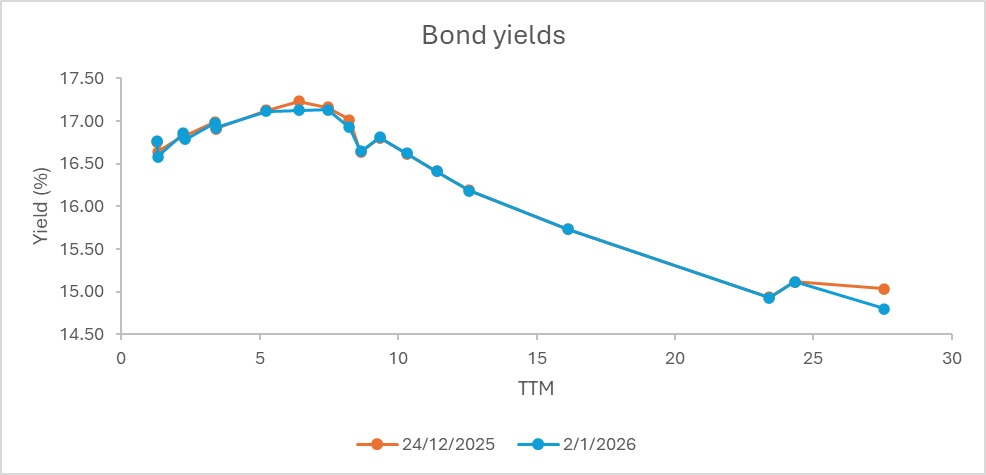

The secondary market maintained a cautiously positive tone, supported by a modest decline in yields. Following the new Jul-2026 OMO bill which traded attractively, the market tilted to a bearish stance into the new year as shown by the trade activity between participants. Bond yields remained broadly stable around the upper-16% to low 17% level, while bills moved within the mid-16% to low-21% band, reinforcing a higher-for-longer rate sentiment. Renewed supply in short- to long-tenor papers, particularly the 2028s–2037s, were met with selective and resilient demand, especially the 2026s, 2030s, 2031s, 2032s, and 2033s, while interest for the 2053 maturity stayed minimal. In the money market, positioning stayed constructive with new issuance demand as investors rotated deliberately across the curve, demonstrating a firmer preference favouring short- and long-dated OMO and Nigeria Treasury Bill (NTB) instruments, balancing yield opportunities with watchful duration extension in a liquidity-rich market.

The Naira traded with modest volatility in the Nigerian Foreign Exchange Market (NFEM), from ₦1,442.51 to ₦1,430.84, gaining ₦11.66 (+0.81%) intra-week and appreciating ₦12.53 (+0.53%) week-on-week, closing at ₦1,430.84 (up from ₦1,443.38 the previous week). Intra-week movements reflected a resilient market despite FX pressures, braced by improved liquidity and steady growth in external reserves.

Nigeria’s external reserves maintained their upward momentum, rising from $44.86 billion on December 01 to $45.50 billion on December 31, 2025, a month-to-date gain of approximately $644.39 million (+1.44%). Blocked funds increased slightly from $554.05 million to $563.89 million, maintaining the blocked reserve ratio at 1.24%, indicating improved FX liquidity, enhanced reserve management efficiency, and continued progress in clearing outstanding obligations.

According to the Central Bank of Nigeria’s 2026 Macroeconomic Outlook, the domestic economy is poised for a significant rebound, with GDP growth projected to accelerate to 4.49% from 3.89% in 2025, while headline inflation is expected to drop sharply to an average of 12.94%. This optimistic trajectory is anchored by sustained structural reforms, enhanced local refining capacity, and a shift toward a more accommodative monetary stance, further supported by a robust external sector with reserves forecasted to reach $51.04 billion. However, despite the positive momentum, the fiscal landscape remains pressured with a projected deficit of ₦12.14 trillion (3.01% of GDP) and faces potential headwinds from capital reversals, geopolitical tensions, crude oil production disruptions, and systemic weights arising from the ongoing banking sector recapitalization exercise.

The Nigerian government’s decision to cancel approximately $5 billion in debt owed by the NNPC is a strategic move to clean up the company’s financial records before its planned public listing in 2028. By removing these large obligations, which include unpaid royalties and contract costs, the government aims to make the company more attractive to international investors who value transparency and a healthy balance sheet. However, while this “reset” solves old issues, the NNPC is simultaneously looking to take on a new $5 billion loan from Saudi Arabia’s Aramco to help pay for current operations. The core insight here is that while the debt wipe-out is a positive step for a future IPO, the company’s continued reliance on new, high-value loans and the existence of a massive $42.4 billion unresolved dispute from previous years mean that true financial independence is still a work in progress.

The Nigerian Exchange (NGX) All-Share Index opened the week at 154,390.00 and traded bullish throughout the short week due to the New Year holiday, closing at 156,492.00 points on Friday. In the week ending January 02, 2026, the ASI recorded a modest week-to-date increase of 1.36% (+2102.00 points) and a week-on-week advance of 1.92% (+2952.00 points), bringing the 2025 year-to-date return to ~51.2%. The rally was driven by strong performance in addition to year-end balancing and restructuring of company’s financials in key sectors, including consumer manufacturing goods, industrial, insurance, oil & gas, and banking.

Between December 29, 2025, and January 2, 2026, global markets drifted through a period of extreme thin liquidity as institutional desks closed for the New Year, resulting in “mechanical” price action rather than fundamental shifts. In the U.S., the major indexes saw a soft finish to their third consecutive winning year; the S&P 500 closed 2025 with an annual gain of 16.4% despite falling 0.7% on New Year’s Eve, while the Nasdaq Composite ended the year up 20.5%, both buoyed by the sustained AI supercycle and the historic $4.55 trillion valuation of Nvidia. The 10-year Treasury yield edged higher to finish at 4.17%, reflecting a defensive stance as traders priced in a “sticky inflation” narrative with only two projected Fed rate cuts for 2026. Commodities remained the standout safe havens, with Gold maintaining its historic ascent toward $4,500/oz and Silver holding near its all-time high of $73–$84/oz, driven by persistent tariff uncertainties and central bank demand. In Asia, the Bank of Japan’s Summary of Opinions signaled a potential shift toward a 0.75% policy rate by mid-2026. At the same time, Chinese markets stayed muted ahead of the final Manufacturing PMI data, leaving global sentiment in a state of “Extreme Fear” (Index at 24) due to low bid depth rather than systemic collapse.

Crude oil prices traded with heightened volatility over the final days of 2025 and into early 2026, supported occasionally by geopolitical risk but ultimately regulated by surplus expectations. Brent rebounded above $61/bbl on December 29, closing near $62, while WTI climbed past $58/bbl, trimming earlier losses as Middle East tensions intensified and uncertainty lingered around Russia–Ukraine peace efforts, alongside China’s signal of expanded fiscal spending in 2026. Momentum softened on December 30, with Brent hovering around $62.15 and WTI near $58.1, as conflicting headlines on Ukraine negotiations, US actions against Venezuelan oil infrastructure, and renewed Middle East risks kept risk premiums elevated. By December 31, both benchmarks eased, Brent to about $61.26 and WTI to roughly $57.7, ending 2025 with steep annual losses of around 18–20%, the sharpest since 2020, amid mounting evidence of a global supply glut, rising US inventories, and subdued demand growth. Early January 2026; WTI and Brent declined closing at $56.7 and Brent at $60.4, buoyed by a larger-than-expected 1.93 million-barrel draw in US crude inventories and expectations that OPEC+ will maintain its pause on output increases at its January 4 meeting, beside the International Energy Agency (IEA) surplus forecasts of about 3.8 million barrels per day this year, limiting the price impact of supply disruptions. Overall, while geopolitics continue to inject short-term support, the oil market entered 2026 constrained by ample supply and watchful demand expectations, keeping upside potential fragile despite periodic price spikes.

Gold prices were volatile into year-end, retreating sharply before stabilising as structural support remained intact. Bullion slid over 4% on December 29 to about $4,335/oz as investors took profits following a string of record highs and hesitant progress in US–Ukraine peace talks reduced safe-haven demand. Prices rebounded modestly on December 30, trading above $4,360/oz, as renewed geopolitical tensions involving Russia, Iran, and Venezuela restored defensive interest. By December 31, gold eased again below $4,330/oz but still closed 2025 with a gain of roughly 65%, its strongest annual performance since 1979. Early 2026 began with prices firming near $4,320/oz, supported by expectations of future US rate cuts, sustained central bank buying, steady exchange-traded fund (ETF) inflows, and persistent geopolitical uncertainty, which reinforced gold’s role as a strategic hedge despite short-term corrections.

The President Tinubu’s official order for a “hard reset” of the national budget (terminating the era of multiple overlapping fiscal years) on March 31, 2026, marks a transition to a single, unified budget cycle starting April 1, 2026. This shift establishes a systematic outlook for 2026, as the consolidation of previous capital liabilities may temporarily expand the federal government’s borrowing requirements during the adjustment period. As a result, yields are expected to remain attractive, sustaining robust investor interest.

The high influx of liquidity entering the system in January, estimated at over ₦7 trillion, is expected to be absorbed through strategic reinvestments in government securities. During the first full week of the year, markets are anticipated to remain steady as investors capitalize on the traditional “January boost,” with liquidity further enhanced by inflows of over ₦1.89 trillion from maturing OMO and Treasury bills, alongside the new Q1 2026 FGN Bond and NTB auction schedules. However, much of this capital is likely to be recycled into new government debt rather than riskier assets. As a result, yields may ease slightly but should remain stable, keeping the Naira supported as investors prioritize careful reinvestment and selective positioning over aggressive risk-taking.

By: Sandra A. Aghaizu

As 2025 faded, Nigeria tightened its sails against thinning global liquidity. The CBN moved firmly, pulling ₦1.27 trillion from the system to steady the Naira and quiet excess cash.

The equities market told a different tale of strength, rising 51.19% for the year and lifting market value to ₦99.4 trillion, placing Nigeria among the world’s top performers.

Globally, geopolitics rippled through commodities. Oil closed mixed, WTI at $56.7, Brent at $60.1 while gold held its shine above $4,300, ending at $4,320.

By year-end, Nigeria stood on firmer ground: clearer policy, $45.5 billion in reserves, and improving visibility. As 2026 opens, the economy shifts from firefighting to formation, with projected growth at 4.49% and inflation easing toward 12.94%.

Liquidity eased into the close at ₦3.36 trillion, and the Naira found balance, ending the week at ₦1,430.84 per dollar.