In the week under review, Nigeria’s financial markets ended on solid, data-driven momentum, supported by clear policy direction and strong fixed-income performance. Robust demand at the DMO’s bond auction, particularly for the 5- and 7-year reopenings, signaled investors’ preference for medium-term duration amid surplus system liquidity and elevated real yields quest, with the slight rise in stop rates reflecting orderly risk repricing rather than weakening sentiment. The CBN’s decision to hold the Monetary Policy Rate (MPR) while adjusting the asymmetric corridor reinforced a stability-focused stance aimed at anchoring inflation expectations, aiding FX market recovery, economic growth, and keeping Naira assets attractive. The policy clarity helped steady secondary-market yields and supported Naira appreciation, led by improved liquidity and rising reserves. Equities were more tempered, trading mixed as profit-taking and cautious positioning filtered across major sectors. Globally, markets closed the month with guarded optimism as expectations of a December Federal Reserve Bank rate cut strengthened, lifting risk assets while boosting gold price near multi-week highs. These global shifts, in tandem with softening U.S. data (ADP’s preliminary report) and persistent geopolitical risks, continue to shape positioning in emerging markets like Nigeria, where investors navigate opportunity with measured caution heading into December.

Interbank liquidity opened with a surplus of over ₦1.92 trillion on Friday, marking a week-to-date change of 65.3% after opening at 1.18 trillion on Monday and peaking at ₦3.26 trillion during the week. Money market rates significantly changed, with the Open Repo Rate (OPR) and Overnight (O/N) peaking at 24.50% and 24.83%, before closing at 22.50% and 22.71% respectively. In the currency market, the Naira traded between $/₦1,436.50 and $/₦1,455.00 during the week, closing at $/₦1,446.74 on Friday.

The November 2025 FGN bond auction by the Debt Management Office (DMO), featuring reopenings of the 17.945% August 2030 and 17.95% June 2032 instruments, delivered a strong outcome against their respective offer. Both papers attracted healthy bidding interest across a competitive bid range, resulting in bid-to-cover ratios of 1.09x and 1.14x with an oversubscription of 1.14x and a remarkable 3.91x, for the 5- and 7-year, respectively, indicating significant deeper demand for the longer-dated note. Stop rates rose modestly by 6.8bps and 15bps for the 2030s and 2032s, respectively, reflecting a slight upward repricing of duration risk in line with the tight monetary environment. Overall, the auction demonstrates the DMO’s heightened need to borrow, together with robust investor appetite for sovereign bonds for attractive real yields, improving macro-stability expectations, and a strong preference for medium-term duration exposure.

BONDS TENOR | AUGUST 2030 | JUNE 2032 |

MATURITY DATE | 27-08-2030 | 25-06-2032 |

TENORS | 5-YEAR | 7-YEAR |

AMOUNT OFFERED (₦) | 130 BILLION | 130 BILLION |

SUBSCRIPTION (₦) | 147.869 BILLION | 509.392 BILLION |

BID RANGE (%) | 14.9000 – 17.9450 | 14.9000 – 17.9500 |

AMOUNT ALLOTTED (₦) | 134.799 BILLION | 448.772 BILLION |

STOP RATES (%) | 15.9000 | 16.0000 |

PREVIOUS STOP RATES (%) | 15.8320 | 15.8500 |

The Central Bank of Nigeria (CBN) Monetary Policy Committee held its 303rd and last meeting for the year on November 24–25, 2025, maintaining a steady hold on all key policy parameters while implementing a downward adjustment of 200/200 basis points to +50/-450 basis points on the asymmetric corridor compared to the previous rate around the Monetary Policy Rate, ahead of its 304th assembly scheduled for February 23–24, 2026. The decision reflects the Committee’s conservative, stability-first posture: by holding the policy rate while adjusting the corridor, with aims to sustain disinflation, stabilise the FX market, control liquidity, and keep Nigerian assets attractive to investors. While this reinforces macro stability, it also means that economic growth may remain constrained and credit conditions tough for households and smaller corporates; however, the slight easing in asymmetric corridor may encourage prime-rated borrowers, particularly large corporates and conglomerates, to take advantage of relatively cheaper bank financing. Given this development, fixed-income investors are likely to find the most compelling opportunities at the short to mid-end of the curve, while equity investors should remain focused on selective, fundamentally strong counters with resilient earnings and inflation-hedging characteristics.

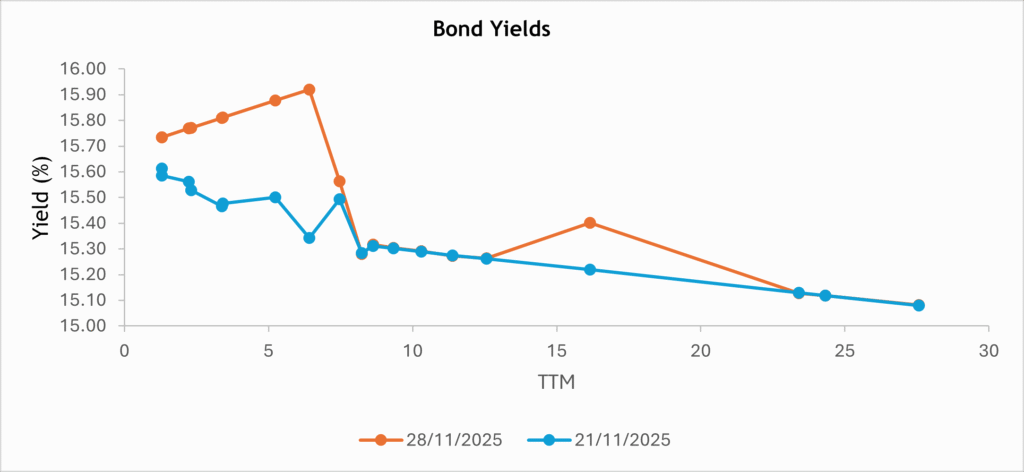

The secondary market saw an improvement compared to the previous week, largely due to the improved level at the bond auction, with yields broadly anchored in the high-15% range for bonds and the low-20% band for bills. Renewed supply in short- to mid-tenor papers — particularly the 2029–2035 segment — was met with selective but resilient demand, most notably in the 2032s, while appetite for the ultra-long 2053 maturity remained low. In the money market, positioning stayed constructive as investors rotated tactically across the curve, showing a firmer preference for mid- and long-dated OMO and NTB bills, consistent with cautious duration extension in a system flush with liquidity. Overall, the tone leaned slightly bearish, with quotes edging lower and prices softening as investors gravitated toward safer, shorter-term instruments.

The Naira traded with modest volatility at the Nigerian Foreign Exchange Market (NFEM), appreciating from ₦1,453.84 to ₦1,446.74, a week-to-date gain of ₦7.10 (0.49%) and a ₦9.98 (0.69%) improvement compared to the previous week’s close. Intra-week movements showed a resilient market despite FX pressures, supported by improved FX liquidity and steady reserve growth. The stability was further anchored by the CBN’s proactive interventions aimed at cushioning volatility and sustaining confidence in the FX market.

Nigeria’s external reserves continued their upward momentum, rising from $43.19 billion on October 31 to $44.55 billion on November 26, marking a gain of approximately $1.36 billion month-to-date (+3.15%), an increase of 3.32% in liquid reserves. Alongside, blocked funds declined from $615.47 million to $560.06 million, reducing the blocked reserve ratio from 1.42% to 1.26%, indicating enhanced FX liquidity, reserve management efficiency, and progress in clearing outstanding obligations.

The Nigerian Exchange (NGX) All-Share Index opened the week at 143,615.00 and traded in a volatile pattern, slipping on Monday, recovering on Tuesday, and oscillating the rest of the week before closing at 143,521.00 points on Friday. For the week ended November 28, 2025, the ASI recorded a marginal week-to-date decline of 0.07% (94.00 points) and a week-on-week decline of 0.19% (270 points). The choppy performance was largely driven by profit-taking and a broader risk aversion across key sectors, including banking, consumer goods, telecommunications, energy, hospitality, industrial goods, and insurance.

As of the end of November 2025, global financial markets exhibit a cautiously optimistic but fragile tone: markets around the world have rallied partly on rising expectations that the Federal Reserve may cut interest rates in December, a shift that has boosted equities and risk assets globally. Yet, underlying headwinds remain real: macroeconomic growth is slowing, trade and credit conditions are tightening, in addition, economic uncertainty, especially in regions still battling sticky inflation, continues to weigh on sentiment. Investors are becoming more selective, pushing some money into traditional safe havens like gold and seeking shelter in shorter-term bond instruments even as yields compress. For emerging markets, this mixed backdrop presents both opportunities and risks: the possibility of renewed capital inflows into yield-bearing assets exists, but currency volatility, external financing pressures, and a potential tightening of global liquidity could just as quickly reverse the gains.

Oil prices showed a modest upward drift through the week as markets balanced oversupply fears with ongoing Russia–Ukraine peace negotiations. WTI rose from $58.08 on November 24 to $59.14 per barrel on November 28, and Brent edged from $62.54 to $62.92 per barrel, even as the broader sentiment remained cautious ahead of the OPEC+ meeting, amidst speculation that a potential peace deal could eventually lift sanctions on Russian crude. Gold continued to strengthen decisively, climbing from $4,091 to $4,198, holding a near two-week high as a string of weaker-than-expected US data, including soft retail sales and labour-market deterioration, all cementing expectations of a December Federal Reserve rate cut, now priced with over an 80% probability. Additional support came from dovish signals by multiple Fed officials and growing market expectations that Kevin Hassett, a frontrunner for Federal Reserve chair, would favour more monetary easing. With geopolitical tensions easing slightly and central-bank demand remaining robust, gold is on track for its fourth consecutive monthly gain and poised for its strongest annual performance since 1979.

With the CBN holding the MPR and adjusting the asymmetric corridor, Nigeria faces a near-term balancing act between global risk-off sentiment, FX pressures, and domestic liquidity. Strong demand at the November bond auction signals investor appetite, yet increased government funding needs are set to influence yields in the upcoming ₦700 billion Nigeria Treasury Bill (NTB) auction. Additionally, inflows of over ₦1.59 trillion are expected from coupons, Open Market Operation (OMO), and NTB maturities, which will increase liquidity. Furthermore, the Bank of Ghana’s 18% benchmark rate adds regional competition for capital. As a result, Nigerian markets will therefore need to navigate a complex mix of attractive yields, macro stability, and global volatility, requiring selective positioning across fixed income, FX, and equities as we move into December.

By: Sandra A. Aghaizu

The ASI moved like a restless tide…

sinking on Monday, rising on Tuesday,

and ultimately closing the week 94 points lower at 143,521,

a gentle 0.07% slip,

and 270 points below last week’s shore.

Profit-takers cast their nets,

risk-averse traders pulled back,

and every major sector…from banking to telecoms,

energy to insurance, felt the pull of the current.

Not a storm, just the market’s quiet reminder:

even in seemingly steady seasons,

the market’s ocean still shifts beneath your feet.