Nigeria’s financial landscape entered December on a dynamic note, marked by the Central Bank of Nigeria (CBN) sweeping cash-policy reforms, resilient Nigerian Treasury Bill (NTB) demand, and a cautious yet constructive market activity. The Central Bank’s upcoming cash-limitation measures, effective January 2026, aim to tighten liquidity, curb security risks, and accelerate the shift toward electronic payments, while the December 3 NTB auction reflected selective investor appetite, with the 364-day bill heavily oversubscribed and yields rising sharply. Complementing this, the Nigeria Exchange’s (NGX) rollout of Commercial Paper listings deepened corporate financing channels and enhanced market transparency. Against this backdrop, the ₦ 54.43 trillion Medium-Term Expenditure Framework signaled a marginal conservative fiscal stance ahead of a pre-election year, balancing revenue assumptions amid volatile oil markets. Liquidity remained abundant, the Naira traded with mild gains, external reserves rose, and the NGX All-Share Index held firm, while global market caution persisted amongst geopolitical and macroeconomic uncertainties, setting the tone for an eventful close to 2025.

Interbank liquidity opened with a surplus of over ₦3.20 trillion on Friday, its highest peak during the week, marking a week-to-date change of 46.2% after opening at 2.19 trillion on Monday. Money market rates experienced significant changes, with the Open Repo Rate (OPR) steady and Overnight (O/N) rates peaking at 22.50% and 22.85%, respectively, before closing at 22.50% and 22.75%, correspondingly. In the currency market, the Naira traded between $/₦1,443.00 and $/₦1,456.00 during the week, closing at $/₦1,450.43 on Friday.

The Nigerian Treasury Bill (NTB) auction of December 3, 2025, reflected a mixed demand pattern across tenors with significant investor preference skewed toward the longer 364-day bill. While the 91-day and 182-day bills were undersubscribed at 44.2% and 22.3%, respectively, against their offers, the 364-day bill drew strong interest, with an oversubscription of 154.9% against its offer. The Debt Management Office (DMO) allocated over 90% of the subscription for each maturity at the auction. Stop rates for the 91- and 182-day bills were held steady at 15.30% and 15.50%, while the 364-day rose sharply by 146bps, clearing at 17.50% from the previous auction rate, signaling rising yield expectations. Overall, the auction highlighted investors’ appetite for higher-yielding long-day paper within evolving market dynamics.

AUCTION DATE | 03-12-2025 | 03-12-2025 | 03-12-2025 |

ALLOTMENT DATE | 04-12-2025 | 04-12-2025 | 04-12-2025 |

MATURITY DATE | 05-03-2026 | 04-06-2026 | 03-12-2026 |

TENOR | 91-DAY | 182-DAY | 364-DAY |

OFFER (₦) | 100,000,000,000 | 150,000,000,000 | 450,000,000,000 |

SUBSCRIPTION (₦) | 44,172,314,000 | 33,376,977,000 | 697,290,308,000 |

ALLOTMENT (₦) | 42,804,311,000 | 30,356,977,000 | 636,460,307,000 |

RANGE OF BIDS (%) | 14.9900 – 19.0000 | 14.9500 – 19.5000 | 15.0000 – 19.4300 |

STOP RATES (%) | 15.3000 | 15.5000 | 17.5000 |

PREVIOUS STOP RATES (%) | 15.3000 | 15.5000 | 16.0400 |

On December 4, 2025, the CBN, on behalf of the DMO, announced key revisions to the Q4 2025 Nigerian Treasury Bills (NTB) Auction Calendar. An additional NTB auction was scheduled for Wednesday, December 10, 2025, with offer sizes of ₦100 billion, ₦150 billion, and ₦500 billion for the 91-, 182-, and 364-day tenors, respectively. Furthermore, the previously planned NTB auction for Wednesday, December 17, 2025, was revised upward to ₦700 billion (+47.8%), comprising ₦100 billion, ₦100 billion, and ₦500 billion across the same maturities. The expanded issuance signals the Federal Government’s increased short-term funding needs and its strategic use of the highly liquid money market to manage near-term fiscal pressures. Largely, these revisions suggest a more active December in the fixed-income space, with expectations of upward yield adjustments as supply increases and investors recalibrate their expectations around government borrowing dynamics heading into 2026.

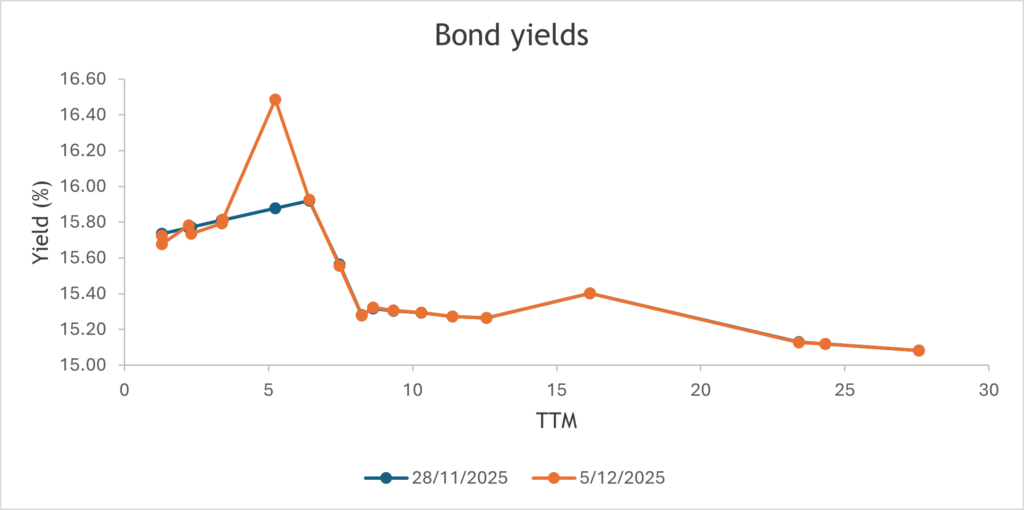

The secondary market experienced a more bearish outcome compared to the previous week, mainly due to the improved level at the NTB auction and the revised Q4 NTB auction calendar, with yields for bonds testing the 17% levels, and bills within the mid-17% to low-20% band. Renewed supply in short- to mid-tenor papers — particularly the 2029–2034 segment — were met with selective but resilient demand, mostly the 2031s, 2032s, and 2033s, while appetite for the 2053 maturity remained low. In the money market, positioning stayed constructive as investors rotated tactically across the curve, showing a firmer preference for mid- and long-dated OMO and NTB bills, consistent with cautious duration extension in a system flush with liquidity. Generally, interest rates in the fixed income market showed a sharp uptrend, with yields edging higher as investors gravitated toward safer, shorter-term instruments.

The Naira traded with modest volatility at ₦1,448.44 to ₦1,450.43 in the Nigerian Foreign Exchange Market (NFEM); gaining a mild ₦3.04 intra-week, it ultimately recorded a week-on-week decline of ₦1.99 (-0.14%), closing at ₦1,450.43 (down from ₦1,448.44 the previous week). Intra-week movements showed a resilient market despite FX pressures, supported by improved FX liquidity and steady reserve growth.

Nigeria’s external reserves continued their upward momentum, rising from $44.67 billion on November 28 to $45.04 billion on December 4, marking a gain of approximately $374.66 million month-to-date (+0.87%), an increase of 0.86% in liquid reserves. In addition, blocked funds declined from $557.08 million to $551.77 million, reducing the blocked reserve ratio from 1.25% to 1.22%, indicating enhanced FX liquidity, reserve management efficiency, and progress in clearing outstanding obligations.

—

In a circular issued on December 2, 2025, the Central Bank of Nigeria (CBN) announced a comprehensive revision of cash-related policies effective January 1, 2026, aimed at reducing cash-handling costs, curbing security risks, and addressing money-laundering concerns. Key changes include the removal of deposit limits and associated excess-deposit fees, the introduction of stricter cumulative weekly withdrawal limits of ₦500,000 for individuals and ₦5 million for corporates, the discontinuation of special withdrawal authorisations, revised ATM limits of ₦100,000 daily, and new excess-cash-withdrawal fees of 3% for individuals and 5% for corporates. The CBN also retained the ₦100,000 over-the-counter (OTC) limit for third-party cheques, mandated monthly reporting of large cash activities, and removed exemptions previously granted to embassies and donor agencies, while allowing all Naira denominations in ATMs. These policy shifts will significantly tighten cash liquidity, push individuals and businesses toward electronic payments, reduce the circulation of physical cash, and improve regulatory oversight—likely enhancing financial transparency but increasing compliance pressure on banks and cash-dependent sectors.

The Nigerian Exchange Limited’s (NGX) rollout of Commercial Paper (CP) listings, approved by the Securities and Exchange Commission (SEC), marks a strategic leap in deepening Nigeria’s short-term debt market and broadening corporate financing channels. By allowing conventional and non-interest CPs to be listed and traded directly on the Exchange, NGX enhances transparency, boosts liquidity, and provides corporates with a cost-efficient alternative to bank borrowing while offering investors credible, short-tenor instruments in a high-yield environment. The move strengthens NGX’s ambition to become a fully integrated capital-markets hub spanning equities, fixed income, derivatives, exchange-traded funds (ETFs), and short-term debt, with strong regulatory oversight ensuring investor protection. Largely, the development is poised to energize market activity, diversify funding sources, and improve capital formation, supporting stability and growth within Nigeria’s financial ecosystem.

The approval of the 54.43 trillion Medium Term Expenditure Framework (MTEF) and Fiscal Strategy Paper by the Federal Executive Council (FEC) for 2026–2028 indicates a cautious yet politically sensitive fiscal stance as Nigeria heads into a pre-election year marked by heightened spending pressures and fragile oil-market conditions. Although the benchmark oil price per barrel was set at $64.85, the current Brent price is around $63 per barrel, showing that the target offers only a marginal buffer given the prevailing volatility. Despite higher realisable prices and a 2.06mbpd target, the tighter 1.8mbpd production assumption reflects concerns about output reliability, emphasizing the need to safeguard revenues against shocks amid persistent fluctuating global crude market demand. However, the wide deficit of N20.1trn, lower projected revenues, and an election-driven rise in liquidity risk could intensify FX pressures, complicate monetary management, and elevate yields across the fixed-income space as the government competes for funding. For the financial markets in general, the framework points to a period of tighter fiscal-monetary coordination, increased borrowing needs, and heightened sensitivity to oil price swings, factors that could shape investor sentiment, pricing of sovereign risk, and capital flows in the months ahead.

The Nigerian Exchange (NGX) All-Share Index opened the week at 143,210.00 and traded in a bullish trend throughout the week before closing at 147,040.00 points on Friday. In the week ended December 5, 2025, the ASI recorded a marginal week-to-date increase of 2.67% (+3830.00 points) and a week-on-week advance of 2.45% (3519.00 points). The rally was mainly driven by key sectors, including banking, consumer goods, energy, oil and gas, manufacturing, industrial goods, and insurance.

Global financial markets traded cautiously as investors weighed mixed macro signals alongside renewed geopolitical and commodity-market volatility. In the U.S., stronger-than-expected services and labour indicators pushed Treasury yields slightly higher, tempering expectations of early Federal Reserve rate cuts and firming the Dollar’s safe-haven bid. In Europe, softer industrial output data and persistent disinflation reinforced bets on a more dovish European Central Bank (ECB) stance, even as political uncertainty in parts of the eurozone kept risk sentiment fragile. Similarly, Asian markets were uneven, with China’s stimulus measures offering short-lived relief amidst continued property-sector strain. Japan’s yen volatility re-emerged following speculation about policy normalisation. Oil prices swung sharply during the week as markets reacted to shifting OPEC+ compliance expectations and geopolitical tensions, keeping energy-sensitive assets on edge. Globally, the week’s developments maintained a defensive trading environment, characterised by selective risk-taking, elevated volatility, and growing investor preference for high-quality assets as 2025 draws to a close.

Oil and gold prices showed a mixed but generally firm trend through the week as markets navigated geopolitical tensions, supply-side concerns, and monetary policy expectations. From December 1–5, WTI edged from $59.46 to $60.08 per barrel, while Brent moved from $63.34 to $63.75 per barrel, supported early on by OPEC+’s reaffirmation of its production freeze for Q1 2026 and escalating risks in Venezuela and Ukraine. Midweek, strikes on Russian energy assets and stalled US-Russia peace talks added a geopolitical risk premium, offsetting concerns over a persistently oversupplied market. Gold fluctuated between $4,166 and $4,222 per ounce, surging to a six-week high early in the week amid dovish Federal Reserve commentary, weak post-shutdown US data, and markets pricing in roughly an 87–90% probability of a 25bps rate cut. Midweek, profit-taking and a cooling labour market, highlighted by a 32,000 private payroll loss and 71,000 Challenger layoffs, moderated gold gains, though support persisted from speculation that Kevin Hassett could succeed Federal Reserve Bank Chair Powell and ongoing central-bank buying. By week’s end, both commodities held near recent highs, with oil constrained by weak demand and rising US inventories, and gold poised for one of its strongest annual performances in decades.

Nigeria faces a delicate near-term balance between global risk-off sentiment, mounting FX pressures, and abundant domestic liquidity. The recent upward yield movement in the secondary market for 1-year T-bills has pushed sovereign bond yields higher, reflecting strong investor appetite despite growing funding needs by the government. At the same time, inflows exceeding ₦1.51 trillion from maturing Open Market Operations (OMO) and NTB bills will reinforce an already liquid system. The upcoming ₦750 billion NTB auction is expected to provide further clarity on yield direction, while the expanded issuance also provides the CBN with a tool to sterilize surplus liquidity through OMO auctions to help contain FX pressures and stability in the currency and money markets.

By: Sandra A. Aghaizu

December opened with Nigeria’s markets humming…

cash-policy winds shifting,

Treasury bills drawing eager hands,

and the Naira steadying its breath.

Liquidity swelled like a rising tide,

banks awash in trillions,

while overnight rates flickered like restless stars.

The NGX strengthened its roots,

even as the government trimmed its sails

ahead of an election year’s uncertain weather.

And beneath global clouds of caution,

Nigeria’s financial landscape moved with quiet resolve…

steady, watchful,

ready for the year’s final chapter.