Nigeria’s financial markets navigated an eventful week ending December 12, 2025, with year-end liquidity pressures, selective investor demand, and global macroeconomic policy signals. The Debt Management Office’s (DMO) circular on ₦460 billion FGN Bond reopenings and recent Nigeria Treasury Bill (NTB) auction result revealed a split demand, with strong appetite for short and long-day papers amid upward yield repricing. The Central Bank of Nigeria’s (CBN) Open Market Operation (OMO) auctions absorbed excess liquidity, while secondary markets saw bonds around 17% and mid-17% to low-20% bills, supported by active price discovery. The Naira remained relatively stable, bolstered by rising external reserves and proactive measures to control FX pressure. In addition, regulatory initiatives such as the audio version of the Nigeria Security and Exchange Commission’s (SEC) Investment and Security Act (ISA) 2025 to boost awareness, also the CBN’s licensing of 82 Bureaux de Change (BDC), enhanced transparency and market confidence. Globally, the U.S. Federal Reserve’s 25 bps cut to 3.50–3.75% reinforced its mandate of price stability and employment growth, with a further easing expected in 2026. Commodities diverged: oil struggled under supply pressures (WTI $58, Brent $61.9); however, gold rallied to $4,317/oz on dovish Federal Reserve signals, structural demand, and China’s continued accumulation, cementing its status as a top-performing asset.

Interbank liquidity opened with a surplus of over ₦2.72 trillion on Friday, its lowest during the week, marking a week-to-date decline of 16.7% after opening at 3.26 trillion on Monday. Money market rates experienced moderate changes, with the Open Repo Rate (OPR) steady at 22.50% and Overnight (O/N) rate peaking at 22.80%, before closing at 22.50% and 22.75%, respectively. In the currency market, the Naira traded between $/₦1,450.25 and $/₦1,459.00 during the week, closing at $/₦1,454.41 on Friday.

On December 8, 2025, the Debt Management Office (DMO) released its final FGN Bond Auction circular for the year, announcing two reopenings for the year-end auction. The issuance will total ₦460 billion, evenly split between the 17.945% FGN AUG 2030 (5-year) and the 17.95% FGN JUNE 2032 (7-year). This signals a deliberate end-of-year liquidity sweep and duration management strategy, positioned to test investors’ appetite following the recent NTB auction upward repricing on the 1-year bill. The choice of mid-curve maturities reflects the government’s aim to lock in borrowing before potential macro resets in early 2026. In addition, the sizable supply could trigger short-term yield repricing and be pivotal in shaping year-end liquidity, guiding portfolio duration decisions, and setting the tone for the authorities’ funding operations in Q1 2026.

The outcome of the DMO’s December 10, 2025 NTB auction revealed a sharply divided market, with investors overwhelmingly concentrated on the 364-day tenor, which drew an exceptional 3.12x oversubscription against its offer, pulling the DMO to allot a significantly higher volume at 134% clearing at an elevated stop rate of 17.95% (+45bps), reflecting strong demand for long-dated yield amidst inflationary concerns and year-end liquidity pressures. In contrast, the 182-day paper saw extremely weak interest, with demand at just 0.15x the offer, resulting in a subdued 9% allotment and unchanged stop rate, indicating clear investor aversion to mid-tenor risk. The 91-day bill showed moderate oversubscription of 1.06x with 103.3% allotment, at a firm stop rate of 15.30%, signifying comfort with short-term liquidity positioning. Bid ranges across all tenors reveal a broader tilt: the 364-day paper saw bids as high as 22%, highlighting aggressive rate expectations from some participants.

Overall, the results highlight a “barbell” demand structure, where investors cluster at the very short and long ends for liquidity and elevated returns. This structure typically emerges when market participants expect monetary policy recalibration in the near term but still want to capture high yields. With the total auction allotment at 105.1%, also demonstrates the authority’s willingness to accept higher borrowing costs to meet fiscal needs, setting a tone of upward yield pressure heading into Q1 2026.

AUCTION DATE | 10-12-2025 | 10-12-2025 | 10-12-2025 |

MATURITY DATE | 12-03-2026 | 11-06-2026 | 10-12-2026 |

TENOR | 91-DAY | 182-DAY | 364-DAY |

OFFER (₦) | 100,000,000,000 | 150,000,000,000 | 450,000,000,000 |

SUBSCRIPTION (₦) | 106,069,241,000 | 23,596,944,000 | 1,559,562,162,000 |

ALLOTMENT (₦) | 103,358,741,000 | 13,636,044,000 | 671,203,244,000 |

STOP RATES (%) | 15.3000 | 15.5000 | 17.9500 |

PREVIOUS STOP RATES (%) | 15.3000 | 15.5000 | 17.5000 |

The CBN’s OMO auction on December 9, 2025, closed with no sales despite offering ₦600 billion equally split between the 98-day and 140-day bills. Although demand was notable, coming in at 60.6% and 387.1%, respectively, the wide bid range of 20.49% to 22.13% suggests that market pricing sat above the acceptable yield threshold.

The result of the OMO sale conducted by the CBN on December 11, 2025 reads as a decisive liquidity mop-up and a surprise yield compression: both tenors were heavily oversubscribed against offer by ~2.28x and 6.62x, and sold above offers at 136% and 305.4% for the 180- and 215-day bills, respectively, signalling a deliberate decision to absorb excess liquidity. Crucially, stop rates cleared individually at 19.39% (-106bps) and 19.49% (-105bps), a material decline compared with previous 174- and 188-day bill auction correspondingly, showing that demand was not only large but also willing to accept lower yields, likely driven by year-end positioning, short-term surplus balances in the banking system, and investors’ preference for locking in mid-term paper despite elevated yield expectations. The CBN’s acceptance of much larger sales than planned suggests a twofold aim: first to sterilise liquidity to stabilise FX and interbank tensions, reset the short-to-mid curve lower to restore market functioning, and second, it further implies keen compression of money-market rates in the near term while signalling to markets its preparedness to actively manage year-end liquidity rather than defend higher yields repricing.

AUCTION DATE | TENOR | OFFER (₦‘B) | BIDS (₦‘B) | STOP RATES (%) | PREVIOUS TENOR STOP RATES (%) | TOTAL SALE (₦‘B) |

09-12-2025 | 98-DAY | 300.00 | 182.00 | 0.0000 | 0.0000 | 0.00 |

140-DAY | 300.00 | 1,161.25 | 0.0000 | 0.0000 | 0.00 | |

11-12-2025 | 180-DAY | 300.00 | 686.12 | 19.3900 | 20.4500 | 408.00 |

215-DAY | 300.00 | 1,985.55 | 19.4900 | 20.5400 | 916.20 |

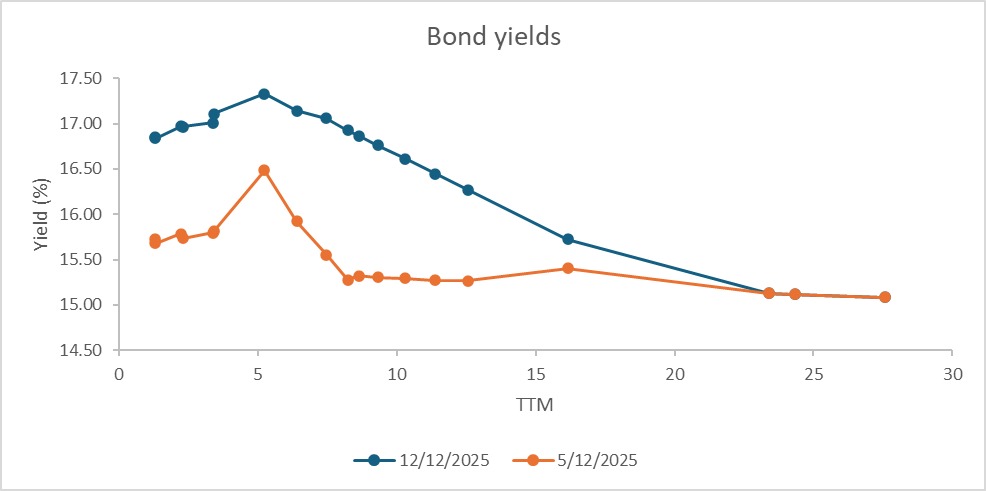

The secondary market recorded a bearish run compared to the previous week, mainly due to the improved stop rate at the recent NTB auction, with supported yields for bonds at the 17% levels, and bills within the mid-17% to low-20% band. Renewed supply in short- to mid-tenor papers, particularly the 2030–2037, were met with selective but resilient demand, especially the 2031s, 2032s, and 2033s, while appetite for the 2053 maturity remained low. In the money market, positioning stayed constructive with new issuance demand as investors rotated deliberately across the curve, showing a firmer preference for mid- and long-dated OMO and NTB bills, consistent with cautious duration extension in a system flush with liquidity. Generally, interest rates in the fixed income market showed a sharp uptrend, with yields edging higher as investors gravitated toward short-term instruments and matching quotes reflecting improved market price discovery.

The Naira traded with modest volatility at ₦1,451.86 to ₦1,454.41 in the Nigerian Foreign Exchange Market (NFEM), falling by ₦2.55 (-0.18%) intra-week, and a week-on-week decline of ₦3.98 (-0.27%), closing at ₦1,454.41 (down from ₦1,450.43 the previous week). Intra-week movements showed a resilient market despite FX pressures, supported by improved FX liquidity and steady reserve growth.

Nigeria’s external reserves continued their upward momentum, rising from $44.67 billion on November 28 to $45.44 billion on December 11, marking a gain of approximately $771.50 million month-to-date (+1.73%), an increase of 1.76% in liquid reserves. In addition, blocked funds declined from $557.08 million to $552.29 million, reducing the blocked reserve ratio from 1.25% to 1.22%, indicating enhanced FX liquidity, reserve management efficiency, and progress in clearing outstanding obligations.

On the regulatory scene, the Nigeria Securities and Exchange Commission’s (SEC) launch of a spoken-word version of the Investment and Securities Act (ISA) 2025, alongside a new USSD verification service, marking a major step toward making capital-market information accessible to all Nigerians, especially young people, rural communities, and those with limited literacy or internet access. By converting the law into audio and enabling operator verification through a simple code, the initiative broadens financial education, reduces vulnerability to fraud and Ponzi schemes, and strengthens trust in formal markets. This expanded, low-barrier outreach empowers underserved and constrained demographics with the knowledge needed to participate safely in the market, supporting inclusion and contributing to national economic growth ambitions.

The CBN’s approval of 82 Bureaux de Change (BDC) under its updated regulatory framework strengthens transparency, structure, and confidence in Nigeria’s FX market, supporting a more orderly rate-setting environment and improving formal access to foreign exchange. By clarifying which operators are licensed, and warning against unregulated dealers, the policy reduces consumer risk, curbs illicit FX activity, and reinforces ongoing market reforms designed to stabilise the Naira. While the tighter capital requirements and tiered licensing may limit participation for smaller operators in the short term, the overall framework promotes stronger compliance, better supervision, and a more credible FX ecosystem, laying the foundation for a healthier and more resilient financial market.

Fitch’s 2026 Sub-Saharan Africa (SSA) outlook highlights a cautiously favourable environment for Nigeria, noting that while easing inflation across the region creates room for policy rate cuts, the CBN must unwind its tight stance gradually to avoid liquidity-driven inflationary pressures. With SSA sovereigns holding a neutral outlook, supported by stable growth, moderated inflation, improved market access, and firmer commodity fundamentals, Fitch warns that political activism, upcoming elections, and high bank exposure to government debt remain key vulnerabilities. For Nigeria specifically, reforms are expected to hold through the 2027 election cycle, but any fiscal loosening must be carefully managed to prevent renewed price instability. The guidance emphasises that a measured, data-driven monetary easing path, paired with disciplined fiscal management, will be crucial in sustaining investor confidence, lowering domestic financing costs, and ensuring that gains from the improving macro environment translate into real economic stability.

The Nigerian Exchange (NGX) All-Share Index opened the week at 147,428.00 and traded bullish despite several consecutive declines in the week, before closing at 149,433.00 points on Friday. In the week ended December 12, 2025, the ASI recorded a marginal week-to-date increase of 1.36% (+2006.00 points) and a week-on-week advance of 1.63% (2393.00 points). Key sectors drove the rally, including consumer goods, oil and gas, manufacturing, industrial goods, and insurance.

Global markets reacted to the Federal Reserve’s 25 bps rate cut at its December 10, 2025, meeting, which lowered the federal funds target to 3.50%–3.75%, marking the third consecutive cut this year as policymakers balanced elevated inflation with signs of a cooling labour market and slowing growth pressures. This move reinforced the central bank’s commitment to its dual mandate of price stability and maximum employment, while smoothing financial conditions as it begins a cautiously accommodative stance into 2026, with forecasts signalling at least one additional cut next year as inflation is projected to moderate and the labour market remains resilient. Beyond the U.S., major central banks, including the Bank of England, are also expected to ease policy in response to softer inflation and slowing growth, reinforcing a global trend toward cautious monetary easing. This broader shift aims to sustain economic activity and support employment, but authorities stress that preserving price stability remains paramount as they adjust policy to evolving data and inflation dynamics in 2026.

Oil and gold markets diverged sharply during the week, with crude struggling under supply-side pressure while bullion advanced toward record highs on strong macro support. Oil opened the week on a relatively firm footing, with West Texas Intermediate (WTI) near $59 and Brent around $62.9 on Monday, supported by expectations of a U.S. rate cut and lingering geopolitical risks involving Russia, Ukraine, and Venezuela. Momentum faded quickly, as markets absorbed signs of a 2026 supply surplus, Iraq’s restored output, and increased U.S. production forecasts, pushing WTI down to $58.5 and Brent to $61.4 by Wednesday. Losses extended into Thursday despite growing expectations of a global glut before prices stabilized on Friday (WTI $57, Brent $61.9) despite the International Energy Agency (IEA) flagging a four-year-high inventory overhang and OPEC’s maintained 2026 outlook. Gold, by contrast, delivered a broad-based sustained rally, rising from $4,197/oz on Monday to $4,314/oz by Friday as traders priced an 88% chance of a 25bps Federal Reserve cut in 2026 and processed the Chairman Powell’s modestly dovish tone. Throughout the week, bullion held firm above the $4,200/oz threshold, $4,198/oz Tuesday, $4,210/oz Wednesday, $4,257/oz Thursday, supported by easing Treasury yields, recent rate cut, a weakening dollar, and the Fed’s plan to buy $40bn in short-term T-bills to steady money markets. Structural demand remained a key pillar, with China raising its gold reserves for the 13th consecutive month to 74.12 million ounces, while exchange-traded fund (ETF) inflows and safe-haven interest helped push year-to-date gains toward 60%, strengthening gold’s position as one of 2025’s strongest-performing assets.

Nigeria’s financial system is at an inflection point as it runs to the year-end, caught between jittery global markets, stubborn FX pressures, and a surplus liquid environment. The sharp upward repricing in 1-year T-bill yields signals robust investor appetite despite the government’s expanding funding needs. More than ₦607 billion in inflows from coupons and maturing OMOs will further support system liquidity, setting the stage for a potentially firmer yield curve at the forthcoming FGN Bond and ₦700 billion NTB auctions. The anticipated moderation in November inflation, supported by improved GDP numbers, gives authorities a credible basis to contemplate future easing, though the statistical rebasing effect on inflation will become fully visible in 2026. However, the CBN appears poised to tighten excess liquidity through selective OMO operations to steady the Naira and keep money-market conditions stable as the year winds down.

By: Sandra A. Aghaizu

The Fed cuts rates by measured steps,

Easing financial conditions carefully.

Across the Atlantic, the Bank of England watches,

Preparing to act as growth slows and inflation fades.

Yield curves soften, liquidity improves,

Markets adjust to a gentler policy tone.

Central banks move with caution,

Focused on stability as 2026 approaches.