The Nigerian fixed-income market remained firm during the week ending December 24, 2025, supported by year-end positioning and ample system liquidity. Interbank balances surged to over ₦2.10 trillion early in the week, prompting the Central Bank of Nigeria’s (CBN) Open Market Operation (OMO) auction to absorb excess funds, clearing the 162- and 211-day bills at slightly lower stop rates of 19.38% and 19.42%, respectively, compared to the previous sale. Money market rates held steady, the Naira strengthened modestly to ₦1,443.38, supported by improved external reserves, which rose to $45.24 billion, and appeared to discipline FX management. In addition, the Nigerian equities market inched higher with the All-Share Index reaching 153,540 points, driven by gains across consumer goods, banking, manufacturing, and industrials. Globally, markets traded cautiously as liquidity thinned, going into the Christmas break; the 10-year US Treasury yield hovered around 4.15%, equities showed modest year-end firmness, and commodities responded to geopolitical risk, with West Texas Intermediate (WTI) and Brent climbing to $58.38 and $62.19 respectively, per barrel on Wednesday. Gold advanced to a new high of $4,500/oz during the period before closing at $4,470/oz.

Interbank liquidity opened with a surplus of over ₦3.89 trillion on Wednesday, its highest in the yuletide week, marking a week-to-date increase of 80.9% after opening at ₦2.15 trillion on Monday. Money market rates witnessed mild changes, with the Open Repo Rate (OPR) steady at 22.50% and Overnight (O/N) rate peaking at 22.75%, before closing at 22.50% and 22.75%, respectively. In the currency market, the Naira traded between $/₦1,431.00 and $/₦1,466.00 during the week, closing at $/₦1,443.37 on Friday.

The result of the OMO sale conducted by the CBN on December 22, 2025, delivered a decisive liquidity mop-up and a mild yield tilt: featuring mid- and long-day tenors, oversubscribed against offer by ~1.59x and 6.28x, which sold above offers at 138.7% and 437.4% for the 162- and 211-day bills, respectively, signalling a deliberate decision to absorb excess liquidity. Stop rates cleared individually at 19.38% (-1bps) and 19.42% (-9bps), a mild decline compared with previous 180- and 215-day bill correspondingly, showing that demand was not only large but willing to accept lower yields, likely driven by year-end positioning, short-term surplus balances in the banking system, and investors’ preference for locking in mid-term paper despite elevated yield expectations. Effective yield reflected the mild decline with both tenors at 21.20% (-24bps) and 21.87% (-15bps). The CBN’s acceptance of much larger sales than planned suggested its aim: to sterilise liquidity to stabilise FX and interbank pressures, control the mid-to-long curve lower, and further implies keen compression of money-market rates in the near term while signalling to markets its preparedness to actively manage year-end liquidity rather than defend higher yields repricing.

AUCTION DATE | TENOR | OFFER (₦‘B) | BIDS (₦‘B) | STOP RATES (%) | PREVIOUS TENOR STOP RATES (%) | TOTAL SALE (₦‘B) |

22-12-2025 | 162-DAY | 300.00 | 476.00 | 19.3800 | 19.3900 | 416.00 |

211-DAY | 300.00 | 1,883.20 | 19.4200 | 19.4900 | 1,312.20 |

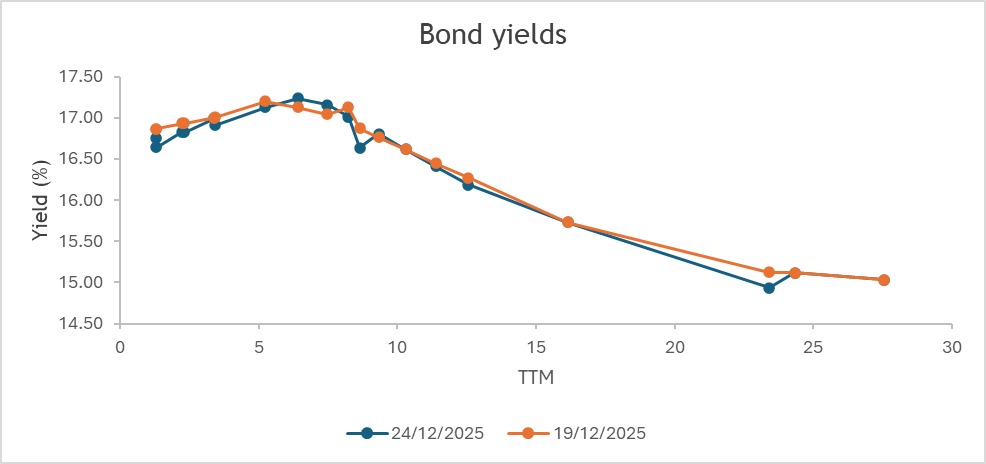

The secondary market turned moderately bullish, driven by the mild decline in yields in addition to the OMO auction result. Bond yields remained supported around the upper-16% to low 17% level, while bills were within the mid-16% to low-20% band, reinforcing a higher-for-longer rate sentiment. Renewed supply in short- to mid-tenor papers, particularly the 2028s–2034s, were met with selective and resilient demand, especially the 2028s, 2031s, 2032s, and 2033s, while appetite for the 2053 maturity remained minimal. In the money market, positioning stayed constructive with new issuance demand as investors rotated deliberately across the curve, demonstrating a firmer preference favouring short- and long-dated OMO and NTB instruments, consistent with cautious duration extension in a system flush with liquidity.

The Naira traded with modest volatility in the Nigerian Foreign Exchange Market (NFEM), from ₦1,456.56 to ₦1,443.38, gaining ₦13.19 (+0.91%) intra-week and appreciating ₦21.12 (+1.44%) week-on-week, closing at ₦1,443.38 (up from ₦1,464.50 the previous week). Intra-week movements reflected a resilient market despite FX pressures, supported by improved liquidity and steady growth in external reserves.

Nigeria’s external reserves maintained their upward momentum, rising from $44.67 billion on November 28 to $45.24 billion on December 23, a month-to-date gain of approximately $569.61 million (+1.28%). Blocked funds increased slightly from $557.08 million to $561.86 million, adjusting the blocked reserve ratio from 1.25% to 1.24%, indicating improved FX liquidity, enhanced reserve management efficiency, and continued progress in clearing outstanding obligations.

The Nigerian Exchange (NGX) All-Share Index opened the week at 152,459.00 and traded bullish through the short week due to the Yuletide holiday, closing at 153,540.00 points on Wednesday, its highest level month-to-date. The week ended December 24, 2025, the ASI recorded a modest week-to-date increase of 0.71% (+1081.00 points) and a week-on-week advance of 0.98% (+1483.00 points), bringing its year-to-date return to ~49%. The rally was driven by strong performance in key sectors, including consumer goods, manufacturing, banking, and industrial.

Between December 22 and 24, 2025, global financial markets traded cautiously as liquidity thinned, going into the Christmas break, with price action driven by positioning and risk management rather than new policy shocks. In the U.S., markets digested routine late-cycle macro updates released by the Commerce Department: Q3 Gross Domestic Product (GDP) was on the upside at 4.3% annualized, the fastest expansion in two years, while easing inflation and a gradually cooling labour market reinforced expectations that policy rates have peaked. The 10-year Treasury yield edged around 4.15%, reflecting a market still pricing in two potential rate cuts in 2026, even as the Federal Reserve officials projected one. Equities showed modest year-end firmness, and the dollar softened marginally as investors locked in gains. In Europe and the UK, markets remained stable with no fresh central bank moves, while Asian markets were mixed amidst currency swings and profit-taking.

Crude oil prices advanced over the week, driven by escalating geopolitical risks despite a broader oversupply backdrop that kept the market on track for annual losses. WTI futures rose from $57.87 on Monday to $58.38 per barrel by Wednesday, while Brent climbed from $61.90 to $62.19 per barrel over the same period, marking six consecutive sessions of gains and two-week highs. The uptick was supported by the US actions targeting Venezuelan oil shipments and preventing tankers carrying roughly 2 million barrels, and ongoing strikes by Ukraine on Russian energy infrastructure along the Black Sea, both heightening risk premiums. Despite Venezuelan crude contributing less than 1% to global supply, the moves are significant for market sentiment given their political and strategic implications. The American Petroleum Institute’s (API) data revealed a 2.4 million-barrel increase in US crude inventories last week, with gasoline and distillate stocks also rising, highlighting supply-side pressures. Overall, geopolitical tension supported prices in the short term, but with global supply expected to remain ample, crude is still poised for an annual decline of more than 18%.

Gold climbed steadily over the short trading week, opening around $4,417/oz on Monday and closing at $4,470/oz on Wednesday, marking a weekly change of ~+1.1%. Prices surged to record highs of $4,500/oz along with expectations of two Federal Reserve rate cuts in 2026, following the US macro data release, in addition to heightened geopolitical tensions, which pushed safe-haven demand. Year-to-date, gold has gained roughly 70%, on track for its strongest annual performance since 1979, supported by sustained central bank buying and exchange-traded fund (ETF) inflows.

Looking ahead, sustained liquidity management, selective bond demand, and geopolitical developments are likely to guide Nigeria’s money and FX markets, while commodities remain sensitive to supply-side dynamics and safe-haven flows. The 2025 year-end week is expected to receive over ₦750 billion in liquidity inflows from FGN Sukuk coupons payment, the FGN Sukuk 15.743% Dec. 2025 bond redemption, and OMO maturities, which is expected to potentially prompt aggressive CBN OMO sales to stabilise FX pressures and maintain market conditions.

By: Sandra A. Aghaizu

Oil found its footing in the fog of geopolitics.

Tensions stirred the market, lifting WTI to $58.38 and Brent to $62.19, even as surplus barrels weighed heavy in the background. The spark was political, not physical…yet oil still walks toward an 18% yearly fall.

Gold, meanwhile, shone like a quiet refuge.

Carried by rate-cut hopes and global unease, it touched $4,500/oz, rising 1.1% this week. Up nearly 70% this year, gold is writing its strongest chapter since 1979.