Nigeria’s financial market conditions in early January 2026 were shaped by an upward repricing in the fixed-income landscape, as the Central Bank of Nigeria (CBN) intensified its efforts to sterilize excess system liquidity through record-breaking Open Market Operation (OMO) issuances. While the Nigerian Treasury Bill (NTB) market saw a sharp upward repricing of risk amidst increased government borrowing, with one-year stop rates climbing nearly 100 basis points. This combination of excess system liquidity, increased borrowing pattern, highlighted by a staggering ₦7.55 trillion quarterly issuance calendar against ₦5.52 trillion maturity, and a deliberate preference for longer-date securities drove a broad repricing across the yield curve, creating a high-yield environment. While this strengthened the Naira, increased external reserves growth, and signaled confidence in monetary control. It has also encouraged capital rotation away from risk assets, raising sovereign funding cost. Against this backdrop, cautious global markets navigated geopolitical tensions, commodities react to geopolitical risk, with West Texas Intermediate (WTI) and Brent closing on Friday at $58.20 and $62.40 per barrel, respectively. Gold sustained the $4,450/oz level during the period before closing at $4,469.84/oz.

Interbank liquidity opened with a surplus of over ₦1.42 trillion on Friday, marking a week-to-date decline of 58.3%, peaking at ₦4.12 trillion, after opening at ₦3.41 trillion on Monday. Money market rates witnessed mild changes, with the Open Repo Rate (OPR) steady at 22.50% and Overnight (O/N) rate peaking at 22.79% with an ease of 0.35% to 22.71% intra-week, before closing at 22.50% and 22.79%, respectively. In the currency market, the Naira traded between a band of $/₦1,414.00 and $/₦1,433.00 during the week, closing at $/₦1,423.16 on Friday.

The 2026 Debut OMO auction result, conducted on January 6, 2025, showed an aggressive liquidity mop-up stance by the CBN, characterized by a massive 816.9% oversubscription on offer, resulting in total allotment of the 210-day tenor. The 161-day paper was marginally undersubscribed at 92.3% with a sale of 86.3% on offer. Stop rates edged down with a mild 1-basis-point dip to 19.40% and 19.34% respectively. Effective yield correspondingly declined at 21.84% (-1bps) and 21.14% (-10bps) for the 161- and 210-bill, signaling institutional investors’ preference for “locking in” higher yields at what the market perceives to be the peak of the current interest rate cycle and an anticipated dovish signal. This strategic absorption of excess system liquidity, executed without a further rate hike, suggests the CBN prioritize price stability, the Naira defense, and yield control, effectively incentivizing capital retention even as it controls broader system liquidity. Nonetheless, yields in the secondary market are likely to stay elevated but stable as high OMO rates continue to act as a headwind for the stock market, as capital remains motivated to stay in “risk-free” government paper rather than volatile stocks.

AUCTION DATE | TENOR | OFFER (₦‘B) | BIDS (₦‘B) | TOTAL SALE (₦‘B) | STOP RATES (%) | PREVIOUS TENOR STOP RATES (%) |

06-01-2026 | 161-DAY | 300.00 | 277.00 | 259.00 | 19.3400 | 19.3500 |

210-DAY | 300.00 | 2,450.80 | 2,450.80 | 19.4000 | 19.4100 |

The first NTB auction of 2026, held on January 7, revealed a significant repricing of risk-free assets, characterized by a broad-based surge in stop rates across all tenors amidst surplus system liquidity. The 364-day bill emerged as the clear anchor of market interest, attracting a staggering 1.73x demand, resulting in allotment of 1.23x its offer. However, this demand came at a cost to the sovereign, as the stop rate for the one-year paper spiked up to 18.47% (+96bps). This trend was mirrored in the shorter tenors, with the 91-day and 182-day rates rising to 15.80% (+30bps) and 16.50% (+55bps), individually, despite noticeably thinner demand and an undersubscription of ~0.75x and 0.25x, leading to an allotment to offer ratio of 0.72x and 0.24x, respectively. Bid ranges across the board showed a pattern of a lower bound of 15% and a progressive upper bound peaking at 21% at the long end, demonstrating investors’ appetite to lock in attractive yields and manage reinvestment risk in a firm monetary policy environment. Conversely, the 182-day low participation indicates cautious positioning at the mid-end of the curve. Effective yield stood at 16.45% (+33bps), 17.98% (+65bps), and 22.64% (+143bps), for the short-, mid-, and long-day bill, correspondingly. Overall, the result of the auction reflects a bearish sentiment shift in fixed income; the combination of rising yields and a “flight to the long end” suggests that investors are bracing for persistent inflationary pressures and a continued firm policy stance in the near term, while the authority adapts to higher management costs with the total auction sale at 99%.

AUCTION DATE | 07-01-2026 | 07-01-2026 | 07-01-2026 |

MATURITY DATE | 09-04-2026 | 09-07-2026 | 07-01-2027 |

TENOR | 91-DAY | 182-DAY | 364-DAY |

OFFER (₦) | 150,000,000,000 | 200,000,000,000 | 800,000,000,000 |

SUBSCRIPTION (₦) | 112,263,937,000 | 49,910,111,000 | 1,380,775,870,000 |

ALLOTMENT (₦) | 108,170,637,000 | 48,230,111,000 | 987,784,870,000 |

BID RANGE (%) | 15.0000 – 16.0000 | 15.8500 – 17.2500 | 16.2400 – 21.0000 |

STOP RATES (%) | 15.8000 | 16.5000 | 18.4700 |

PREVIOUS STOP RATES (%) | 15.5000 | 15.9500 | 17.5100 |

The Debt Management Office (DMO) Q1 2026 NTB issuance calendar signals increased government borrowing, with a record of ₦7.55 trillion aggregate offer and ₦5.52 trillion maturity, for the quarter. This represents a staggering 90.2% increase over the ₦3.97 trillion offered and matured ₦3.36 trillion (+64.3%) in Q4 2025, highlighting increased government funding needs and a strategic shift toward domestic debt markets to anchor fiscal operations. January alone, accounts for a projected ₦2.30 trillion issuance against ₦1.24 maturing, is expected to absorb significant system liquidity, potentially driving stop rates further higher toward the 19% corridor as the market reprices to accommodate this massive supply surge. The heavy issuance creates a “crowding out” effect for private sector credit but offers a high-yield window for institutional investors to lock in returns before an anticipated monetary easing cycle in 2026. Consequently, we expect the 364-day bill to remain the anchor of market activity, serving as the primary instrument for both short-term funding and liquidity sterilization in a dynamic inflation environment.

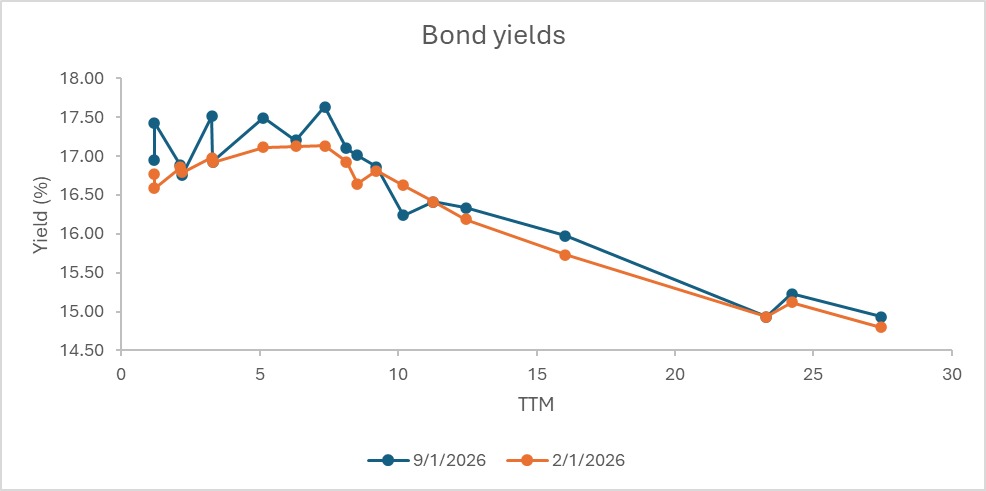

The secondary market improved with yields skyrocketing by almost 100bps jump to 18% levels on 2031s-2034s bonds. Following the new OMO and NTB bill issuance, which traded attractively, the market tilted bearish on price into the weekend. Bond yields inch up from mid-16% to low 18% level, while bills moved within the mid-16% to low-21% band, reinforcing a higher-for-longer rate sentiment. Renewed supply in short- to long-tenor papers, particularly the 2026s–2037s, was met with selective and resilient demand, especially the 2029s, 2030s, 2031s, 2032s, and 2033s, while interest for the 2053 maturity stayed minimal. In the money market, positioning stayed constructive with new issuance demand as investors rotated deliberately across the curve, demonstrating a firmer preference favouring short- and long-dated OMO and NTB instruments, balancing yield opportunities with watchful duration extension in a liquidity-rich market.

The Naira appreciated modestly in the Nigerian Foreign Exchange Market (NFEM), from ₦1,429.31 to ₦1,423.17, with a gain of ₦6.14 (+0.43%) intra-week and ₦7.68 (+0.5%) week-on-week, closing at ₦1,423.17 (up from ₦1,430.25 the previous week). Intra-week movements reflected a resilient market despite FX pressures, braced by improved liquidity and steady growth in external reserves.

Nigeria’s external reserves maintained their upward momentum, rising from $45.57 billion on January 02 to $45.67 billion on January 08, 2025, a month-to-date gain of approximately $100.46 million (+0.22%). Blocked funds declined slightly from $563.52 million to $559.65 million (-0.69%), lowering the blocked reserve ratio to 1.23%, indicating improved FX liquidity, enhanced reserve management efficiency, and continued progress in clearing outstanding obligations.

With the March 31, 2026, recapitalization deadline fast approaching, the Nigerian banking sector has demonstrated remarkable agility, with nine of the eleven listed institutions already securing their required minimum paid-in capital. Key players, including ZENITHBANK, WEMABANK, UBA, STANBIC, JAIZBANK, GTCO, FIRSTHOLDCO, FIDELITYBK, ACCESSCORP, have successfully met their capital bases, signaling deep investor confidence and systemic stability. This compliance reflects a significant strengthening of the sector’s fundamental health, with the liquidity and balance-sheet resilience necessary to navigate the next phase of the credit cycle while the remaining entities finalize their capital-raising efforts.

The Nigerian Exchange (NGX) All-Share Index traded bullish throughout the week, opening the week at 159,218.00 and closed at 162,298.08 points on Friday. In the week ending January 09, 2026, the ASI recorded a modest week-to-date increase of 1.93% (+3080.00 points) and a week-on-week advance of 3.71% (+5806.00 points), lifting the year-to-date return to 4.30%. The rally was driven by strong performance in key sectors, including consumer manufacturing goods, industrial, insurance, oil & gas, and banking.

Between January 5 and January 9, 2026, global markets transitioned from holiday tiredness into a volatile reality check as investors grappled with the return of geopolitical friction and a “hawkish pause” narrative. In the U.S., the early-week momentum was stifled by indications of the Federal Reserve’s reluctance to cut rates before June, causing the S&P 500 and Nasdaq to retreat from their December peaks by roughly 1.2%. While the tech sector faced headwinds from rising yields, defense and aerospace stocks surged following President Trump’s calls for a significant expansion of military capabilities and the creation of a “European Peace Fund.” In Europe, the FTSE 100 provided a rare bright spot, flirting with the 10,000-point threshold on the back of strong German factory data, even as the Euro struggled against a revitalized U.S. Dollar Index (DXY). Commodities remained the primary theatre of speculation; Gold continued its aggressive trajectory toward the $4,500/oz psychological barrier, while Brent Crude climbed to $62 per barrel as tensions in the Middle East reignited supply-chain anxieties. By Friday’s close, market sentiment shifted from “Extreme Fear” to “Cautious Neutral,” as a steady December Nonfarm Payrolls report suggested the U.S. labour market remained resilient enough to withstand a “higher-for-longer” interest rate environment. The Eurozone inflation fell to 2.00% YoY in December 2025, from 2.10% in November 2025 (the lowest since August 2025) per the European Union statistical office’s inflation flash estimate, and also within the European Bank’s target of 2.00%. Largely driven by the substantial year-on-year energy deflation of -1.90%, a modest slowdown in services by 3.40% and non-industrial goods by 0.40%. The decline in headline inflation is expected to boost household purchasing power and demand slightly, further enabling the European Central Bank (ECB) to likely maintain its hold stance in the medium term, to sustain the easing gains.

Crude oil prices traded with notable volatility as geopolitical developments competed with surplus concerns. Early in the week, both benchmarks edged higher, WTI around $58.3/bbl and Brent near $61.6/bbl, after the US capture of Venezuelan President Nicolás Maduro, although the impact on global supply was muted given Venezuela’s limited output (less than 1% of global production) and structural constraints tied to heavy crude grades and underinvestment. By midweek, prices softened, with WTI slipping below $57/bbl and Brent under $60.6/bbl, as expectations of increased supply from Venezuela and Russia, in addition to progress toward a US–Ukraine security arrangement, weighed on sentiment, partly offset by a larger-than-expected 2.8mb US crude inventory draw. Momentum reversed by Friday, with oil rallying sharply on renewed geopolitical risk, Trump’s warning to Iran, tighter scrutiny of Russian oil flows, and tanker seizures linked to Venezuela, lifting Brent to about $62.40/bbl and WTI to $58.20/bbl on Friday, putting both benchmarks on track for a third consecutive weekly gain despite OPEC+ maintaining its Q1 output pause and lingering concerns over global oversupply.

Between January 5 and 9, 2026, gold markets remained dominated by safe-haven flows amid elevated geopolitical tensions and looming US economic data, closing Friday around $4,470 per ounce while still pacing for an approximate 3% weekly gain. Prices initially jumped over 2% on Monday to about $4,445/oz after a surprise US operation removed Venezuelan President Nicolás Maduro, with Washington suggesting a temporary role in managing the country and tightening oil blockades, moves that lifted haven demand. On Tuesday, bullion climbed further toward $4,488/oz, extending gains as rate-cut expectations persisted and markets priced in about two Federal Reserve reductions in 2026, even as Maduro pleaded not guilty in a New York court. Mid-week profit-taking saw gold dip near $4,457/oz on Wednesday and Thursday at $4,460/oz as some geopolitical fears eased and focus shifted to data, including underwhelming ADP employment figures and mixed ISM readings, ahead of Friday’s nonfarm payrolls release. Despite short-term volatility, the metal entered the week still significantly higher year-to-date, following a record close near $4,550/oz in late December, and supported by ongoing central bank purchases, extended Chinese buying, and persistent ETF inflows, reflecting bullion’s role as a hedge against policy uncertainty and market risk.

Market attention shifts to the upcoming FGN Bond Issuance Calendar for Q1, 2026 as well as the December inflation report, where a cooling of price pressures could accelerate the current buying momentum in the secondary market. Conversely, a surprise spike would likely keep yields high. Over ₦810 billion in maturing OMO bills is expected to enter the system, potentially prompting a fresh CBN OMO auction to mop up. Simultaneously, the 2025 tax reforms have introduced a change in retail banking; as of January 1, 2026, the ₦50 stamp duty on electronic bank transfers of ₦10,000.00 and above has been reassigned as a sender-side cost aside in addition to the bank charge, though salary payments and internal account movements, and smaller transactions remain exempt. It is expected that this implementation will begin to show its impact on consumer behavior, leading to a slight temporary dip in electronic transaction volumes as high-frequency retail users adjust their transfer patterns to avoid the fee.

By: Sandra A. Aghaizu

The Nigerian stock market found its rhythm this week, climbing with quiet confidence. The All-Share Index rose from 159,218 to 162,298 points, marking steady gains and renewed investor optimism.

Powered by strength in banking, consumer goods, industrials, oil & gas, and insurance sector, the market closed the week higher, lifting year-to-date returns to 4.30%…a calm but promising start to the year.