In the week ending January 23, 2026, Nigeria’s financial markets entered a defining inflection point, where fiscal consolidation, liquidity management, and structural reform converged to reshape price discovery across assets. The government’s transition to a unified budget framework by April 2026 has triggered a heightened funding cycle, evident in outsized sovereign bond auction offers, robust Central Bank of Nigeria’s (CBN) Open Market Operation (OMO) and Nigeria Treasury Bill (NTB) long-tenor oversubscriptions, and a clear investor drive toward yield optimization across the curve. While elevated issuance tests demand depth, resilient bidding, selective duration extension, and anchored stop rates signal growing confidence in inflation moderation and policy stabilization. This evolving fixed-income landscape is unfolding alongside improving FX buffers, rising external reserves, landmark industrial expansion at Dangote Refinery, and cautious equity market consolidation, together, framing a market that is no longer merely reacting to liquidity but increasingly repricing risk, returns, and long-term value within a more disciplined macroeconomic regime. Against this backdrop, cautious global markets navigated geopolitical tensions and oversupply concerns, commodities reacted to geopolitical risk, with West Texas Intermediate (WTI) and Brent closing on Friday at $61.09 and $65.90 per barrel, respectively. Gold prices reached new levels above $4,600/oz during the period before closing at $4,976.81/oz.

Interbank liquidity opened with a surplus of over ₦2.78 trillion on Friday, marking a week-to-date gain of 24.3%, despite peaking at ₦3.77 trillion with a brief deficit of ₦973.89 billion during the week. Money market rates witnessed mild changes, with the Open Repo Rate (OPR) steady at 22.50% and Overnight (O/N) rate peaking at 22.80% before easing by 0.40% to 22.71% intra-week, closing at 22.50% and 22.79%, respectively. In the currency market, the Naira traded between a band of $/₦1,418.40 and $/₦1,423.50 during the week, closing at $/₦1,421.63 on Friday.

Following the government’s transition plan to a unified budget system with a single revenue cycle by April 2026, effectively marking an end to the practice of running multiple budgets concurrently, the fiscal impact is evident. Increased offer volumes at sovereign auctions in January 2026 are reflective of the government’s intensified funding drive to meet its funding needs. The Debt Management Office (DMO) issued an offer circular for the first FGN Bond auction in 2026, scheduled for January 26, 2026. The auction offer features three reopened papers with a total offer of ₦900 billion, representing a substantial 95.6% increase from the December 2025 offer. The papers are offered in an allocation ratio of 3:4:2 across the 7-, 10-, and 10-tenors, for FGN 18.50% Feb-2031, FGN 19.00% Feb-2034, and FGN 22.60% Jan-2035, respectively. Strategically, the auction is positioned to test the depth and resilience of demand across the mid-to-long end of the curve. In tandem, the twin long-dated Feb-2034 and the Jan-2035 bonds are expected to appeal to institutional and yield-sensitive financiers aiming to lock in long-term real returns in a moderating inflation environment. The high coupon on the 2035 bond suggests either legacy pricing from prior issuance conditions or a deliberate incentive to pull demand further out the curve, potentially steepening the long end where the stop rates clear near the coupon rate. Overall, the auction outcome will serve as a critical signal of investors’ inflation and policy-rate expectations, in addition to risk duration repricing and market sentiment.

The 20th January, 2026 OMO auction result showed a strong preference for long-day bills amid the excess system liquidity. The sustained investor appetite for mid- to long-tenor risk-free instruments, as the total bids outpaced the total offer by 4.84x. The sale featured 203- and 245-day tenors, the longest OMO bills issued so far in January 2026. Observing per tenor, the 245-day bill attracted a strong demand with a 7.91x bid-to-offer ratio and cleared at 7.16x, reflecting strong duration demand amid expectations of upward yield repricing. The 203-day bill recorded a modest bid-to-offer ratio of 1.77x, with 1.63x allotted. Stop rates settled at 19.39% for the 245-day and 19.38% for the 203-day, with a mild 4bps uptick from the previous auction, signalling a cautious repricing rather than a sharp shift in the yield curve. Overall, the aggressive oversubscription and elevated allotments highlight investors’ willingness to secure attractive returns with effective yield at 22.29% and 21.70% for the 245- and 203-day bills, respectively. While it reinforced the CBN’s liquidity mop-up objective, keeping short-end rates and management costs largely anchored despite the increased issuance.

AUCTION DATE | TENOR | OFFER (₦‘B) | BIDS (₦‘B) | TOTAL SALE (₦‘B) | STOP RATES (%) | PREVIOUS TENOR STOP RATES (%) |

20-01-2026 | 203-DAY | 300.00 | 532.00 | 491.00 | 19.3800 | 19.3400 |

245-DAY | 300.00 | 2,373.30 | 2,150.70 | 19.3900 | – |

The 21st January, 2026 NTB auction emphasised a pronounced division of demand across the curve, with overwhelming investor preference for the 364-day paper reflecting continued yield optimization and reinvestment of system liquidity into longer short-end instruments. While the 91- and 182-day tenors were markedly under-subscribed, attracting just 30.7% and 23.2% against their respective offers, the 364-day tenor drew a massive 418.1% in subscriptions against its offer, showing investors’ preference to secure higher yields with limited duration risk. Stop rates inched higher for the short- and mid-day bill, clearing at 15.84% (+4bps) and 16.65% (+15bps), while the 1-year tenor declined marginally to 18.36% (-11bps), suggesting competitive bidding. The wide bid range across the board, with a minimum bound of 15% and a maximum level of 23%, signals divergent inflation and policy-rate expectations, but the final clearing outcome points to growing confidence in rate stabilization and a gradual control of the curve. Overall, the issuance reinforces the narrative of yield compression at the long end despite persistent liquidity, while the weak uptake at shorter maturities reflects selective positioning rather than broad-based risk aversion. Full allotment to demand stood at 31%, a decline of 58.4% from the previous sale.

AUCTION DATE | 21-01-2026 | 21-01-2026 | 21-01-2026 |

MATURITY DATE | 23-04-2026 | 23-07-2026 | 21-01-2027 |

TENOR | 91-DAY | 182-DAY | 364-DAY |

OFFER (₦) | 150,000,000,000 | 200,000,000,000 | 800,000,000,000 |

SUBSCRIPTION (₦) | 46,128,936,000 | 46,513,613,000 | 3,345,074,849,000 |

ALLOTMENT (₦) | 40,614,643,000 | 42,159,295,000 | 977,682,907,000 |

BID RANGE (%) | 15.0300 – 17.5000 | 15.5000 – 20.0300 | 15.5000 – 23.0000 |

STOP RATES (%) | 15.8400 | 16.6500 | 18.3600 |

PREVIOUS STOP RATES (%) | 15.8000 | 16.5000 | 18.4700 |

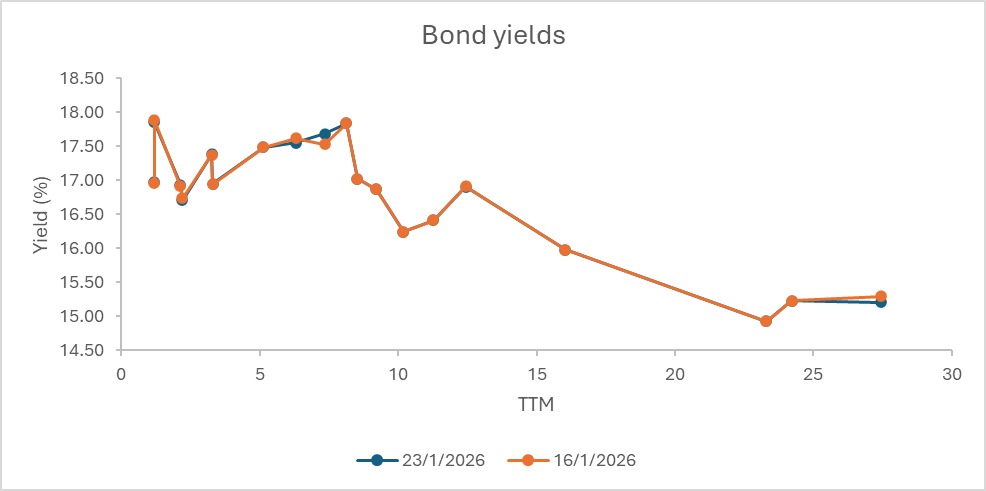

The secondary market witnessed a mix of moderating yields across the bonds and money market. Following the recent issuance of OMO and NTB bills, yields traded between a band of low-17% to low-18% levels on 2026s-2035s bonds, the money-market tilted bearish on price with selling pressure at the long end and across the curve. Bond yields inch up from mid-16% to low 18% level, while bills moved within the mid-16% to mid-23% band, reinforcing a higher-for-longer rate sentiment. Renewed supply in short- to long-tenor papers, particularly the 2026s–2035s, was met with selective and resilient demand, especially the 2029s, 2030s, 2031s, 2032s, 2033s, and 2034s, while interest for the 2053 maturity remained low. In the money market, positioning stayed constructive with recent issuance demand as investors rotated deliberately across the curve, signifying a firmer preference favouring short- and long-dated OMO and NTB instruments, balancing yield opportunities with vigilant duration extension in a liquidity-rich market.

The Naira depreciated modestly in the Nigerian Foreign Exchange Market (NFEM), from ₦1,420.28 to ₦1,421.63, with a decline of ₦1.35 (-0.09%) intra-week and ₦3.68 (-0.26%) week-on-week, closing at ₦1,421.63 (up from ₦1,417.95 the previous week). Intra-week movements reflected a resilient market despite FX pressures, braced by improved liquidity and steady growth in external reserves.

Nigeria’s external reserves maintained their upward momentum, rising from $45.57 billion on January 02 to $46.01 billion on January 22, 2026, a month-to-date gross gain of approximately $447.00 million (+0.98%). Blocked funds declined from $563.52 million to $543.44 million (-3.57%), lowering the blocked reserve ratio to 1.18%, indicating improved FX liquidity, enhanced reserve management efficiency, and continued progress in clearing outstanding obligations.

The $350 million expansion contract signed between Dangote Refinery and Engineers India Limited (EIL) for a scale-up to 1.4 mbpd is structurally positive for Nigeria’s financial markets, reinforcing long-term confidence in the industrial, energy, and capital markets ecosystem. With EIL serving as Project Management Consultant (PMC) and Engineering, Procurement and Construction Management (EPCM) consultant, the development strengthens Nigeria’s balance of payments outlook by materially reducing refined fuel imports, supporting FX stability through import substitution and future export earnings, and deepens the domestic capital market narrative ahead of the planned 10% refinery listing on the NGX in 2026. For investors, the project enhances prospects across equities, fixed income, and infrastructure-linked financing, while positioning Nigeria as a global refining and petrochemical hub, improving energy security, boosting downstream value chains, and anchoring sustainable foreign capital inflows into the Nigerian financial market.

The Nigerian Exchange All-Share Index (ASI) traded largely flat with a mild negative bias over the January 19–22, 2026 period, reflecting cautious investor sentiment. The index opened the week at 166,113.00 on Monday, edged higher to 166,257.00 on Tuesday, before recording a marginal uptick to 166,267.60 on Wednesday, indicating limited buying interest and a consolidation phase at elevated levels. However, sentiment weakened on Thursday as profit-taking emerged, pulling the ASI down to 165,397.00, before closing at 165,512.00 on Friday, an indication of investors locking in gains amid broader macroeconomic and market uncertainties, with near-term direction likely dependent on liquidity flows and earnings-related triggers across key sectors. Overall, the ASI recorded a week-to-date decline of 0.36% (-601.00 points) and a week-on-week loss of 0.37% (-617.00 points), pulling the year-to-date return to 5.76%.

In the week ending January 23, 2026, the global financial market navigates a complex landscape defined by resilient growth and critical pockets of volatility. The International Monetary Fund (IMF) recently upgraded its 2026 global growth forecast to 3.3%, citing a surge in AI-driven technology investment that is helping to offset persistent trade disruptions, while the World Bank maintains a more cautious outlook at 2.6%. These developments collectively point to a cautiously supportive but increasingly divided global macro environment with important cross-market implications. China’s economy expanded by a resilient 5% in 2025, surpassing ¥140 trillion ($20tn) in GDP, contributing roughly 30% to global growth, strengthening its role as a stabilizing demand anchor. In contrast, the Eurozone is entering a low-inflation, low-growth phase, with headline inflation dipping to 1.9% in December, below the ECB’s 2% target, supporting expectations of steady rates as growth forecasts are modestly revised upward to 1.2%. In the U.S., a stronger-than-expected Q3 GDP growth of 4.4% and rising corporate profits (up $175.6bn in Q3) highlight cyclical momentum, but legal challenges testing Federal Reserve independence under President Trump introduce policy uncertainty that could reprice risk assets. The UK presents a stagflationary tilt, with inflation rising to 3.4% in December even as rate-cut expectations hinge on the Bank of England’s February move. Meanwhile, the launch of a $1bn UK-backed blended finance fund (the Allianz Climate Engagement fund) for emerging markets, with significant disbursements directed towards Africa, signals sustained institutional appetite for climate investment, partially counterbalancing tighter macro financial conditions. Together, these dynamics suggest global growth support is increasingly Asia-led, monetary divergence remains pronounced, and capital flows may favour resilient emerging markets and real-economy investments amidst increased policy and geopolitical risk in developed markets.

Crude oil prices traded within a volatile but relatively narrow range between January 19 and 23, 2026, shaped by shifting geopolitical risks, supply disruptions, and persistent concerns about oversupply. On January 19, WTI slipped to $59.21/bbl while Brent fell to $64.00/bbl as easing tensions around Iran reduced immediate supply fears, though trade tariff threats from the US against Europe and surplus expectations topped sentiment. Prices rebounded on January 20, with WTI rising over 1% to $60.17/bbl and Brent climbing to $64.79/bbl, supported by temporary production halts at Kazakhstan’s Tengiz and Korolev fields amidst escalating US–EU tensions. On January 21, crude recouped further losses as President Trump ruled out the use of force over Greenland, with WTI at $60.45/bbl and Brent at $64.92/bbl, aided by the Energy Information Administration’s (EIA) upward revision to 2026 demand growth despite projecting a 3.7mbpd stock build. The tone turned softer again on January 22 as oversupply concerns dominated, US crude inventories rose by about 3mbbl, and WTI fell to $59.72/bbl while Brent eased to $64.01/bbl, even as Kazakh and Venezuelan supply issues offered limited support. By January 23, prices stabilized, with WTI closing at $61.09/bbl and Brent at $65.90/bbl, supported by renewed US threats toward Iran, supportive comments from Saudi Aramco on strong underlying demand, and a softer dollar, although the IEA’s view that supply will exceed demand in 2026 continued to restrain upside.

Gold prices surged sharply through January 19–23, 2026, repeatedly setting new record highs as escalating and then shifting geopolitical and policy risks sustained strong safe-haven demand. On Monday, bullion jumped over 1% to $4,674.78/oz as President Trump announced new tariffs on eight European countries, reviving trade-war fears and compounding existing geopolitical tensions in Iran and Venezuela alongside concerns over the Federal Reserve’s independence. The rally extended to Tuesday, with gold climbing to $4,755.76/oz after Denmark boosted its military presence in Greenland and US-EU trade tensions intensified, while investors awaited key US inflation data. By Wednesday, prices spiked intraday to around $4,887/oz before easing to about $4,818.07/oz as Trump ruled out the use of force over Greenland, triggering profit-taking despite continued support from a softer dollar and policy uncertainty. Gold rebounded on Thursday to $4,873.12/oz as markets balanced resilient US growth with contained inflation, headline and core PCE rose 0.2% m/m, reinforcing expectations of gradual policy easing rather than renewed tightening. By Friday, bullion advanced further closing at $4,976.80/oz, marking its strongest weekly performance since March 2020, supported by lingering geopolitical uncertainty, a weaker dollar, expectations of two Federal Reserve rate cuts later in the year, and investors’ focus on Trump’s pending choice of a new, potentially more dovish, Federal Reserve chair.

The week ahead is poised with developing macroeconomic updates. Locally, the scheduled January 2026 FGN Bond auction outcome is a keen indicator of yield direction and investor demand. This is in addition to the expected inflows of over ₦2.55 trillion in maturing OMO bills and coupon payments, driving reinvestment pressure. Potentially, prompting fresh OMO(s) auction.