Nigeria’s financial markets closed the week on a cautious but positive note, shaped largely by the outcome of the Central Bank of Nigeria’s (CBN) 302nd Monetary Policy Committee (MPC) meeting. The apex bank signalled a more accommodative stance, cutting the benchmark rate to 27.00% and adjusting Cash Reserve Requirements (CRR) to boost credit and address excess liquidity in the interbank system. With inflation on a steady decline, these moves highlight a shift toward supporting growth while still managing risks around liquidity and external shocks.

Beyond monetary policy, the Securities and Exchanges Commission, (SEC) introduced a phased move to mark-to-market valuation for fixed income funds, improving transparency and investor confidence. At the same time, Pensions Commission, (PENCOM) rolled out its amended investment guidelines to balance safety with growth, while the DMO prepared for another ₦200 billion bond auction. In addition to a steady build-up in foreign reserves, these developments further depict Nigeria’s ongoing efforts to deepen financial stability, attract investment, and support long-term economic resilience. The commodities markets closed the week mixed; gold steadied at $3,750/oz with a modest 0.25% gain, the NGX ASI gained 0.45% WTD at 142,133.00 points, while oil rallied strongly as WTI rose by 5.6% to $65.61 and Brent gained 5.2% to $69.90 per barrel, reflecting divergent drivers across asset classes.

The interbank money market opened on Friday with a liquidity surplus in excess of ₦4 trillion, marking an 89.59% increase within the week, after opening at ₦2.1 trillion on Monday. Money market rates declined, with the Open Repo Rate (OPR) and Over Night (O/N) falling about 7.5% and 7.7% WTD to close at 24.50% and 24.88% respectively. At the NAFEX window, the Naira traded between $/₦1,481.00 and $/₦1,4980.00 during the week, and closed at $/₦1,480.00 on Friday.

At the CBN’s 302nd Monetary Policy Committee Meeting, the committee adopted a more accommodating stance, cutting the MPR by 50bps to 27.00% and easing the CRR for deposit money banks to 45% (-500bps), while retaining 16% for merchant banks and introducing a new 75% CRR for Non-Treasury Single Account, (Non-TSA) public sector deposits. The adjustment of (-250/-150) on the asymmetric corridor to (+250/-250) around the Monetary Policy Rate (MPR) effectively narrows the gap between the Standing Lending Facility (SLF) and the Standing Deposit Facility (SDF), improving liquidity management. In view the elevated system liquidity in recent weeks, these measures signal the Committee’s intention to strike a balance between sustaining disinflation momentum and supporting credit expansion to the real economy, and facilitate growth. By maintaining the Liquidity Ratio at 30%, the MPC preserves a prudent buffer, yet the overall tilt toward easing reflects confidence in underlying macroeconomic stability and a willingness to stimulate growth amidst moderating inflationary pressures.

Most analysts believe that the decision signals a dovish tilt with hawkish undertones, indicating a carefully calibrated policy stance. By reducing the CRR for banks while introducing a CRR of 75% on Non-TSA public sector funds, the CBN has embedded a critical transparency mechanism into liquidity management, addressing the long overdue liquidity clog in the wheel of market progress as a consequence of public sector injections. This recalibration, coupled with a refined asymmetric corridor and stable liquidity ratio, reflects a decisive and intelligent approach to addressing distortions around FAAC inflows. The CBN’s strategy blends fiscal and monetary alignment, easing structural drags while reinforcing system stability. With these measures, Nigeria is set on a stronger fiscal footing, enhancing investor confidence and sustaining resilience in the broader macroeconomic landscape.

System liquidity conditions reflected a sharp surge in placements with the CBN’s Standing Deposit Facility (SDF) during the week following the MPC decision, with balances rising from ₦1.70bn on Monday, September 22nd, to ₦3.73bn by Friday, September 26th. This represents a week-to-date increase of 120%, reinforcing an improved liquidity environment in the banking system. Notably, there were no borrowings under the Standing Lending Facility (SLF) throughout the week, further emphasizing that banks remained sufficiently funded and preferred to park excess liquidity with the CBN.

Nigeria’s Securities and Exchange Commission’s (SEC) directive mandating a gradual shift from full Mark-to-Market (MTM) valuation for fixed income funds marks a major step toward transparency and global alignment in Nigeria’s capital market. This transition, phased over two years, may initially heighten valuation volatility, but will ultimately enhance price discovery, standardize reporting across fund managers, and strengthen investor confidence by offering a clearer view of portfolio performance in relation to market realities.

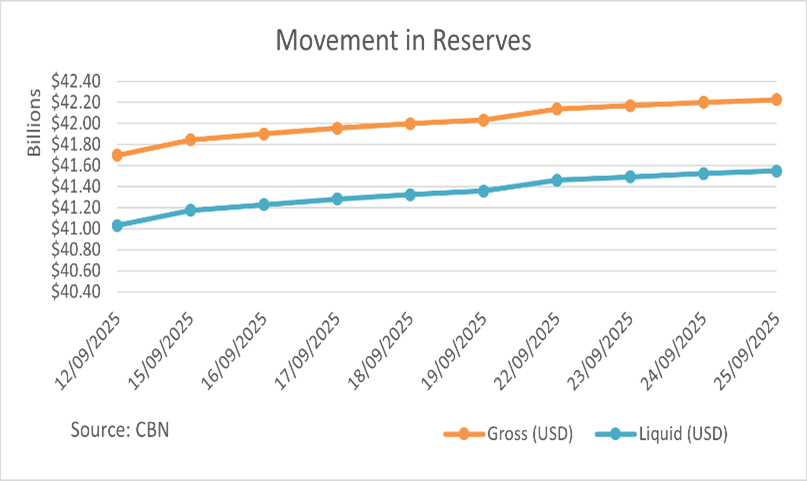

The 0.15% increase in external reserves (about $65.3m) over a two-week period reflects sustained FX inflows, supported by improved oil receipts and robust foreign portfolio participation in sovereign debt instruments. The consistent build-up reinforces a stronger external buffer, offering the Central Bank greater flexibility in managing Naira stability despite elevated system liquidity and external policy shifts.

Ahead of the auction on Monday, 29th September 2025, the Debt Management Office (DMO), on behalf of the Federal Government of Nigeria, released a circular offering ₦100 billion each in the re-opened 5- and 7-year paper, respectively; 17.945% FGN AUG 2030 and 17.95% FGN JUNE 2032. The combined offer size of ₦200 billion is consistent with August’s offer, showing continued government borrowing momentum to support fiscal needs while deepening the domestic bond market. The outcome of the auction is expected to test investor appetite amid elevated system liquidity and pivoting monetary policy.

Between robust system liquidity, the bond secondary market remained moderately active, trading between 16.30% and 16.70% throughout the week. Most mid-tenor bonds traded within the 16.20% – 16.70% range, with notable demand and offers concentrated in APR-2029s, FEB-2031s, FEB-2034s, MAR-2035s, JUN-2053s, SK-2032s, and MAY-2033s, which saw heightened demand on Wednesday. T-bill and OMO papers witnessed elevated activity, especially at the long end of the curve. Strong demand was observed in T-bills maturing on 20-Aug., 8-Jan., 22-Jan., 3-Sept., 17-Sept., 26-Mar, as well as 7-Apr., 17-Feb., 23-Dec., 8-Jan., 10-Mar., and 17-Mar., OMO maturities. The sustained appetite across sovereign bonds and money market instruments signals investors’ positioning for attractive returns amidst eased interest rates.

The National Pension Commission (PenCom) launched a bold reform initiative (Pension Revolution 2.0) aimed at repositioning the pension industry for inclusive growth, resilience, and long-term sustainability. Its amended regulation sets clear asset allocation thresholds to balance safety, liquidity, and long-term growth of pension assets. Pension Fund Administrators (PFAs) are required to anchor portfolios with a strong core in Federal Government securities, ranging between 40% and 50%, ensuring stability and predictable returns. This conservative foundation is complemented by state government bonds (≤20%) and corporate debt instruments (≤35%), which introduce measured exposure to credit markets while enforcing minimum credit rating standards to manage risk. Equities and collective investment schemes add further diversification, capped at 25% and 20% respectively, alongside money market instruments (≤35%), which provide liquidity and tactical flexibility.

Beyond traditional assets, the regulation introduces a measured allocation of up to 5% each in private equity, infrastructure funds, and real estate vehicles, indicating an intentional push to channel long-term pension capital into the real economy. Foreign investments, capped at 20%, broaden diversification and offer currency hedging benefits under strict regulatory oversight. In practice, this structure encourages a barbell allocation strategy: a defensive core anchored in government securities, balanced with selective growth through corporates, equities, and alternatives. These small but strategic exposures reflect PenCom’s goal of aligning pension funds with Nigeria’s development agenda while safeguarding systemic stability.

Gold prices ended the week around $3,750/oz, posting a modest 0.25% week-to-date gain, though momentum was capped as the US dollar firmed on stronger-than-expected economic data. Weekly jobless claims fell, and Q2 GDP was revised higher on robust consumer spending and business investment, paring market bets for a September Fed rate cut to 85% from 90% previously. While policy repricing pressured bullion, safe-haven demand remained supported by renewed trade frictions after President Trump announced sweeping tariffs effective October 1, spanning 100% levies on branded drugs, 25% on heavy-duty trucks, 50% on kitchen cabinets, and 30% on upholstered furniture.

The Nigerian All-Share Index (ASI) closed the week on a positive note, rebounding strongly from midweek softness to finish at 142,133.00 points on Friday, September 26, a 0.45% week-to-date gain. After dipping to a low of 140,716.00 points midweek on the back of profit-taking and cautious positioning, renewed liquidity-driven demand lifted sentiment in the latter sessions, erasing earlier losses. The late-week rally reflects resilient investor appetite despite elevated system liquidity and eased rates, positioning equities for further upside should macro stability persist into October.

Crude oil prices staged a strong recovery through the week, with both WTI and Brent logging their biggest weekly gains since early June, driven by intensifying geopolitical risks and tightening supply signals. WTI advanced from $62.16 on Monday to $65.61 per barrel on Friday, up 5.6% week-to-date, while Brent climbed from $66.47 to $69.90 per barrel, a 5.2% increase.

Early in the week, markets were weighed by Iraq’s incremental exports and demand worries, but the drive shifted with US inventory draws, Kurdish export suspensions, and Ukrainian drone strikes on Russian refineries, heightening supply concerns. Fresh sanctions from the EU, NATO warnings over airspace violations, and Washington’s call for Ankara to curb Russian oil imports further amplified geopolitical fragility. By week’s end, Russia’s partial fuel export bans amplified bullish sentiment, though the tentative resumption of Kurdish flows and tempered Fed rate-cut bets offered a check on upside. Overall, crude oil remains influenced by conflict-driven supply risks, keeping the balance of risks tilted to the upside despite lingering demand headwinds.

The week ahead is laden with key events, including the final FGN bond auction in Q3 2025; a key gauge of yield direction and a test of investor appetite, alongside expected inflow of over ₦730 billion in OMO maturities, and a possible resumption of OMO(s) auction after a fortnight’s absence. The Nigerian financial market stands at a modulation point, with the reduced pension fund allocation to fixed-income investments from 75% to 50%; a shift that would pave the way for greater exposure to alternative investments, equities, and real assets. Consistent with most Central bank tones in the last couple of weeks (US FED, ECB, BOE, CBN, amongst others), the outlook for markets looks dovish at a glance but with heavily hawkish undertones.

By: Sandra A. Aghaizu

Oil rose like a tide this week…

pulled first down by Iraq’s extra barrels,

then lifted by falling U.S. reserves,

Kurdish silence, and fire in Russian skies.

Sanctions, warnings, and bans

blew like storm winds across the market,

while faint whispers of weak demand

tried, but failed, to calm the waves.

For now, crude drifts on conflict’s current,

its course steered more by war and worry

than by the thirst of those who burn it.