Nigeria’s financial market opened its second full week of January 2026 with a normalization from the previous week’s price hike. The regularisation followed the execution of a key partnership agreement between Nigeria and the United Arab Emirates (UAE), a move meant to usher in long-term economic progress. The Nigeria Securities and Exchange Commission (SEC) issued a new minimum capital requirement for capital market operators to boost the capital market stability and safeguard investors. By tightening financial regulations and opening new doors for international trade, the country appears to be transforming from a volatile environment into a more predictable and secure place for investment. This shift toward stability, backed by growing national savings and a positive outlook, suggests that the toughest economic hurdles are now being replaced by a clear, organized plan for long-term progress. Against this backdrop, cautious global markets navigated geopolitical tensions, commodities reacted to geopolitical risk, with West Texas Intermediate (WTI) and Brent closing on Friday at $59.80 and $64.40 per barrel, respectively. Gold sustained the $4,500/oz level during the period before closing at $4,568.2/oz.

Interbank liquidity opened with a surplus of over ₦2.10 trillion on Friday, marking a week-to-date decline of 43.2%, peaking at ₦2.21 trillion, after opening at ₦1.47 trillion on Monday. Money market rates witnessed mild changes, with the Open Repo Rate (OPR) steady at 22.50% and Overnight (O/N) rate peaking at 22.78% with an ease of 0.44% to 22.68% intra-week, before closing at 22.50% and 22.69%, respectively. In the currency market, the Naira traded between a band of $/₦1,416.80 and $/₦1,426.00 during the week, closing at $/₦1,417.95 on Friday.

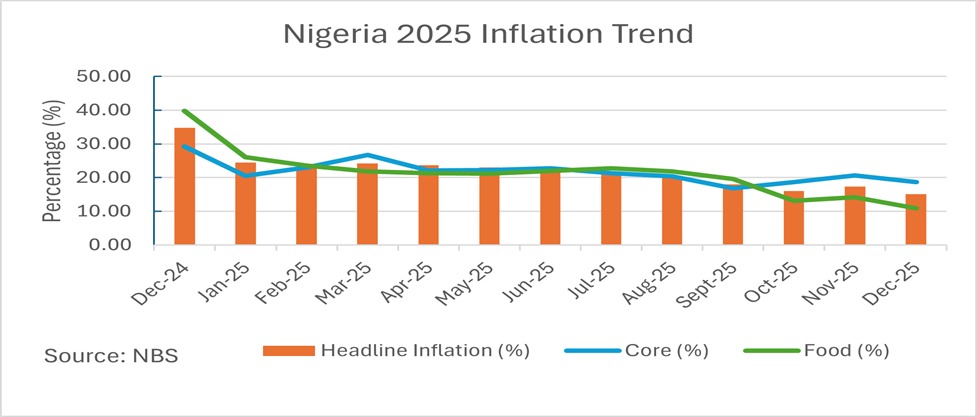

The Nigeria Consumer Price Index (CPI) report for December 2025 by the National Bureau of Statistics (NBS) marks a crucial shift in the nation’s inflationary narrative, as the NBS successfully transitioned to a 12-month normalized index reference period (2024=100) to moderate the “base effect” that would have otherwise caused an artificial statistical spike, averting unnecessary market volatility and distortion of real “price discovery” process. The year 2025 was characterized by a robust disinflationary trend, with the year-on-year (YoY) headline inflation rate declining from a peak of 34.80% in December 2024 to 15.15% by December 2025. This deceleration persisted for eight record, and a month-on-month ease despite an upward revision to the November 2025 inflation rate at 17.33% (headline), 14.21% (food), and 20.59% (core). December 2025 readings were 15.15% (-218bps), 10.84% (-337bps), and 18.63% (-196bps), respectively, for the headline, food, and core inflation, indicating that the firm monetary tightening and structural adjustments of the past year have begun to take effect. For financial markets, this normalized reading of 15.15% provides a clearer “green light” for a transition in monetary policy; the sharp drop in headline and food inflation indices signals an anticipated change in the Central Bank’s hawkish cycle, which is expected to drive yields lower in the fixed-income market while providing a valuation tailwind for equities as the macroeconomic environment stabilizes into 2026.

Following the Central Bank of Nigeria’s (CBN) progressive reforms in the financial sector, the impact is now being felt across the capital market through the Securities and Exchange Commission’s (SEC) revised minimum capital requirements. SEC Nigeria Circular 26-1, issued on January 16, 2026, constitutes a far-reaching regulatory intervention aimed at strengthening market stability and investor protection by substantially increasing capital thresholds across the capital market ecosystem. The new framework imposes significant capital upgrades for traditional operators, most notably Broker-Dealers, whose minimum capital rises from ₦300 million to ₦2 billion, and Tier-2 Issuing Houses with underwriting licenses increased from ₦200 million to ₦7 billion, while formally incorporating emerging participants such as Virtual Asset Service Providers (VASPs) and Robo-Advisers into the capital adequacy regime. The framework shall be implemented with immediate effect from January 16, 2026, with a final compliance deadline of June 30, 2027. The SEC is proactively aligning the financial resilience of Nigerian market operators with global best practices and the growing complexities of digital and commodity-based asset markets.

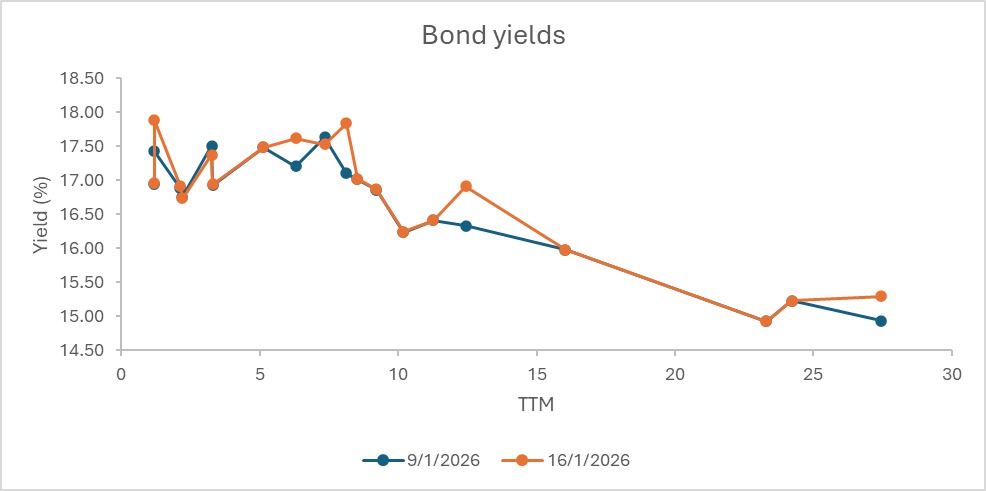

The secondary market was moderately bullish in addition to the December 2025 inflation report. Yields traded between a band of low-17% to 18% levels on 2031s-2035s bonds, the money-market tilted bearish on price with selling pressure at the long end and across the curve. Bond yields inch up from mid-16% to low 18% level, while bills moved within the mid-16% to low-23% band, reinforcing a higher-for-longer rate sentiment. Renewed supply in short- to long-tenor papers, particularly the 2027s–2035s, was met with selective and resilient demand, especially the 2030s, 2031s, 2032s, 2033s, and 2034s, while interest for the 2053 maturity stayed minimal. In the money market, positioning stayed constructive with recent issuance demand as investors rotated deliberately across the curve, demonstrating a firmer preference favouring short- and long-dated OMO and NTB instruments, balancing yield opportunities with watchful duration extension in a liquidity-rich market.

The Naira appreciated modestly in the Nigerian Foreign Exchange Market (NFEM), from ₦1,421.48 to ₦1,417.95, with a gain of ₦3.51 (+0.25%) intra-week and ₦5.22 (+0.37%) week-on-week, closing at ₦1,417.95 (up from ₦1,423.17 the previous week). Intra-week movements reflected a resilient market despite FX pressures, braced by improved liquidity and steady growth in external reserves.

Nigeria’s external reserves maintained their upward momentum, rising from $45.57 billion on January 02 to $45.86 billion on January 15, 2026, a month-to-date gross gain of approximately $295.12 million (+0.65%). Blocked funds declined from $563.52 million to $552.37 million (-1.99%), lowering the blocked reserve ratio to 1.20%, indicating improved FX liquidity, enhanced reserve management efficiency, and continued progress in clearing outstanding obligations.

The January 2026 Global Economic Prospects report by the World Bank projects that Nigeria’s economy will grow by 4.4% in both 2026 and 2027, marking the country’s fastest expansion in over a decade and a significant upgrade from previous estimates. This accelerated growth, which surpasses both the global average of 2.6% and the Sub-Saharan African (SSA) average of 4.3%, is primarily driven by a robust services sector (particularly finance and ICT), a rebound in agricultural production, and the country’s emergence as a net exporter of refined petroleum products. While the World Bank credits ongoing tax reforms and prudent monetary policy for stabilizing the macroeconomy and boosting investor confidence, it cautioned that sustaining this momentum requires addressing deep-seated structural bottlenecks and strengthening institutional frameworks to ensure growth translates into meaningful job creation and poverty reduction.

The Comprehensive Economic Partnership Agreement (CEPA) between Nigeria and the United Arab Emirates (UAE) is a transformative economic catalyst that bridges Nigeria’s industrial potential with the UAE’s global trade leadership, specifically by granting duty-free access for over 7,000 Nigerian products. This deal is set to accelerate Nigeria’s non-oil export growth, which already surged by 21% in 2025, by removing tariffs on high-demand goods like seafood, oil seeds, and cereals, while simultaneously lowering the cost of industrial machinery for Nigerian manufacturers. In the agricultural sector, the partnership shifts the focus from raw exports to high-value processing, supported by UAE investment in climate-smart infrastructure and logistics. For the financial markets, this creates a secure “liquidity bridge” for the UAE’s sovereign wealth funds to invest in Nigeria’s green energy, mining, and infrastructure projects, ultimately positioning Nigeria as the primary gateway for global investors into the $3.4 trillion African Continental Free Trade Area.

The Nigerian Exchange (NGX) ASI delivered a broadly positive performance during the week, closing higher despite mild late-week profit-taking on Thursday. The index opened at 163,244.69 on January 12 and advanced strongly through mid-week, peaking at 166,771.95 on January 14, reflecting sustained bargain hunting and renewed investor confidence. Momentum softened on January 15 as the ASI dipped to 166,057.29, before closing higher at 166,129.00 on January 16. Overall, the ASI recorded a modest week-to-date increase of 1.77% (+2884.31 points) and a week-on-week gain of 2.36% (+3831.00 points), lifting the year-to-date return to 6.16%. The rally was driven by strong performance in key sectors, including consumer goods, industrial, insurance, oil & gas, and banking.

In the week ending January 16, 2026, global financial markets showed mixed performance amid geopolitical tensions, policy uncertainty, and sector rotation: U.S. equities were volatile but generally upward‑tilted, with major indexes including the S&P 500, Dow Jones, and Nasdaq rising modestly around mid‑week as tech and financial earnings supported sentiment, while safe‑haven assets like gold climbed and the U.S. dollar weakened on concerns over central bank independence and geopolitical risk. Asian markets also advanced, driven by strength in technology and AI sectors and reflected in gains in regional benchmarks such as the MSCI Asia‑Pacific index, even as some Japanese and Chinese stocks underperformed. In bond markets, U.S. Treasury yields hovered near multi‑year elevated levels around ~4.15% on the 10‑year note, partly influenced by uncertainty around monetary policy credibility, while UK 10‑year gilt yields eased to around ~4.36–4.40% as easing inflation expectations bolstered expectations of future rate cuts. Commodities were active, with oil initially rallying then pulling back sharply as geopolitical risk receded, while gold reached and held elevated levels before a modest retreat, indicating persistent caution across asset classes. Currency and fixed‑income markets reflected cautious positioning as investors balanced potential Federal Reserve rate cuts against resilient economic data and ongoing global risks.

Crude oil markets were highly volatile between January 12 and 16, 2026, as geopolitical risk premiums were repeatedly built and unwound. Prices opened the period under pressure on January 12, with Brent easing toward $63/bbl and WTI slipping below $59/bbl, as expectations of a potential resumption of Venezuelan oil exports, possibly releasing up to 50 million barrels of previously sanctioned crude, outweighed concerns over escalating unrest in Iran. Sentiment reversed sharply on January 13 and 14, with both Brent and WTI rallying nearly 3% to 12-week highs amid intensifying geopolitical tensions, including heightened U.S. rhetoric toward Iran, new Iran-linked trade measures, and supply disruptions at Kazakhstan’s Caspian Pipeline Consortium, where loadings were cut nearly in half. Fears that unrest could disrupt Iran’s oil production and key shipping routes through the Strait of Hormuz drove a pronounced geopolitical risk premium into prices. However, this premium was rapidly unwound on January 15, as signs emerged that the immediate risk of U.S. military action against Iran had eased, triggering Brent’s sharpest single-day decline since October and pushing WTI back toward $59/bbl. By January 16, crude prices had stabilized and were trading in narrow ranges, with Brent closing at $ 64.40/bbl and WTI near $ 59.80/bbl, as markets continued to monitor developments in Iran. While tensions appeared to cool, residual geopolitical risk kept traders cautious, leaving oil prices to close the week with little to no change after three consecutive weeks of gains, with the Energy Information Administration (EIA) warning of an enormous global supply glut in 2026 as production exceeded demand, leading to increasing oil inventories.

Between January 12 and 16, 2026, Gold prices posted a volatile but record-setting week opening with a sharp rally above $4,620/oz on Monday as safe-haven demand surged on heightened geopolitical tensions around Iran and growing concerns over the U.S. Federal Reserve’s independence, before consolidating near $4,600/oz on Tuesday following softer U.S. CPI data that reinforced expectations of multiple Fed rate cuts this year. The metal extended its upward momentum on Wednesday, trading above $4,630/oz, supported by warm producer price data and persistent policy uncertainty, marking another all-time high. However, profit-taking emerged on Thursday, pulling prices slightly below $4,600/oz as strong U.S. labour market signals and easing political risk reduced immediate haven demand. By Friday, gold slipped further to $4,568/oz, as investors scaled back bets on near-term rate cuts amid resilient U.S. economic data and a temporary de-escalation of tensions in the Middle East. However, bullion still closed the week up over 2%, firmly anchored near historic highs and supported by medium-term expectations of monetary easing and ongoing geopolitical risk.

With December 2025 inflation printing lower, secondary market activity has adjusted, with markets awaiting the upcoming FGN Bond Issuance Calendar for Q1 2026. In the near term, over ₦3.52 trillion in maturing instruments, including Central Bank of Nigeria (CBN) Open Market Operations (OMO), Nigeria Treasury Bills (NTBs), coupon payments, and the redemption of the FGN 12.50% Jan. 2026 Bond, are expected to enter the system, potentially prompting fresh CBN OMO(s) auction and heightened investor participation at the scheduled NTB auction. Meanwhile, the Securities and Exchange Commission’s (SEC) new minimum capital requirement introduces a strategic trade-off: while it strengthens long-term market stability by encouraging consolidation among capital-intensive players and refining the quality of market participants, it also creates short-term operational pressures. Entities unable to meet the new threshold may be forced to merge, restructure, or exit, effectively purging low-performing operators. The policy is also likely to deter non-capital-intensive entrants, reducing speculative activity. However, it carries risks, including consolidation pressure, higher compliance costs, and potential market concentration, which could increase the likelihood of oligopolistic structures in the capital market.

The 21st Edition of the WEF Global Risks Report 2026 characterizes the upcoming decade as “The Age of Competition,” with over 50% of survey respondents anticipating a “turbulent” or “stormy” global outlook over the next two years. The report identifies geoeconomic confrontation, AI-driven misinformation, and societal polarization as the primary short-term threats, while warning of a looming “economic reckoning” as one-third of global corporate debt faces refinancing by 2027. These compounding risks suggest a world standing on a “precipice,” where traditional multilateral systems are increasingly challenged by split multipolarity and structural debt crises. For Nigeria specifically, this environment translates into higher borrowing costs, threatened social cohesion, and the risk of being marginalized in global trade as economic tools are increasingly weaponized for national security.

By: Sandra A. Aghaizu

U.S. stocks chase resilience,

even as the dollar loosens its grip.

In the UK, patience is priced into bonds,

and rate cuts are whispered, not promised.

Asian markets trade innovation and hope,

while capital moves carefully,

aware that borders do not contain risk.